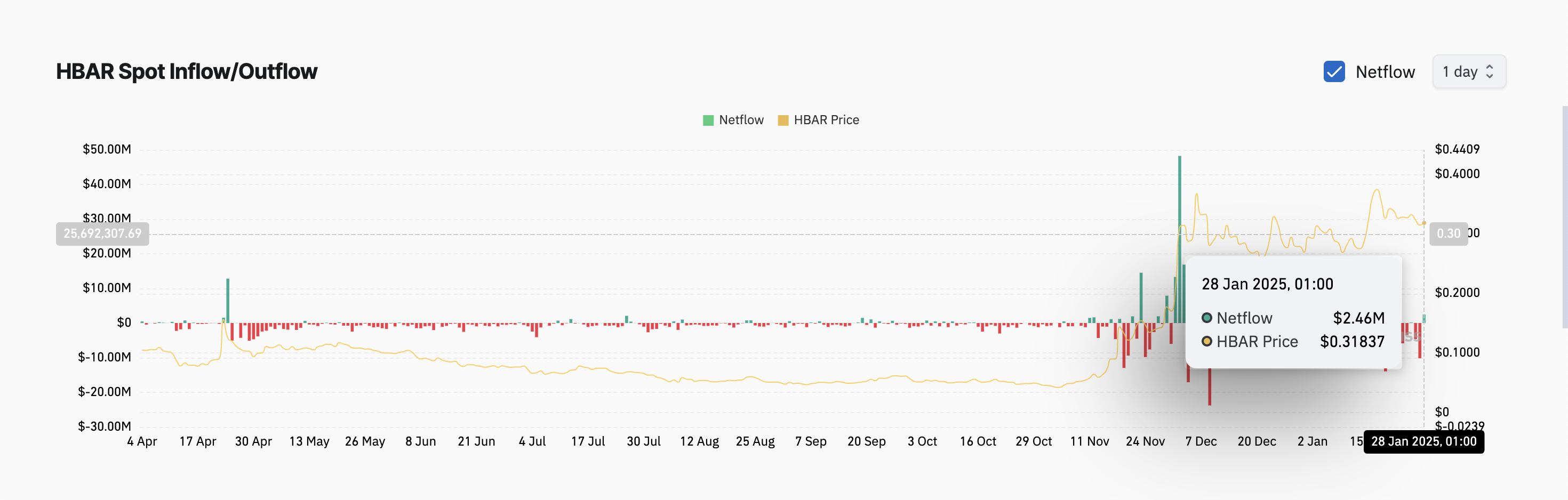

Hedera (HBAR) recently witnessed its first significant spot inflows in over ten days, totaling $2.46 million. These inflows, signaling renewed investor interest, have provided a slight boost to the token’s price. However, technical indicators suggest this upward momentum may be fleeting, with bearish sentiment continuing to dominate HBAR’s market dynamics.

