|

Getting your Trinity Audio player ready...

|

Mike Novogratz’s crypto venture Galaxy Digital predicts a significant inflow of capital into spot Bitcoin ETFs in their first year, potentially transforming the investment landscape.

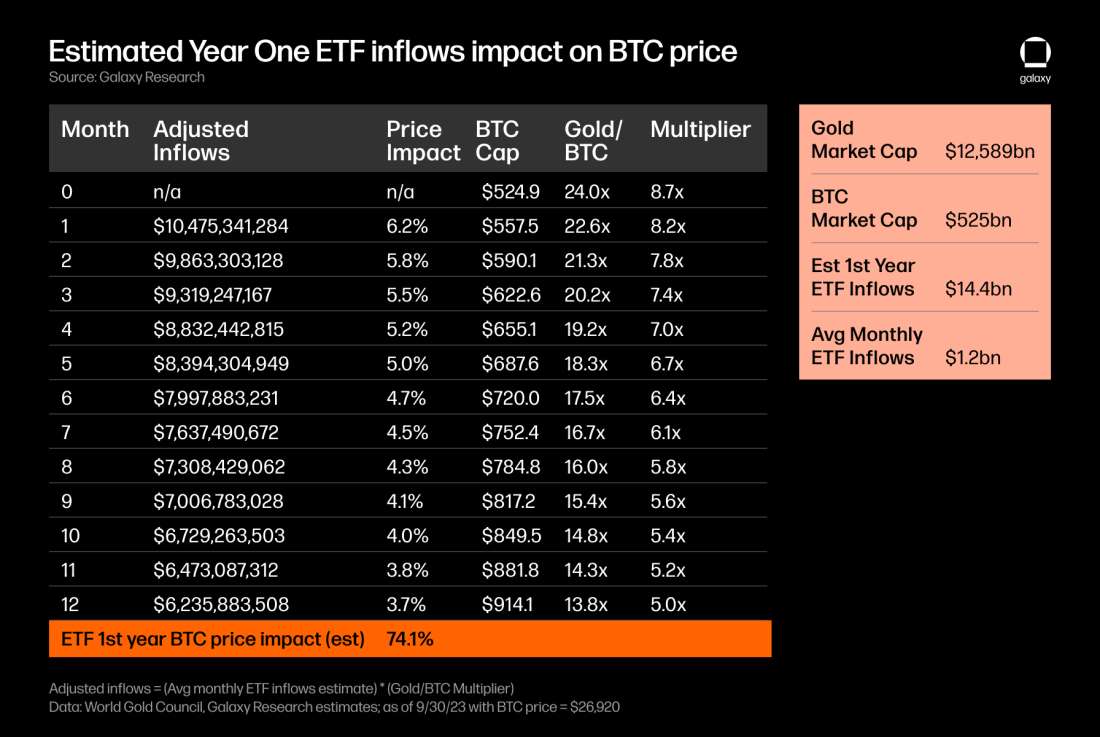

In a recent research report, Galaxy Digital analysts estimated that the total addressable market size for Bitcoin ETFs could reach $14.4 trillion in the first year after launch. This figure is based on the assumption that spot Bitcoin ETFs would attract investors from a variety of asset classes, including gold, bonds, and equities.

The analysts also believe that spot Bitcoin ETFs would have a significant impact on the price of Bitcoin. They estimate that the price of Bitcoin could increase by up to 74% in the first year after spot Bitcoin ETFs are launched.

This prediction is based on the assumption that spot Bitcoin ETFs would increase demand for Bitcoin from institutional investors. Institutional investors have traditionally been hesitant to invest in Bitcoin due to its volatility and regulatory uncertainty. However, spot Bitcoin ETFs would provide institutional investors with a more regulated and accessible way to invest in Bitcoin.

If Galaxy Digital’s predictions are accurate, spot Bitcoin ETFs could have a major impact on the cryptocurrency industry. A significant influx of capital into spot Bitcoin ETFs would boost the price of Bitcoin and attract more investors to the cryptocurrency market. This could lead to a more mature and sophisticated cryptocurrency ecosystem.

Also read: BlackRock’s Spot Bitcoin ETF Listed on DTCC, Signaling Potential Approval

Potential Impact of Spot Bitcoin ETFs

Spot Bitcoin ETFs could have a number of potential impacts on the cryptocurrency industry and the broader investment landscape.

Increased Liquidity and Accessibility

Spot Bitcoin ETFs would provide investors with a more liquid and accessible way to invest in Bitcoin. Currently, investors need to purchase Bitcoin on cryptocurrency exchanges, which can be complex and time-consuming. Spot Bitcoin ETFs would allow investors to buy and sell Bitcoin through traditional brokerage accounts.

Increased Institutional Investment

Spot Bitcoin ETFs are expected to attract a significant amount of institutional investment. Institutional investors have traditionally been hesitant to invest in Bitcoin due to its volatility and regulatory uncertainty. However, spot Bitcoin ETFs would provide institutional investors with a more regulated and accessible way to invest in Bitcoin.

Increased Price of Bitcoin

Increased demand for Bitcoin from institutional investors could lead to a significant increase in the price of Bitcoin.

Maturation of the Cryptocurrency Ecosystem

A significant influx of capital into spot Bitcoin ETFs would boost the legitimacy of the cryptocurrency industry and attract more investors to the market. This could lead to a more mature and sophisticated cryptocurrency ecosystem.

Overall, spot Bitcoin ETFs have the potential to have a major impact on the cryptocurrency industry and the broader investment landscape.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.