|

Getting your Trinity Audio player ready...

|

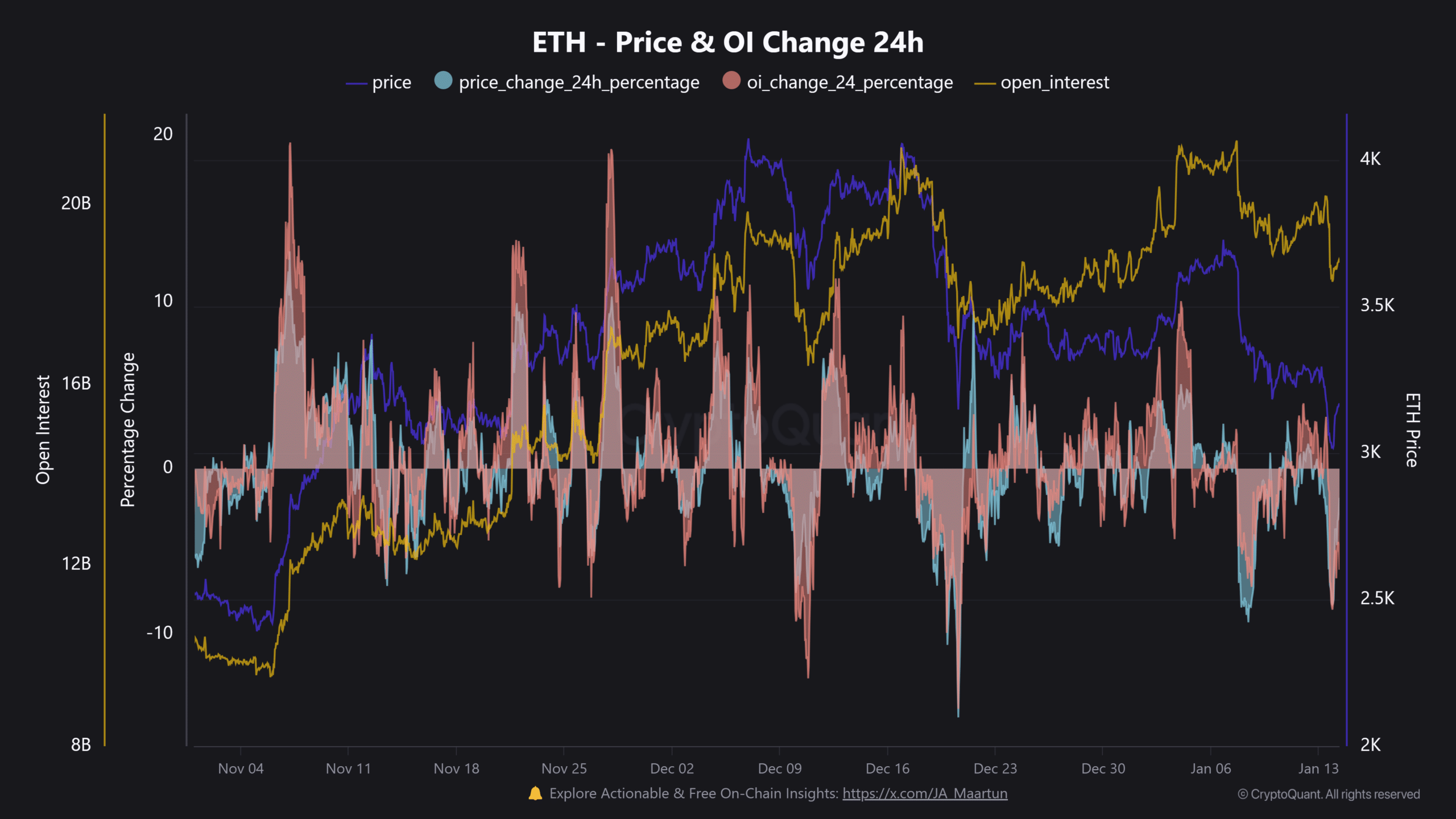

Ethereum (ETH) has historically been a star performer in the first quarter, with an impressive track record of delivering average gains of 81%, according to Coinglass data. However, a mounting $10 billion in leverage could dampen its potential rally and expose the altcoin to heightened liquidation risks.

$ETH has added $10b+ in leverage since the election

— Andrew Kang (@Rewkang) January 13, 2025

This unwind will be painful, but $ETH won't go to zero

It will simply range from $2k to $4k for a very long time

The bright side is that Vitalik has adopted MooDeng https://t.co/AqFQp9W5mw pic.twitter.com/BOGnHohcBQ

Andrew Kang, co-founder of crypto venture capital firm Mechanism Capital, highlighted this concern. He noted that ETH leverage skyrocketed from $9 billion before the U.S. elections to a staggering $19 billion by December. This surge fueled speculative trading but resulted in a sharp price drop to $3,100 as liquidations erased over-leveraged positions.

Kang projected ETH might remain range-bound between $2,000 and $4,000 due to these risks. He pointed out that the leverage increase wasn’t driven by “delta-neutral” CME Futures trades, where spot ETH purchases are hedged by short positions in the futures market. Instead, speculative traders are primarily responsible for the excessive leverage, raising concerns about potential price volatility.

Historical trends reinforce these fears. In instances where leverage Open Interest grew faster than price during a rally, pullbacks and local tops often ensued. This pattern was evident in early November and late December, when ETH saw significant liquidations. On December 20 alone, ETH recorded over $300 million in liquidations, with long positions taking the brunt of the losses.

Despite these challenges, Q1 has consistently been Ethereum’s strongest quarter. Over the past seven years, ETH closed only two Q1s in the red, offering hope for another bullish season. At press time, ETH rebounded above $3,000 following a dip to $2,900 earlier in the week.

Also Read: Ethereum Struggles Amid Market Downturn: Is It Time to Be Cautious or Seize the Opportunity?

The path forward for ETH remains uncertain. While historical trends favor a Q1 rally, the looming leverage risk could cap gains and spark further volatility. Traders and investors should closely monitor leverage metrics and liquidation trends as the altcoin navigates these turbulent waters.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!