|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Whale accumulation is intensifying, with a notable rise in wallets holding large HBAR stakes, signaling strong institutional confidence.

- Funding rates remain elevated but not excessive, indicating bullish leverage without the immediate threat of a long squeeze.

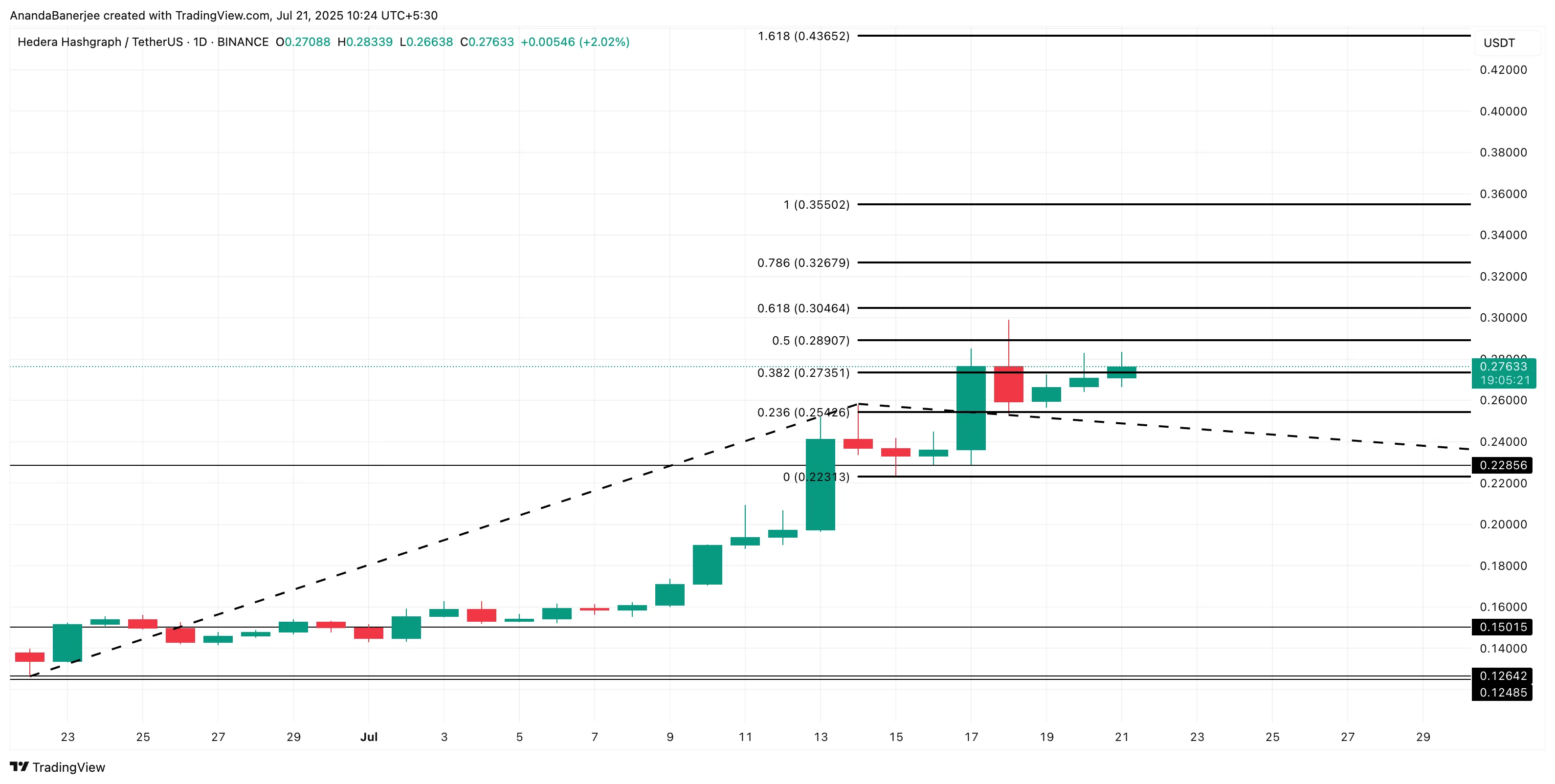

- Price action near key Fibonacci levels suggests consolidation before a potential breakout, with critical support at $0.25 and upside targets at $0.28, $0.30, and beyond.

The Hedera Hashgraph (HBAR) ecosystem is witnessing a notable increase in whale wallet activity, signaling growing confidence in the token’s near-term price potential. Over the past week, the number of wallets holding at least 1 million HBAR rose sharply from 67.28% to 71.41%. Even more impressive, wallets with holdings exceeding 10 million HBAR jumped from 86.29% to 91.62%, marking a significant accumulation by large investors.

This concentrated surge in whale holdings often reflects a bullish sentiment among institutional and high-net-worth investors. Such accumulation pressure typically precedes a potential continuation rally, indicating that these major players are positioning themselves ahead of an expected price move.

Elevated Funding Rates Reflect Aggressive Long Positions

Complementing the whale accumulation trend, HBAR’s funding rates have spiked recently, reinforcing bullish momentum. On July 18, the open interest-weighted funding rate peaked at 0.057%—its highest in months. While it has moderated slightly to 0.01% by July 21, the rate remains elevated, implying that long positions continue to dominate.

A rising funding rate is often a hallmark of aggressive leveraged long bets on the token. It suggests that traders are willing to pay premiums to maintain bullish positions, which can foreshadow sustained upward price pressure. Fortunately for HBAR investors, these funding rates have not reached overheated levels, reducing the immediate risk of a long squeeze—a scenario where leveraged longs are forced to liquidate, triggering sharp price declines.

Technical Price Action Hints at an Imminent Breakout

Technically, HBAR is showing promising signs around key Fibonacci extension levels, which traders use to identify potential resistance and breakout zones. After breaking above the critical 0.236 Fibonacci resistance level near $0.25, HBAR is currently consolidating around the 0.382 extension at approximately $0.27.

This consolidation zone has provided solid support over recent sessions, suggesting strength in the current price structure. Should HBAR hold this level, the next targets to watch are the 0.5 Fib resistance at $0.28 and the 0.618 Fib at $0.30. A confirmed breakout past these points could pave the way toward the $0.35+ range, aligning with the 1.0 Fibonacci extension and prior swing highs.

Also Read: Hedera (HBAR) Surges 125% — Will It Follow XRP to a New All-Time High?

However, a drop below the $0.25 support could invalidate the bullish thesis in the short term, and a fall under $0.22 might turn the trend bearish.

If you’re tracking Hedera Hashgraph and HBAR’s market dynamics, these factors could be key signals to watch as the token navigates its next critical price moves.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.