|

Getting your Trinity Audio player ready...

|

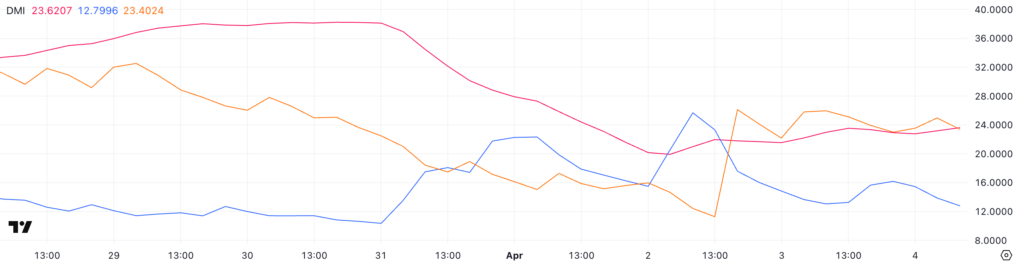

Hyperliquid (HYPE) is showing signs of a strengthening downtrend as sellers gain dominance in the market. The Directional Movement Index (DMI) is signaling a shift in market dynamics, with a rising Average Directional Index (ADX) suggesting that the bearish momentum may continue to build.

DMI Indicates Seller Strength

The ADX for Hyperliquid has recently climbed from 21.5 to 23.6, approaching the critical 25 threshold. The ADX measures the strength of a trend, with values above 25 typically indicating a strong trend, regardless of its direction. While the ADX has yet to fully break the 25 level, this movement suggests that the market is showing increasing trend strength—likely signaling further downside in price action.

Meanwhile, the directional movement lines have shifted dramatically. The +DI, which represents bullish momentum, has dropped sharply from 25.68 to 12.79, while the -DI (bearish pressure) surged from 11.29 to 23.4. This indicates that bearish pressure is now outweighing bullish momentum, with sellers firmly in control. Without a reversal in the +DI line, HYPE may continue facing significant selling pressure.

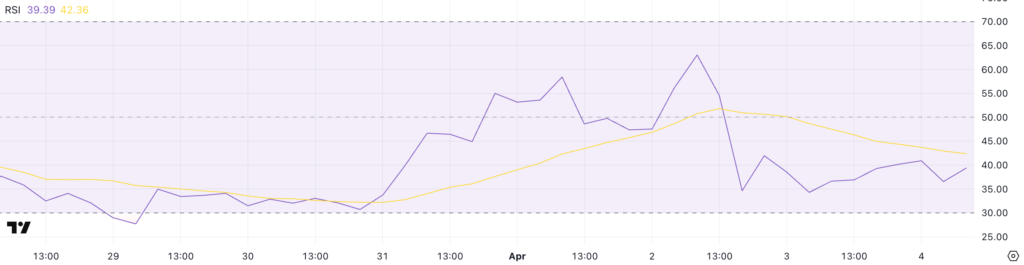

RSI Reveals Weakening Buying Momentum

Hyperliquid’s Relative Strength Index (RSI) has also declined, from 63.03 to 39.39 over the past two days. The RSI is a momentum oscillator that gauges the speed and magnitude of price changes. A reading below 30 typically signals an oversold market, while values above 70 indicate an overbought asset. With HYPE’s RSI now below 40, it reflects weakening bullish momentum and growing bearish pressure.

The lack of any recent rallies above the 70 mark since March 24 suggests that buying conviction has been absent in recent weeks, further supporting the case for a bearish trend.

Can HYPE Hold Above $11?

As HYPE nears key support levels, the market is watching closely to see if bulls can mount a recovery. If the downtrend persists, the price could soon dip below the $11 mark, with bearish indicators suggesting further downside. However, if buyers step in and reclaim momentum, a break above the $12.19 resistance could signal a potential reversal, paving the way for a rally toward $14.77 or even $17.33.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: HyperLiquid Faces Backlash Over JELLY Crisis

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.