Bearish Momentum Persists

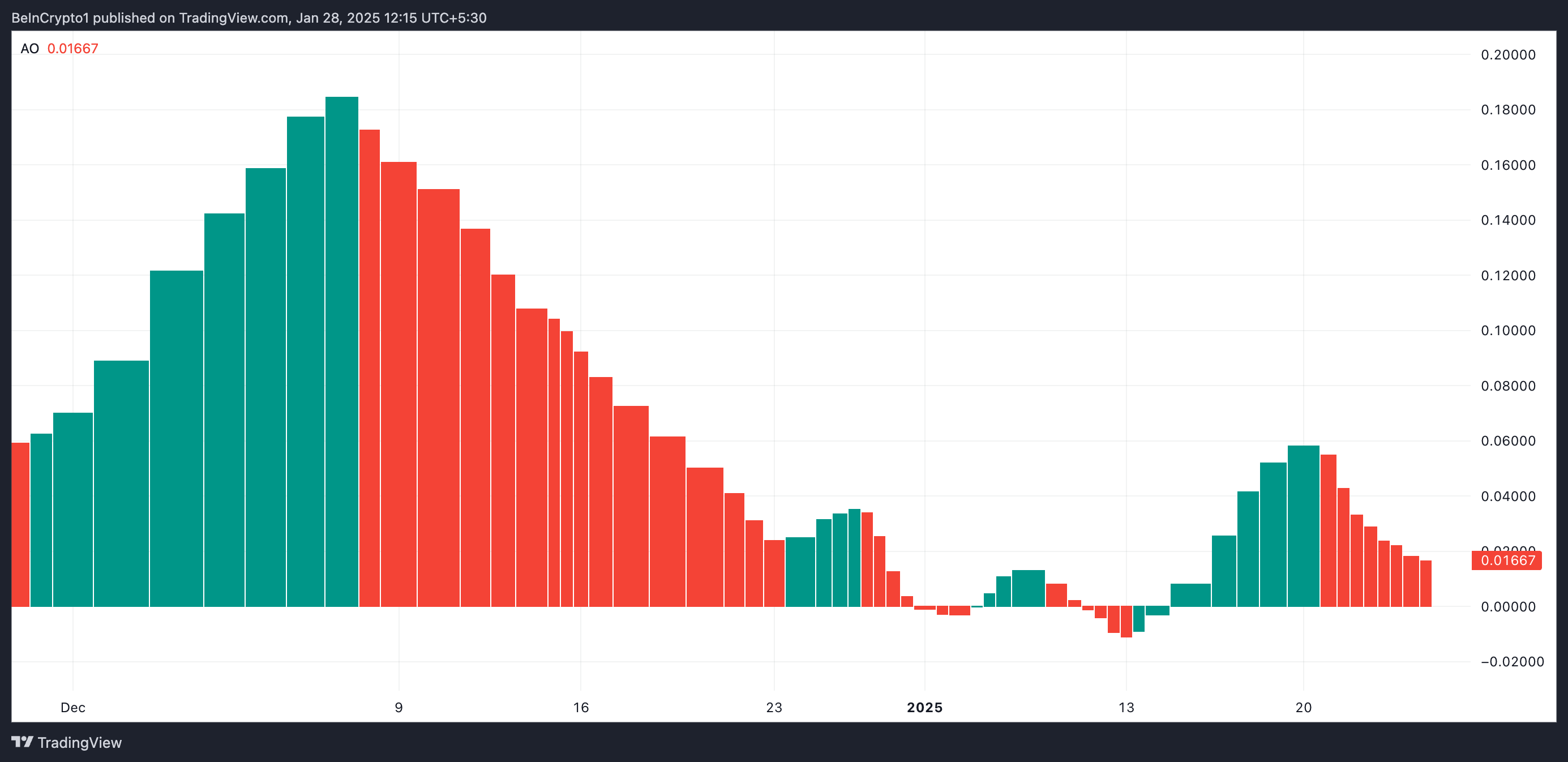

While spot inflows typically reflect fresh capital entering the market and could indicate short-term bullish momentum, HBAR’s technical indicators paint a less optimistic picture. The Awesome Oscillator (AO), a key metric for market momentum, continues to display red histogram bars, signaling weakening bullish pressure.

