|

Getting your Trinity Audio player ready...

|

Key Takeaways:

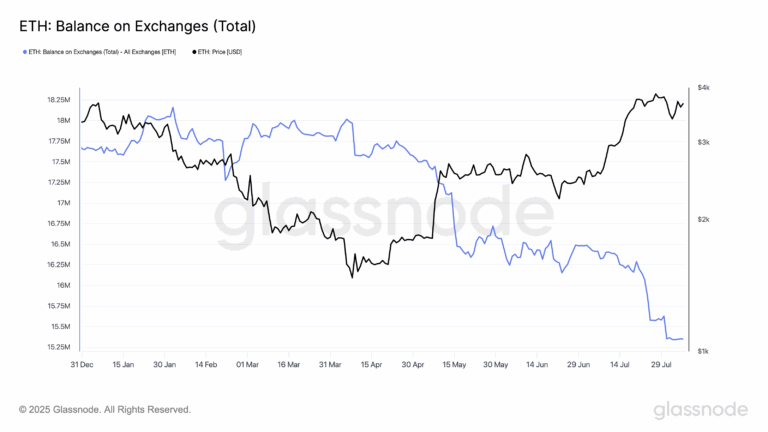

- ETH on exchanges hits 9-year low, signaling reduced sell pressure.

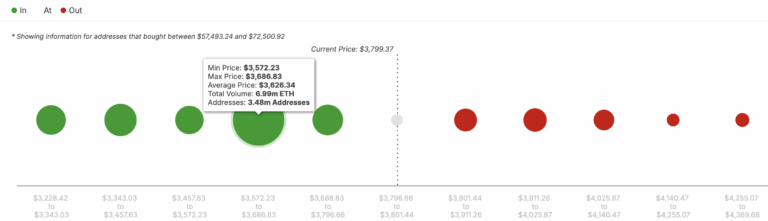

- Strong buy wall at $3,626 creates crucial support zone.

- Bull flag breakout could send ETH toward $5,800+ highs.

Ethereum (ETH) is flashing bullish signals as exchange balances fall to their lowest level in nine years. This rare on-chain event points to reduced sell pressure and a potential setup for an extended price rally, driven by growing investor confidence and tightening supply.

Investors Move ETH Off Exchanges

Data shows that ETH held on centralized exchanges has dropped from over 18 million in April to just 15.35 million — a level not seen since 2016. This reduction indicates a major shift in investor behavior, with more coins being moved to cold storage, self-custody wallets, or deployed in DeFi protocols.

Such a trend typically reflects strong conviction among holders and historically signals the onset of a supply squeeze. With fewer tokens available on exchanges, new demand could result in outsized price movements due to increased price elasticity.

Key On-Chain Support Zone Forms at $3,626

According to IntoTheBlock’s IOMAP indicator, around 7 million ETH were bought by 3.48 million addresses near the $3,626 price level. This buying activity has established a strong on-chain support zone, making it a psychologically significant level.

If Ethereum maintains this support and breaks through nearby resistance zones, it could trigger a wave of bullish momentum. Resistance lies just above $4,100, and a breakout could push ETH toward the $4,255–$4,369 range in the short term.

Bull Flag Pattern Hints at Price Surge

Ethereum’s daily chart reveals a bull flag formation, with price action testing the upper boundary of the flag’s descending trendline. If ETH closes decisively above this resistance, it would confirm the bullish pattern and could propel the price towards a new all-time high of $5,809.

Also Read: Ethereum Price Holds $3.6K Despite $418M Sell-Off — Can Bulls Reclaim $3,950?

Additionally, the Bull Bear Power (BBP) indicator has flipped positive, indicating diminishing bearish control.

With on-chain supply shrinking, strong buy-side support, and bullish technical patterns aligning, Ethereum is poised for a potential breakout. While price rejection remains possible around $3,529 or lower, momentum is building for ETH to challenge and possibly surpass its previous highs.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!