|

Getting your Trinity Audio player ready...

|

Cardano (ADA), a top ten cryptocurrency by market capitalization, has been a subject of debate recently. While many believe it holds immense potential, crypto analyst Dan Gambardello suggests some “unique” and “massive” challenges are hindering its growth.

Industry of “Blockade”

Gambardello highlights a two-pronged attack on Cardano’s progress. Firstly, he claims the project faces an “industry blockade” fueled by misinformation and negative narratives spread by major players and venture capital firms (VCs). He likens the situation to Cardano being excluded from a “big party” where billions flow freely.

This alleged blockade reportedly involves misrepresenting Cardano’s data or omitting it entirely. Gambardello suggests crypto analytics firms prioritize promoting projects aligned with their investments, leaving others like Cardano in the dust. He points out the backing of these firms by prominent VCs like FTX Ventures, potentially influencing their reporting.

Social Media Scrutiny Adds Fuel to the Fire

A recent example involved a user comparing ADA’s price movement unfavorably to Solana’s. While Cardano founder Charles Hoskinson responded, the negative comparison might have swayed public perception.

VC Influence and Media Manipulation

Gambardello further claims VCs leverage their media influence to spread negative narratives about Cardano. He suggests their financial support gives them sway over media coverage, potentially manipulating public opinion.

Also Read: Cardano (ADA) to $8 by 2025? Analyst Predicts Bullish Rally on ETF Hype and Strong Fundamentals

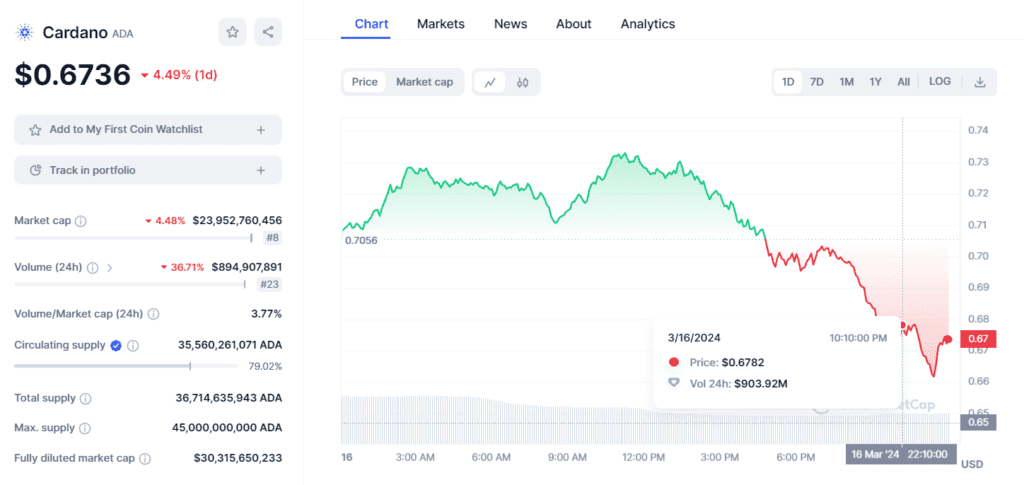

Cardano’s Price Feels the Pinch

The impact of these alleged tactics is evident in ADA’s current price. Trading at $0.672, it struggles to break the $1 barrier. While it shows resilience, the negative press, according to Gambardello, continues to cast a shadow on its market value.

Gambardello’s accusations raise critical questions about transparency and objectivity within the crypto industry. Whether these claims hold merit requires further investigation. However, they highlight the importance of scrutinizing information sources and conducting independent research before making investment decisions.

Crypto and blockchain enthusiast.