|

Getting your Trinity Audio player ready...

|

The Ethereum Foundation’s ongoing strategy of selling its Ethereum (ETH) holdings has once again triggered market jitters. On December 10th, on-chain data revealed by Spot on Chain showed the non-profit organization selling 100 ETH for over 374,334 DAI. This latest selloff adds to the 4,266 ETH already sold throughout 2024, bringing the total revenue generated to $12.21 million with an average price of $2,796 per ETH.

These sales, coming nearly a month after the previous recorded selloff, have instilled apprehension among market participants. The concern lies in the increased selling pressure placed on ETH as the foundation continues to offload its holdings. As reported by CoinGape, the Ethereum Foundation holds a significant treasury of $970.2 million, with the vast majority being in Ethereum. This raises the possibility of further sales in the future, potentially impacting the asset’s price negatively, especially during bull market periods.

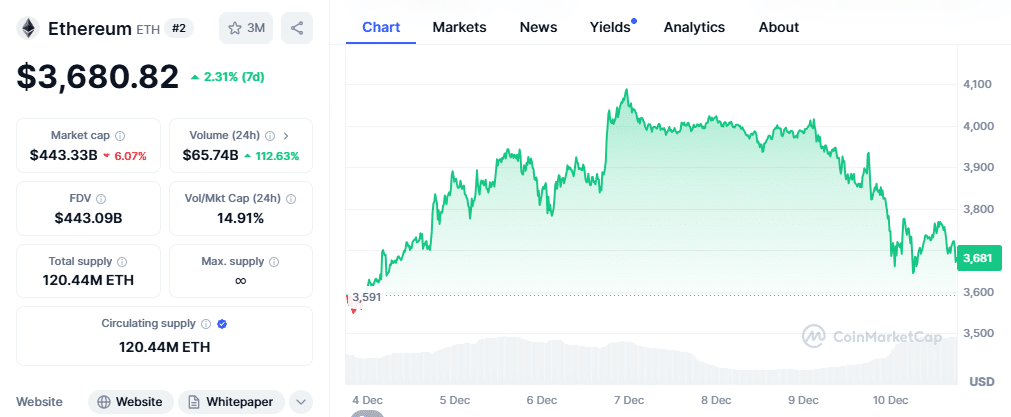

The market’s unease is further amplified by the recent decline in ETH price. At the time of writing, ETH has dipped nearly 3%, trading at $3,752. The 24-hour trading range sits between $3,525.23 and $3,944.76. Notably, this price movement coincides with the Ethereum Foundation’s selloff, leading to increased market anxiety.

While the broader market charts indicate impressive gains – 4% and 17% in the past month and week, respectively – questions linger about the impact of potential future selloffs on the price momentum. This uncertainty is compounded by additional bearish technical indicators and broader market conditions, as suggested by a recent Ethereum price analysis from CoinGape Media.

Also Read: Ethereum Foundation’s $970M Holdings Spark Selloff Fears: ETH Drops 3% Amid Market Apprehension

Cryptocurrency enthusiasts are closely monitoring the situation, waiting for any significant shifts in ETH’s price. With continued sales from the Ethereum Foundation and mixed market signals, the near future of ETH remains shrouded in some degree of uncertainty.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.