|

Getting your Trinity Audio player ready...

|

The recent surge in selling pressure has highlighted weakening demand for Hedera (HBAR), raising concerns about its ability to hold above the critical $0.20 support level.

HBAR Outflows Indicate Bearish Sentiment

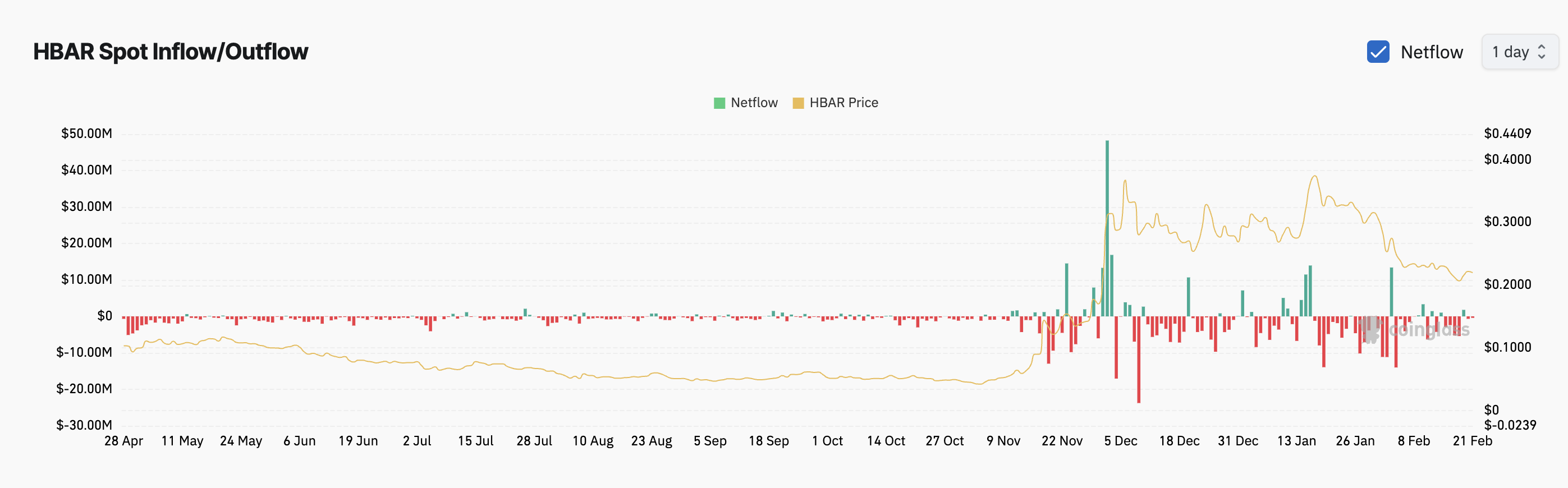

Over the past week, HBAR has witnessed significant capital outflows from its spot markets, with investors withdrawing over $17 million, according to data from Coinglass. Notably, the altcoin recorded just one inflow of $1.78 million on January 19, further underscoring the trend of dwindling investor confidence.

Spot market outflows typically occur when investors sell their holdings and move funds to other assets, indicating weakening demand and increased selling pressure. The persistent outflows from HBAR suggest a bearish market sentiment, as traders opt to exit their positions rather than accumulate more of the asset.

Additionally, the token’s negative weighted sentiment reflects the prevailing pessimism. On-chain data from Santiment reveals that HBAR’s sentiment score remains at -0.61, with negative discussions outweighing positive ones across social media platforms. When this metric trends negative, it signals a likelihood of prolonged price declines, as traders remain hesitant to re-enter the market.

HBAR Struggles to Maintain Support Amid Downtrend

Technical analysis of HBAR’s daily chart further supports the bearish outlook. Since reaching a four-year high of $0.40 on January 17, the token has followed a descending trend line, shedding nearly 48% of its value to trade at $0.21 at press time. Trading below a descending trend line typically indicates a sustained downtrend, where selling pressure consistently outweighs buying activity.

If this trend persists, HBAR risks slipping below the $0.20 support zone, potentially testing lower levels around $0.17. A continued lack of demand and ongoing negative sentiment could accelerate this decline.

However, a shift in market dynamics could invalidate this bearish projection. If HBAR experiences renewed buying interest and breaks above its descending trend line, the token could target a recovery toward $0.26, signaling a potential bullish reversal.

Also Read: HBAR Price Analysis: Is Hedera’s Downtrend Losing Strength or Poised for a Reversal?

With HBAR facing mounting selling pressure and weak demand, its ability to hold above $0.20 remains uncertain. While a price rebound is possible, the current technical indicators and market sentiment point toward further downside risk unless investor confidence returns.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!