|

Getting your Trinity Audio player ready...

|

- ETH climbs above $4,000 following SharpLink Gaming and Bitmine purchases.

- Derivatives data signals short-term volatility despite bullish spot market.

- Best Wallet presale exceeds $16.6M amid Ethereum momentum.

Ethereum (ETH) broke past the $4,000 mark on Tuesday, October 21, posting a 3% daily gain amid renewed market optimism. The surge follows major institutional moves, including SharpLink Gaming’s recent ETH purchases, highlighting Ethereum’s growing appeal among large-scale investors.

SharpLink Gaming Drives Bullish Momentum

SharpLink Gaming revealed on X (formerly Twitter) that it acquired 19,271 ETH at an average price of $3,892, bringing its total treasury to 859,853 ETH—valued at approximately $3.5 billion as of October 19, 2025. The company also reported 5,671 ETH in staking rewards since June, emphasizing the profitability of ETH holdings.

NEW: SharpLink acquired 19,271 ETH at an average price of $3,892, bringing total holdings to 859,853 ETH valued at $3.5B as of October 19, 2025.

— SharpLink (SBET) (@SharpLinkGaming) October 21, 2025

Key highlights for the week ending October 19, 2025:

– Raised $76.5M at a 12% premium to market

– Added 19,271 ETH at $3,892 avg.… pic.twitter.com/Y4Ewu4EiuF

The firm’s concentration ratio has doubled to 4.0 since June, reflecting aggressive treasury expansion. Additionally, SharpLink raised $76.5 million at a 12% premium to market, signaling strong confidence in Ethereum’s institutional viability.

Ethereum’s price now hovers around $4,020, maintaining support above its 50-day moving average, while traders watch potential retests of the $4,200 resistance level. Bitmine, Ethereum’s largest treasury holder, also announced $250 million in fresh ETH purchases, bringing its total reserves to $13.4 billion.

Ethereum Derivatives Suggest Short-Term Volatility

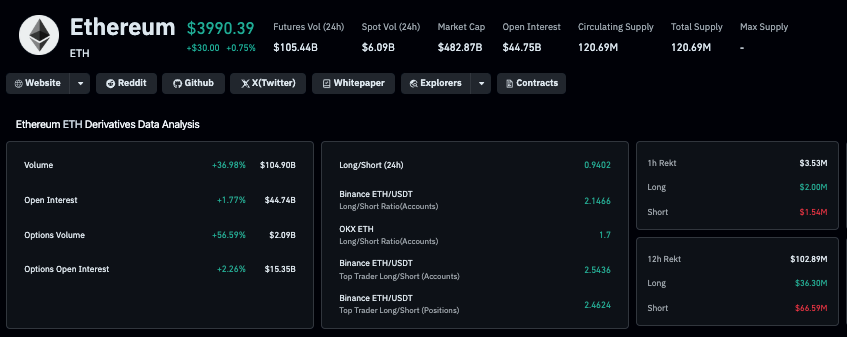

While ETH’s spot market is buoyant, derivatives trading hints at cautious positioning. Coinglass data shows Ethereum futures trading volume jumped 37%, but Open Interest increased only 1.77% to $44.74 billion. This suggests intraday repositioning rather than significant new capital inflows.

The long/short ratio sits at 0.94, indicating a slight bearish bias. Traders are closely monitoring whether ETH can maintain above $4,000; failure could trigger a pullback to $3,900. Conversely, a short-squeeze could push Ethereum quickly toward $4,200 if macro catalysts emerge.

Also Read: Ethereum Controversy Deepens — Former Developer Claims Vitalik Controls Ecosystem

Best Wallet Presale Gains Traction

Amid Ethereum’s price consolidation, the Best Wallet (BEST) presale has surpassed $16.6 million. The multi-chain crypto wallet offers institutional-grade security, non-custodial features, and high staking rewards. With less than 48 hours before the next price tier unlocks, early investors still have a chance to join and benefit from exclusive perks.

Ethereum’s recent climb above $4,000 underscores its appeal to institutional investors and market participants alike. SharpLink Gaming and Bitmine’s treasury expansions provide strong bullish signals, while derivatives markets suggest short-term volatility. Investors will be watching closely to see whether ETH sustains momentum or faces a retest of key support levels.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.