|

Getting your Trinity Audio player ready...

|

Key Takeaways:

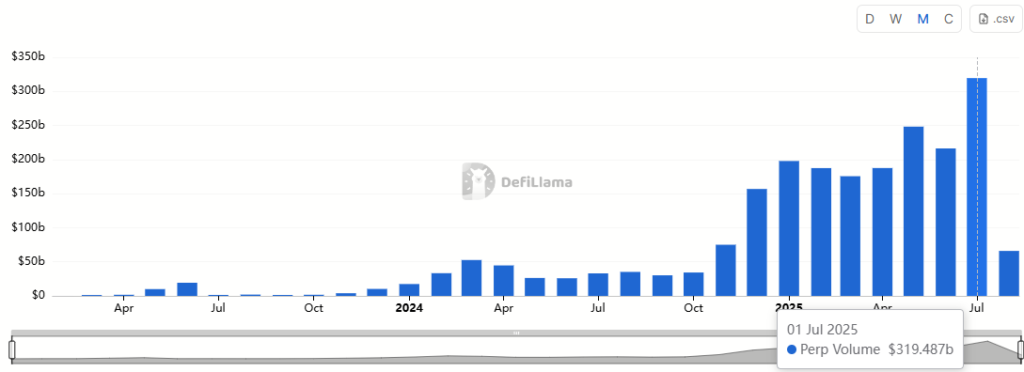

- Hyperliquid led DeFi perpetuals with $319B in July trading volume.

- The platform captured 35% of all blockchain revenue last month.

- Registered users surged past 600K despite a brief platform outage.

Decentralized derivatives exchange Hyperliquid reached a major milestone in July, processing $319 billion in monthly volume, a record among DeFi perpetual futures platforms. According to DefiLlama, this surge marked the highest ever recorded trading activity in the sector, signaling shifting momentum from centralized exchanges to decentralized alternatives.

The explosive growth helped drive total DeFi perpetual futures volume to a monthly all-time high of $487 billion, up 34% from June’s $364 billion.

Capturing Market Share from Ethereum, Solana, and BNB Chain

A recent report from VanEck revealed that Hyperliquid captured a massive 35% of all blockchain revenue in July — overtaking traditional leaders like Ethereum, Solana, and BNB Chain. The report credited the platform’s user-friendly interface and functional design as key drivers behind its adoption.

“Hyperliquid was able to capture much of Solana’s momentum,” wrote VanEck analysts, suggesting the platform is even influencing broader ecosystem valuations.

User Base Growth and Community Trust

Despite a brief 37-minute outage on July 29, Hyperliquid earned praise for its swift response, reimbursing affected users $2 million in trading losses. This move further cemented trust within its fast-growing community, which swelled to over 604,000 registered users, up from 488,000 in June, per Dune Analytics.

The exchange gained significant attention earlier this year after introducing spot trading and an aggressive token listing strategy, rapidly becoming the seventh-largest derivatives exchange by daily volume globally.

Also Read: Hyperliquid Surges Past Solana, Grabs 35% of Blockchain Revenue in July

Outlook: DeFi Derivatives on the Rise

With platforms like EdgeX and MYX Finance trailing far behind at $21B and $9B respectively in July volume, Hyperliquid is clearly leading a broader trend toward decentralized perpetuals. As traders seek more control and transparency, DeFi platforms appear poised to continue eating into CEX market share.

Hyperliquid’s record-breaking July is more than a performance milestone — it’s a signpost for the DeFi derivatives market’s rapid evolution. With user trust, strong revenue capture, and growing dominance, the platform is rewriting the competitive map of crypto trading.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!