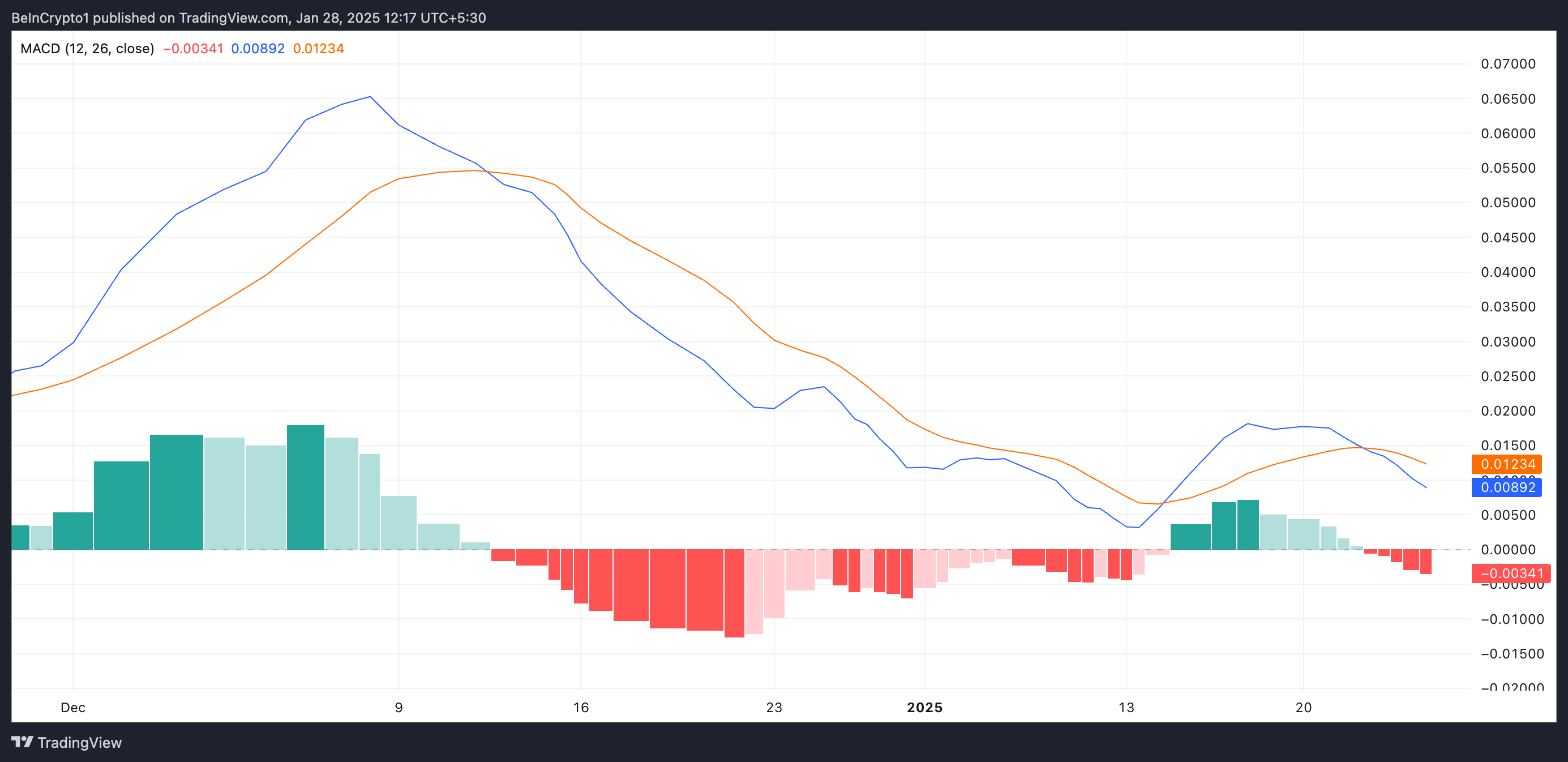

When AO bars turn red, bearish momentum intensifies, and the likelihood of a price reversal increases. This is further supported by HBAR’s Moving Average Convergence Divergence (MACD) indicator. As of now, the MACD line (blue) remains below its signal line (orange), underscoring the dominance of bearish momentum. Such a setup often reflects sell-offs outweighing buying pressure, increasing the likelihood of further price declines.

Price Outlook: $0.24 or $0.40?

HBAR’s immediate future hinges on whether bulls can regain market control. Should bearish pressure persist, the token’s price could retrace to $0.26, with the potential to dip further to $0.24 if the $0.26 support fails to hold.

Conversely, a resurgence in bullish activity could propel HBAR above the $0.33 resistance level, setting the stage for a rally toward $0.40. However, sustained buying momentum will be crucial to breaking through these resistance points.

For now, HBAR’s market remains precariously balanced between renewed investor interest and dominant bearish signals. Investors should monitor key support and resistance levels closely, alongside market momentum indicators, to navigate the token’s uncertain trajectory.

Also Read: Hedera Blockchain Soars 10x: How Stablecoins and Partnerships Drive HBAR’s Future

While HBAR’s recent inflows suggest growing interest, bearish technical indicators warn of a potential correction. Whether the bulls can overcome current downward pressures will determine HBAR’s path forward, making the next few days critical for the token’s price action.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.