|

Getting your Trinity Audio player ready...

|

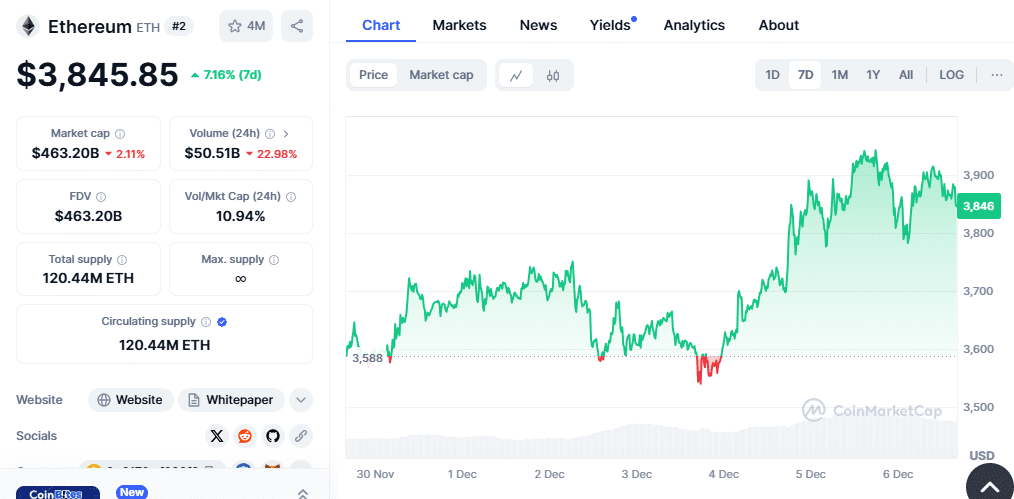

Ethereum’s meteoric rise above $3,800 has sparked renewed activity among crypto whales, with Justin Sun, the founder of TRON, taking center stage. Sun recently deposited a staggering 20,000 ETH, valued at $76.3 million, into the cryptocurrency exchange HTX. This transaction marks one of his largest deposits this year, underscoring his strategic approach to capitalizing on bullish market conditions.

Justin Sun (@justinsuntron) deposited another 20,000 $ETH ($76.3M) to #HTX 8 hours ago as the price surged past $3,800!

— Spot On Chain (@spotonchain) December 5, 2024

Since $ETH began rebounding in early November, he has deposited 41,630 $ETH ($145.9M) into CEXs—39,000 $ETH ($137M) to HTX and 2,630 $ETH ($8.76M) to… https://t.co/G3QOPod2L3 pic.twitter.com/8RtZfJg71I

A Calculated Strategy to Leverage Market Rallies

Justin Sun’s latest deposit reflects a deliberate strategy to maximize returns during Ethereum’s price surges. Since November, Sun has deposited a total of 41,630 ETH—valued at approximately $145.9 million—into centralized exchanges like HTX and Poloniex. By strategically entering the market during price recoveries, Sun not only strengthens his position as a prominent Ethereum investor but also contributes significantly to the liquidity of the Ethereum market.

The timing of Sun’s transactions highlights his proficiency in navigating volatile markets. His decision to transfer 19,000 ETH worth $60.8 million to HTX earlier this year, when Ethereum was priced at $3,202, aligns with his approach of leveraging bullish trends to maximize profitability.

Unrealized Gains and Ethereum’s Market Resurgence

A profit and loss (PnL) analysis of Sun’s Ethereum investments reveals remarkable returns. With $3.7 million in realized profits and $65.67 million in unrealized gains, Sun demonstrates a keen ability to balance holding assets with generating returns. His acquisition of 392,474 ETH—worth $1.19 billion at an average price of $3,027—has resulted in combined profits of $293 million, representing 24% of total revenue.

Sun’s strategic moves are not only a testament to his market acumen but also a reflection of Ethereum’s growing strength in the cryptocurrency landscape. The recent price surge past $3,800 has reignited investor confidence, driving substantial trading volumes and reinforcing Ethereum’s dominance.

Implications for Ethereum and the Broader Market

Justin Sun’s massive deposits into HTX illustrate the significant role that influential investors play in shaping market trends. His actions provide a boost to market liquidity, fostering a favorable environment for further growth. At the same time, these high-profile transactions underscore the importance of strategic decision-making in navigating cryptocurrency’s inherent volatility.

Also Read: Justin Sun’s $146M Ethereum Transfer: Is He Cashing Out or Preparing for a Major Move?

As Ethereum continues its bullish trajectory, Sun’s investments highlight the potential for substantial returns in the decentralized finance (DeFi) ecosystem. With a proven track record of profiting from market rallies, Sun remains a key player to watch as the crypto market evolves.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.