|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- HBAR’s positive funding rate shows strong trader confidence.

- A weakening CMF suggests rising sell pressure and caution.

- The $0.27 resistance and $0.24 support levels are critical to watch.

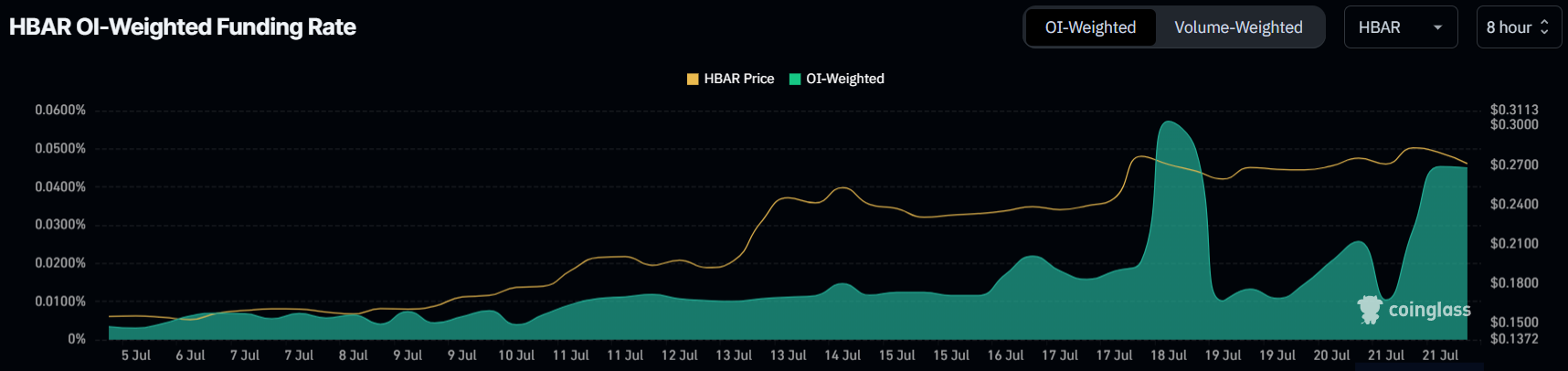

Despite overall crypto market caution, Hedera Hashgraph (HBAR) is drawing attention for its resilient bullish sentiment. The altcoin’s funding rate has remained positive for over a month—an indication that long positions are dominating futures markets.

Twice this week, funding rate spikes suggest increased leverage among traders, as many bet on continued price gains. However, technical signals hint at growing divergence between short-term enthusiasm and longer-term caution.

Positive Funding Rate Reflects Market Confidence in HBAR

HBAR’s consistently green funding rate paints a picture of optimism among traders. These rates, used in perpetual futures contracts, rise when demand for long positions increases.

This week’s funding spikes are strong indications that leveraged traders expect HBAR’s price to break through its key resistance at $0.27. Such sentiment often precedes upward momentum and reflects investor confidence in the altcoin’s performance.

Chaikin Money Flow Signals Caution Amid Inflows

However, not all indicators align with the bullish narrative. The Chaikin Money Flow (CMF), which measures buying and selling pressure, has dipped recently—despite remaining above the neutral zero line. This divergence suggests that while capital inflows continue, there is a growing number of investors cashing out.

This could indicate that long-term holders are taking profits as HBAR nears a potential local top. The contradiction between CMF and funding rates creates an atmosphere of uncertainty, potentially stalling a decisive move.

HBAR Price Outlook: Breakout or Breakdown?

As of writing, HBAR is priced at $0.26, just under its critical resistance of $0.27. A clean breakout above this level could trigger bullish momentum, with the next target likely around $0.30—a key psychological and technical milestone.

However, if selling pressure increases and HBAR dips below its $0.24 support, it could retrace further to $0.22, invalidating the short-term bullish setup. For now, the altcoin remains in a tight consolidation range, waiting for a catalyst.

The market’s tug-of-war between bullish leveraged traders and cautious long-term holders is keeping HBAR’s price action range-bound. Investors should watch the $0.27 and $0.24 levels closely for a directional shift.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Hedera (HBAR) Surges 125% — Will It Follow XRP to a New All-Time High?

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.