|

Getting your Trinity Audio player ready...

|

The overall cryptocurrency market is experiencing a bearish trend, with some investors seizing the opportunity to accumulate tokens while others panic-sell their holdings. Chainlink (LINK) is among the assets facing heightened selling pressure amid market volatility.

610,000 LINK Tokens Transferred to Exchanges

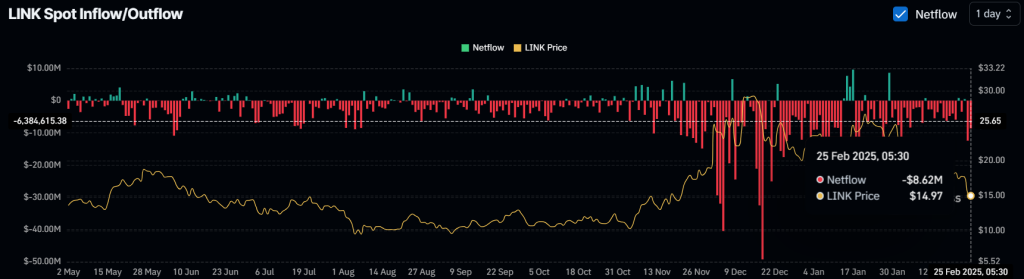

Recently, a prominent crypto analyst revealed that whales have moved approximately 610,000 LINK tokens to exchanges within the past 24 hours, a move typically signaling increased selling pressure. This sudden influx of LINK on exchanges has raised concerns about further downside risks.

LINK Price Drops Over 7.50%

Following this large-scale transfer, LINK’s price took a significant hit, dropping by over 7.50% in the past 24 hours. At press time, LINK is trading around $15. Despite the price decline, trading volume has surged by 160%, reflecting heightened market activity. This increase in volume suggests a shift in sentiment and a possible breakdown from the previous consolidation phase.

Chainlink’s Technical Outlook: More Downside Ahead?

From a technical perspective, LINK appears poised for further losses. The asset had been consolidating within a tight range for an extended period. However, as bearish sentiment intensified, LINK failed to hold its support, breaking below the consolidation phase and triggering a steep decline.

Historical price action indicates that LINK has found temporary support around $15. However, if the asset closes a daily candle below this level, further losses of up to 15% could push the price down to the next key support at $12.60.

Adding to the bearish case, LINK’s breakdown occurred below the 200 Exponential Moving Average (EMA), reinforcing the downtrend.

Despite the bearish outlook, some long-term investors are accumulating LINK. On-chain data from Coinglass reveals that exchanges witnessed outflows of over $8.65 million worth of LINK tokens in the past 24 hours, suggesting accumulation by strategic investors.

The contrasting movements—whales dumping while some investors accumulate—highlight the uncertainty in the market, making LINK’s next move critical for traders and investors alike.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Chainlink (LINK) Eyes $88 Surge: Key Resistance at $47.154 in Focus

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.