|

Getting your Trinity Audio player ready...

|

- Whales bought 25,000 ETH for $112M post-Fed rate cut.

- Exchange outflows hit $86M, tightening market supply.

- Long positions dominate, signaling bullish trader sentiment.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Ethereum [ETH] has seen a surge in accumulation activity following the U.S. Federal Reserve’s recent 25bps interest rate cut. A major OTC whale purchased 25,000 ETH for $112.34 million in USDC at $4,493 each — a bold move that coincided with heavy exchange outflows. This points to large investors shifting ETH into cold storage, often a sign of long-term conviction.

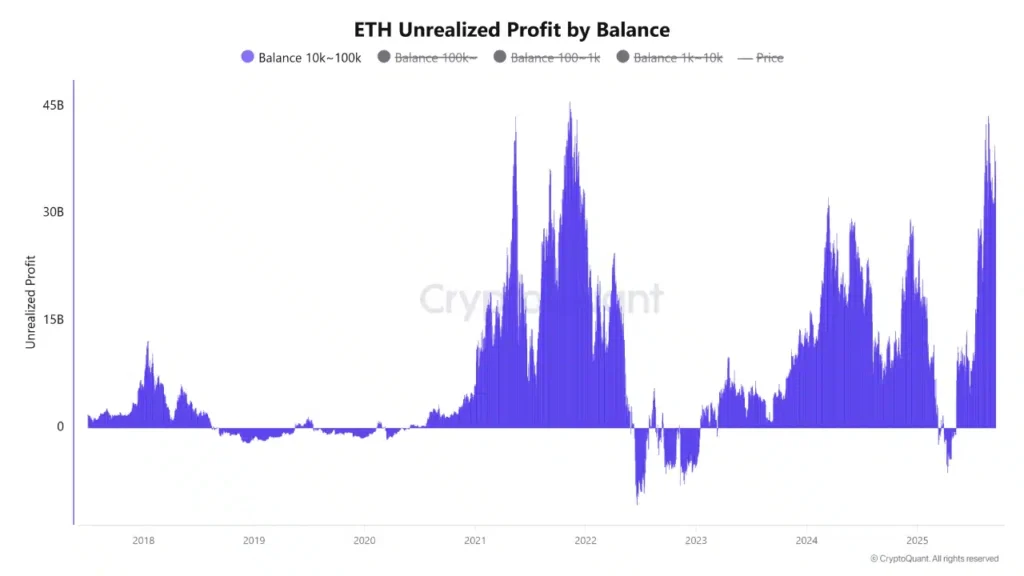

Mid-Sized Whales Near 2021 Profit Levels

Ethereum wallets holding between 10,000 and 100,000 ETH are now sitting on unrealized profits not seen since the 2021 market peak. While this puts them in a position to take profits, many continue to hold, signaling strong conviction. Historically, such profit levels have triggered both profit-taking and renewed rallies, creating uncertainty about near-term direction.

Exchange Outflows Reflect Growing Holding Sentiment

On September 18, Ethereum recorded $86.17 million in net outflows from spot exchanges. This sharp shift suggests investors prefer self-custody over keeping ETH on centralized exchanges for quick trades. Reduced supply on exchanges can heighten volatility but often supports price during demand surges, adding to the bullish structure forming post-Fed cut.

Also Read: SEC Approves Grayscale’s $GDLC — Bitcoin, Ethereum, XRP & More Coming to NYSE

Leverage Tilted Toward Bulls

Futures data shows 64.95% of ETH/USDT positions on Binance are long, reflecting growing speculative demand. While such leverage can accelerate gains, it also heightens the risk of sharp liquidations if prices dip. Even so, the dominance of longs, combined with whale accumulation and exchange outflows, suggests traders broadly expect Ethereum to push higher.

Ethereum is at a critical juncture. Heavy whale buying, rising unrealized profits, and shrinking exchange balances have aligned to create bullish conditions. If selling pressure remains muted and accumulation persists, Ethereum could break decisively higher in the sessions ahead.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.