|

Getting your Trinity Audio player ready...

|

France is considering a groundbreaking move that could have a significant impact on the world of cryptocurrency. The government is proposing a new tax on what it calls “unproductive wealth.” This category includes not only luxury assets such as yachts, private jets, and high-end cars but also digital assets like Bitcoin. As the proposal gains attention, questions arise: Could this new tax hurt Bitcoin’s price? Will it make cryptocurrency less appealing to investors?

Understanding the Proposed Tax on Unproductive Wealth

The French government’s plan targets assets that do not directly generate income or contribute to economic production—essentially, wealth that sits idle. Bitcoin, which doesn’t produce dividends, interest, or rents, falls into this category. Historically, wealthy individuals have turned to such assets—luxury goods and cryptocurrencies alike—to preserve and grow their wealth. Now, the French government seeks to impose a tax burden on these assets in an effort to address wealth inequality and encourage investment in more productive, income-generating ventures.

Why Is the French Government Pushing for This Tax?

The reasoning behind this tax is straightforward: assets like Bitcoin and luxury goods are seen as “unproductive” since they don’t contribute directly to the economy in terms of income generation. The French government believes that by taxing these assets, it can incentivize wealth to be deployed in more economically productive ways, such as through businesses or investments that drive growth and job creation. While the idea might seem appealing to some, its implications for Bitcoin and luxury goods could be far-reaching.

Impact on Bitcoin and Cryptocurrency Investors

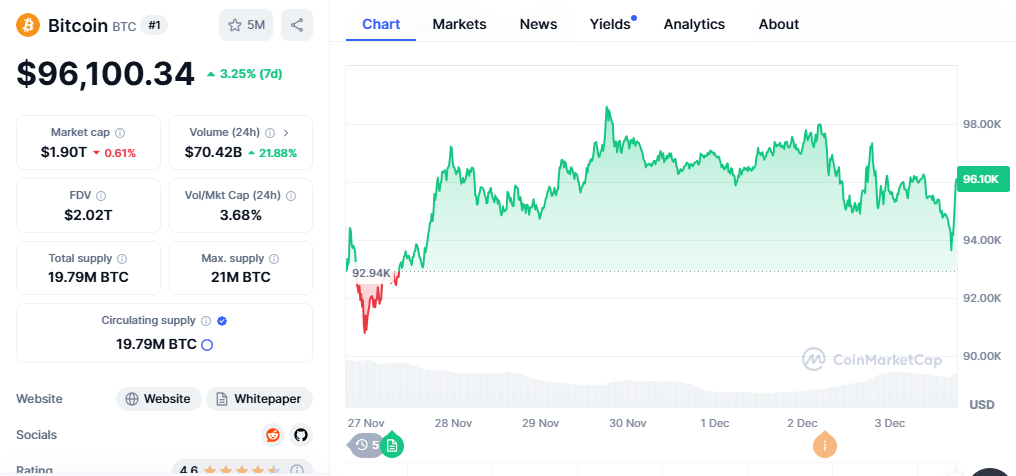

If the tax proposal moves forward, it could have profound consequences for Bitcoin. Currently, Bitcoin has been performing remarkably well, having achieved a historic monthly gain in November, surging by $26,400 and closing at a remarkable $96,400. While it hasn’t yet broken the $100,000 mark, the cryptocurrency remains resilient, driven by strong market dynamics.

However, a tax on Bitcoin could dampen investor enthusiasm. For many, cryptocurrency is a hedge against inflation and a store of value, much like gold. The prospect of an added tax burden on Bitcoin could make holding the asset less attractive, especially to French citizens. This could reduce demand for Bitcoin, causing liquidity to drop, potentially leading to a short-term decrease in its price.

Moreover, the move could set a precedent for other countries considering similar taxation on digital assets. If other nations follow France’s lead, this could trigger a broader shift in the regulatory landscape for cryptocurrencies, impacting global demand and pricing.

While the full implementation of this tax is still under discussion, the possibility of such a change has left many investors nervous. In the short term, Bitcoin’s price might face downward pressure if the tax proposal moves forward. However, its long-term prospects depend largely on how the global regulatory environment evolves and how other countries react.

Bitcoin has proven its resilience, and the continued innovation in the crypto space could offset some of the potential negative effects of such a tax. Still, the uncertainty surrounding France’s proposed tax on unproductive wealth adds a new layer of complexity to the cryptocurrency market. Investors will need to stay vigilant as the proposal moves through discussions and keep an eye on any potential fallout for Bitcoin’s price.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Telegram CEO Detained In France – Justin Sun Proposes FreePavel DAO

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!