|

Getting your Trinity Audio player ready...

|

The legal battle between Ripple and the SEC over XRP’s classification has taken a significant turn. Judge Analisa Torres’ July 2023 decision, which excluded programmatic sales of XRP from being considered securities, is gaining traction as a precedent for future crypto cases. This could have major implications for the ongoing fight and the broader legal landscape of digital assets.

Judge Torres’ ruling hinged on the Howey Test, a legal framework used to determine if an asset qualifies as a security. The court found that XRP, specifically in programmatic sales, didn’t meet the third prong of the test, which requires an expectation of profits based solely on the efforts of a third party. This distinction separated XRP from the SEC’s view of it as an unregistered security.

Courts Align with Torres, SEC’s Stance Challenged

The impact of Torres’ decision extends beyond the Ripple case. As Stuart Alderoty, Ripple’s General Counsel, pointed out, other courts are recognizing her ruling as consistent with existing legal principles. This alignment strengthens the decision’s authority and weakens the SEC’s attempts to challenge it. Alderoty emphasizes this as a crucial step towards legal clarity for XRP holders and the entire cryptocurrency market.

SEC’s Legal Strategies Under Fire

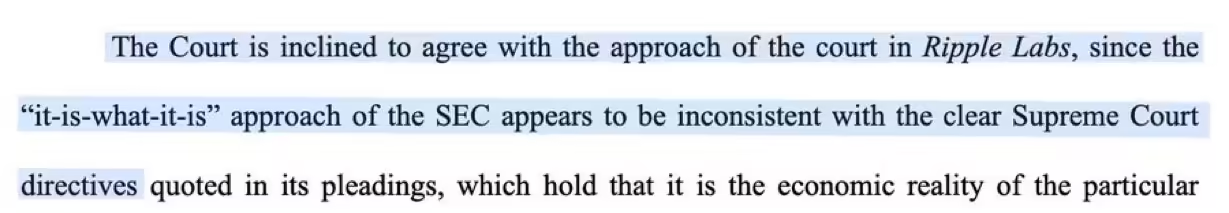

The Torres ruling also shines a light on the SEC’s approach to regulating cryptocurrencies. Critics have long argued for consistency in how the agency classifies digital assets. The recent Binance ruling, while not directly tied to Ripple’s case, exemplifies this critique. Alderoty highlights the importance of this lengthy decision, suggesting it reflects a growing judicial skepticism towards the SEC’s legal arguments.

Ripple Awaits Penalty Decision

While the recent court victories offer momentum for Ripple, a key question remains: the size of the potential penalty. The Binance case doesn’t directly influence this decision, but it could impact how the SEC approaches its appeal against Torres’ ruling on XRP’s programmatic sales.

Related: Court Victories for Crypto: Recent Rulings Favor XRP, Sets Precedent for Secondary Sales

Overall, Judge Torres’ decision marks a turning point in the ongoing legal battle between Ripple and the SEC. As courts increasingly recognize the precedent set by this ruling, the SEC’s legal strategy regarding cryptocurrencies faces growing scrutiny. Investors and the crypto industry will be watching closely as the Ripple case progresses and the penalty decision is reached.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.