|

Getting your Trinity Audio player ready...

|

- HyperLiquid bans employees and contractors from trading HYPE derivatives.

- HYPE has dropped over 58%, with technical indicators signaling oversold conditions.

- Despite volatility, staking levels and revenue-driven buybacks support long-term fundamentals.

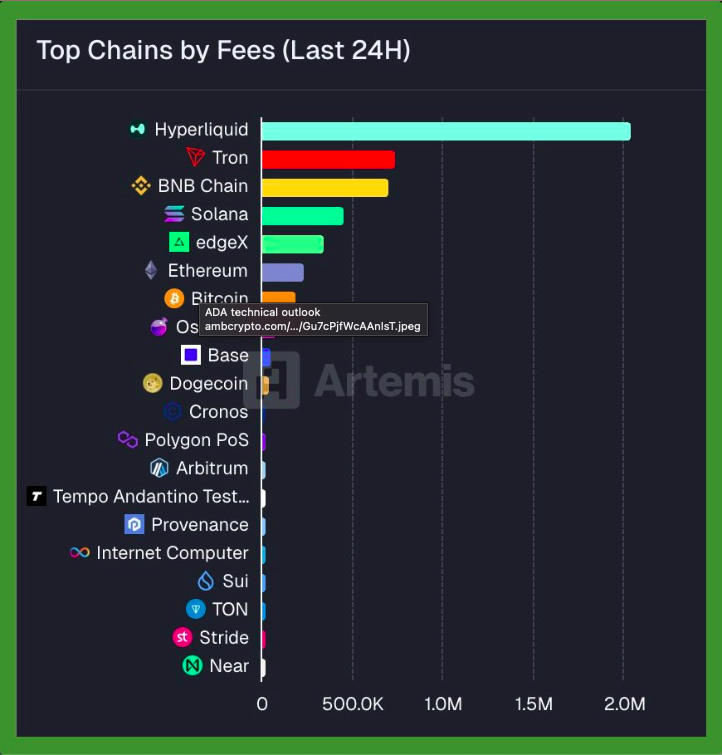

Decentralized perpetual futures exchange HyperLiquid Labs has moved to reassure markets after concerns emerged around alleged short-selling activity linked to a former employee. As HYPE remains under heavy price pressure, the exchange has publicly reiterated its strict internal trading policies, emphasizing transparency and ethical conduct.

The clarification comes as HYPE has lost more than half its value since October, fueling uncertainty among traders and prompting closer scrutiny of insider activity.

HyperLiquid Bars Staff From HYPE Trading

HyperLiquid stated that all employees and contractors are prohibited from trading HYPE derivatives, including both long and short positions. The policy also bans the use or sharing of material non-public information and restricts any derivative trading tied to the protocol’s native token.

According to the team, violations result in immediate termination and may lead to legal action. The exchange stressed that integrity is “non-negotiable” and central to maintaining trust within its ecosystem.

The announcement followed speculation that a wallet actively shorting HYPE belonged to an insider. HyperLiquid confirmed that the wallet in question was linked to a former employee who was terminated in the first quarter of 2024 and is no longer associated with the company. The exchange said no current staff are involved in derivative trading or insider activity.

HYPE Price Slides as Volatility Surges

HYPE has fallen roughly 58% from its October peak near $60 to around $25, reflecting strong bearish momentum. Technical indicators suggest heightened volatility, with prices hovering near the lower Bollinger Band — often a signal of oversold conditions.

Momentum indicators remain weak, but recent green candles point to tentative buying interest following a sharp mid-December sell-off. While the broader trend remains under pressure, short-term stabilization has begun to emerge.

Token Transfers Raise Unlock Speculation

Adding to market unease, roughly $90 million worth of HYPE was recently moved from staking-related wallets, triggering speculation around upcoming token unlocks. On-chain data shows a team-linked address transferring approximately 2.6 million HYPE in multiple transactions, primarily to external wallets.

Despite rumors, HyperLiquid has not sold any HYPE. Most tokens — valued at over $8 billion — remain staked, while a relatively small portion sits in spot balances. Some community members noted that recent transfers were tied to reward distribution, with unused tokens returned to staking.

Long-Term Fundamentals Remain Intact

HyperLiquid highlighted that the protocol continues to generate daily revenue, with the majority directed to an assistance fund used for HYPE buybacks and burns. While short-term price action remains fragile, the team argues that fundamentals are unchanged.

For long-term holders, the project’s revenue model and token mechanics suggest that temporary price weakness may present an opportunity rather than a threat.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!