|

Getting your Trinity Audio player ready...

|

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has been at the center of market discussions following a massive liquidation event. According to blockchain analytics platform Lookonchain, a whale recently liquidated 160,234 ETH, valued at approximately $306.85 million.

This whale just got liquidated for 160,234 $ETH($306.85M)!https://t.co/6LXpmU9hCq pic.twitter.com/yFobkbE68K

— Lookonchain (@lookonchain) March 12, 2025

Ethereum Whale Liquidation: A Market Shift?

The whale had accumulated ETH at an average buying price of $1,900, with a liquidation threshold of $1,805. As ETH dipped below this critical level, the position was automatically liquidated. Despite this, ETH has demonstrated resilience, currently trading around $1,908, reflecting a modest 0.50% increase in the past 24 hours.

However, despite the slight price rebound, Ethereum’s trading volume has plummeted by 35%, signaling reduced market participation. This decline could be attributed to uncertainty following the large-scale liquidation, causing traders to adopt a cautious stance.

Technical Analysis: ETH’s Next Move

From a technical perspective, ETH has regained momentum above the crucial $1,900 level, historically known as a key support zone. If Ethereum sustains its position above $1,800, analysts anticipate a potential 15% rally, pushing prices toward the $2,200 mark in the near term.

Additionally, Ethereum’s Relative Strength Index (RSI) indicates a bullish divergence, with the indicator forming a higher high while ETH previously made a lower low. This pattern suggests a potential price reversal and a shift in market sentiment towards the upside.

Key Liquidation Levels and Market Sentiment

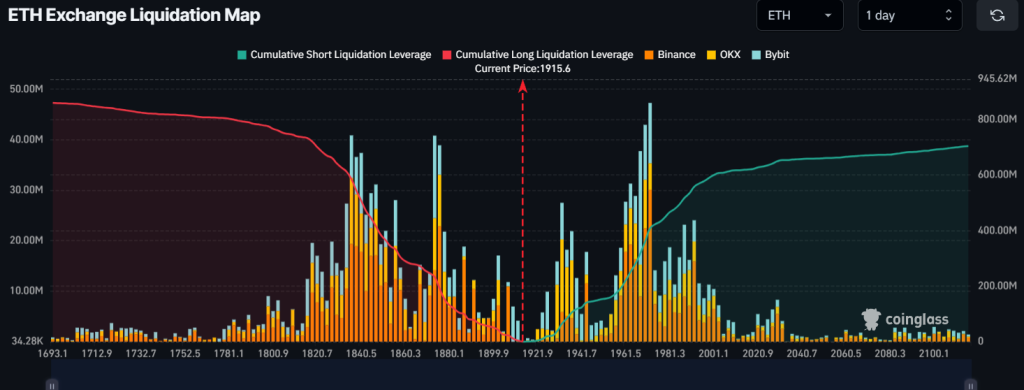

According to on-chain data from Coinglass, the next major liquidation levels are positioned at $1,835 on the lower side and $1,970 on the upper side. Traders appear over-leveraged at these points, making them crucial zones for price volatility.

Moreover, data reveals that traders currently hold $585 million in long positions, compared to $410 million in short positions at the $1,970 level. This suggests that bullish sentiment remains dominant, which could help ETH maintain its footing above the critical $1,800 support level.

As Ethereum continues to navigate market turbulence, investors will be closely watching whether it can sustain bullish momentum or face further corrections.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Holders Face Losses as Market Struggles – Is a Rebound Coming?

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!