|

Getting your Trinity Audio player ready...

|

President Trump’s second term has ushered in a period of intense volatility for the cryptocurrency sector, marked by both soaring highs and unsettling lows. While Bitcoin initially surged to a record $109,000, fueled by initial optimism, the market subsequently plummeted to near $70,000, rattled by fears of Trump’s trade tariffs and broader global economic uncertainty. This turbulent landscape highlights the complex interplay between political developments and the nascent digital asset market.

Despite the volatility, a wave of substantial financial support from crypto heavyweights has underscored the sector’s growing political influence. Federal Election Commission (FEC) filings reveal that digital asset firms poured approximately $18 million into Trump’s inauguration fund. Leading the charge was Ripple Labs, with a staggering $5 million donation, showcasing the industry’s commitment to fostering a favorable regulatory environment. This significant contribution, alongside million-dollar donations from Solana Labs and notable figures like Uniswap CEO Hayden Adams, signifies a strategic push to solidify ties with the administration.

crypto companies and execs donated $18 million to trump's inauguration fund, according to sunday's FEC filing:https://t.co/5wJo077vmT pic.twitter.com/XyNLwSyY6k

— Ben Weiss (@bdanweiss) April 21, 2025

Crypto’s Political Clout: Millions Flow into Trump’s Inauguration

The substantial donations reflect a broader trend of increased political engagement by the crypto industry. Between Trump’s victory and the April 20th report release, his political party amassed around $239 million in donations, with major crypto players like Coinbase, Kraken, Ondo Finance, and Robinhood contributing seven-figure sums. This financial backing coincides with a perceived pro-crypto stance from the Trump administration, evidenced by the SEC’s decision to drop significant lawsuits against industry giants like Coinbase, OpenSea, and Ripple. Furthermore, Trump’s announcement of an executive order to establish a U.S. strategic cryptocurrency reserve, encompassing Bitcoin, Ether, XRP, Solana, and Cardano, signals a potential shift towards integrating digital assets into the national economic framework.

XRP’s Stalled Rally Amidst Regulatory Wins

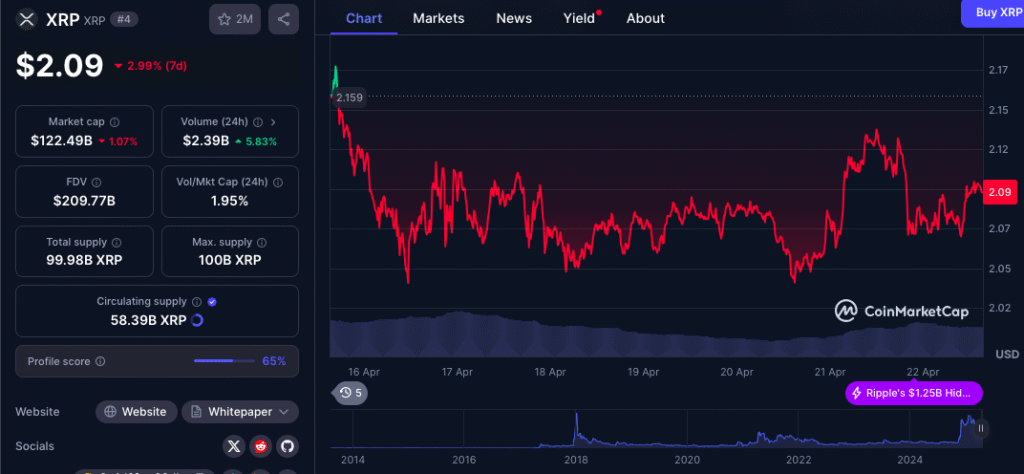

While Ripple Labs’ significant political contributions and the favorable regulatory developments initially sparked optimism for XRP, the cryptocurrency has failed to capitalize on the momentum. Despite meetings between Ripple’s CEO Brad Garlinghouse and CLO Stuart Alderoty with President Trump, XRP’s price has remained stagnant. Currently trading at $2.10, it has experienced a 0.9% decline in the past day and over a 3% drop in the past week. This lackluster performance underscores the independent dynamics of individual cryptocurrencies, where broader market sentiment and specific project developments often outweigh even positive political tailwinds. The divergence between regulatory relief and XRP’s price action serves as a reminder of the multifaceted factors influencing the crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Solana, Uniswap, and Consensys Donated to Donald Trump Before SEC Dropped Investigations

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.