|

Getting your Trinity Audio player ready...

|

As market conditions remain volatile, HBAR (Hedera) continues to struggle with investor sentiment, and its recent price performance paints a grim picture. With weak inflows and a lack of momentum, HBAR remains vulnerable to further downside unless broader market conditions improve.

Weak Inflows Signal Investor Skepticism

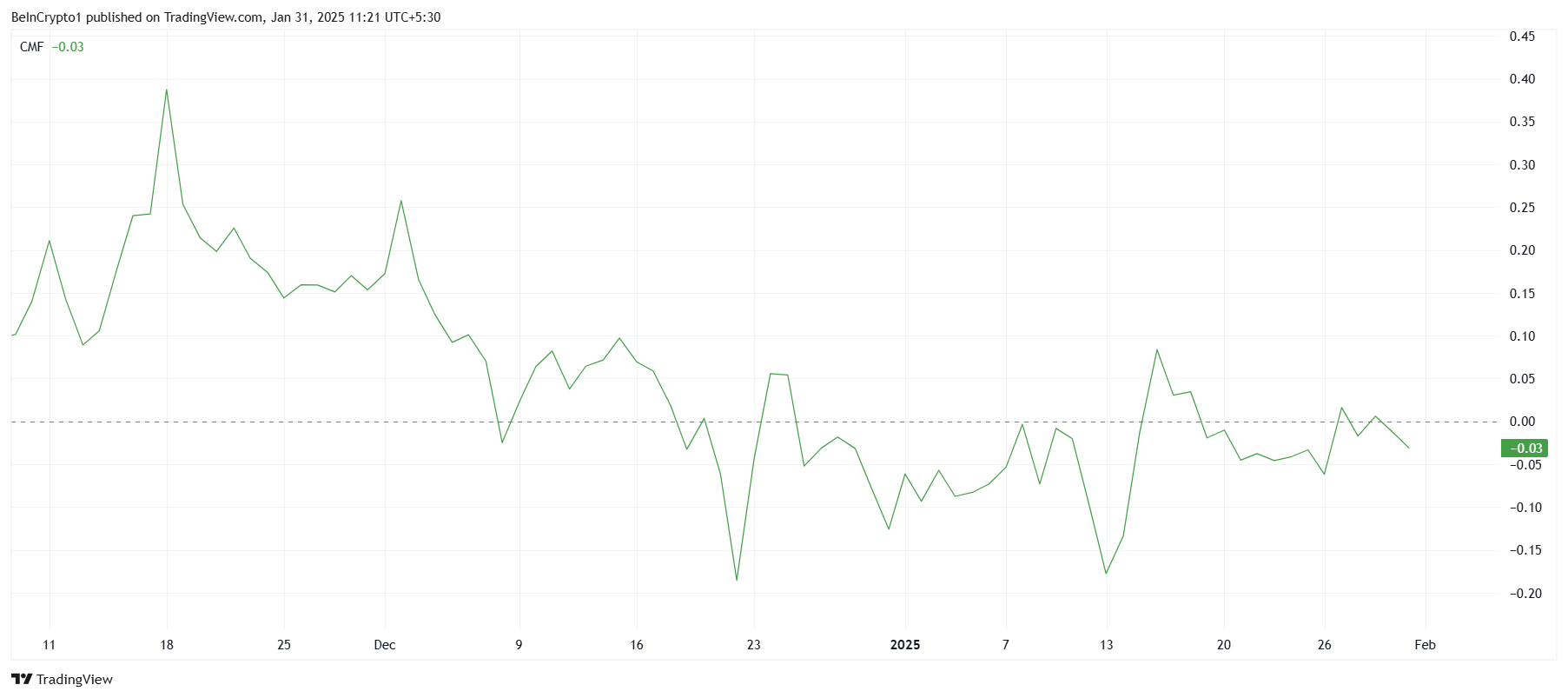

The Chaikin Money Flow (CMF) indicator, a tool that tracks the flow of capital into an asset, reveals that HBAR is experiencing subdued inflows. After a failed breakout attempt, the CMF remains close to the zero line, signaling limited new capital entering the market. Investors appear cautious, waiting for a definitive bullish signal before committing more funds to HBAR.

Currently, most investors are hesitant to act until the cryptocurrency can breach the $0.40 resistance level. This resistance has been a significant barrier, with traders unwilling to take action until a clear breakout occurs. In the meantime, HBAR seems to be stuck in consolidation, with little new buying interest to drive its price higher.

Weakening Correlation with Bitcoin Raises Concerns

In recent days, HBAR’s correlation with Bitcoin (BTC) has dropped to 0.64, indicating a weakening relationship between the two assets. A historically strong correlation with Bitcoin has helped HBAR maintain some upward momentum during market rallies, but this has begun to fade. As Bitcoin nears its $105,000 resistance, HBAR’s failure to follow suit could signal that it is losing its connection to the broader market.

With Bitcoin displaying bullish potential, HBAR’s divergence could leave it lagging behind in any crypto-wide rallies. Without the support of Bitcoin’s strength, HBAR may struggle to generate enough buying interest to sustain a recovery.

Price Outlook: Consolidation and Risk of Further Decline

HBAR is now trading within the consolidation range it experienced in late 2024, between $0.33 and $0.25. The loss of the $0.33 support level has intensified bearish pressure, increasing the risk of further downside movement. If HBAR fails to maintain $0.25, it could face a sharp decline toward $0.20.

However, if HBAR manages to reclaim $0.33 as support and successfully breaks the $0.40 resistance, the bearish outlook may shift. Such a move could reignite investor interest, providing an opportunity for HBAR to recover and potentially push higher. Until then, HBAR remains vulnerable to market uncertainty.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.