|

Getting your Trinity Audio player ready...

|

Ethereum’s long-term holders (LTH) have displayed more bullish conviction than Bitcoin (BTC) holders in early 2025, signaling a potential shift in market dynamics. According to analytics firm IntoTheBlock, Ethereum’s LTH cohort increased its holdings, pushing its dominance to nearly 75%. In contrast, Bitcoin’s LTH dominance has dipped below 60% due to sustained liquidation, marking a stark contrast in investor behavior between the two leading cryptocurrencies.

This chart highlights the long-term holder ratios for Ethereum and Bitcoin.

— IntoTheBlock (@intotheblock) January 9, 2025

Currently, 74.7% of Ethereum addresses are long-term holders, significantly outpacing Bitcoin. This trend is likely to hold until Ethereum approaches its all-time high and holders start taking profits. pic.twitter.com/mZzWI6HVr6

This trend began in early 2024, with Ethereum struggling to match Bitcoin’s impressive price performance. Bitcoin surged past $108,000, crossing its previous cycle high and making nearly all holders profitable. Ethereum, however, has yet to replicate this performance, leaving many ETH holders waiting for a potential rally to recoup or profit from their investments.

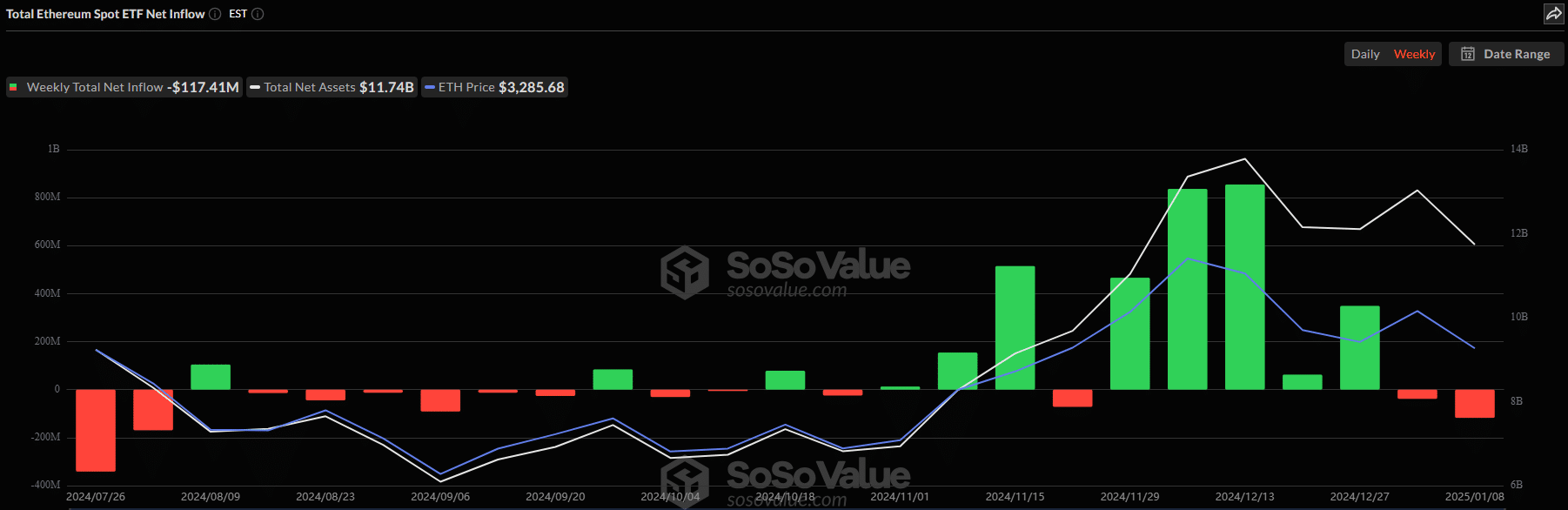

Despite Ethereum’s strong holder sentiment, institutional demand has shown a mixed outlook for both assets. Data from Soso Value highlights that ETH ETFs experienced outflows during the first weeks of 2025, contrasting with the five consecutive weeks of inflows seen in November. Meanwhile, Bitcoin saw net inflows during the same period, suggesting that BTC could continue outperforming ETH if this trend persists.

However, the ETH/BTC ratio, which tracks Ethereum’s price relative to Bitcoin, shows signs of a potential reversal. The ratio recently hit a four-year low of 0.30 but formed a double bottom pattern, hinting at a possible rebound in favor of ETH. If this momentum continues, Ethereum could see a significant recovery.

ETH’s price is also positioned for a potential rebound from its recent lows above $3,000, with the $3K-$3.3K zone acting as key support. Traders are eyeing a move toward the $3.6K level, with further bullish sentiment contingent on Ethereum reclaiming its 50-day EMA. As Q1 2025 unfolds, Ethereum’s performance may hinge on whether these technical indicators and holder confidence can align for a decisive rally.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum to $12K? Trump Presidency and Pectra Upgrade Could Fuel Massive ETH Surge – Analyst

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.