|

Getting your Trinity Audio player ready...

|

Ethereum [ETH] exchange-traded funds (ETFs) concluded December 2024 with remarkable momentum, netting $2.6 billion in inflows. This achievement underscores the growing institutional interest in Ethereum as a compelling investment vehicle. By year-end, ETH ETFs amassed $35 billion in inflows, narrowing the gap with Bitcoin [BTC] ETFs, which trailed in comparative growth.

Institutional Confidence and Ethereum’s Edge

Ethereum’s robust ecosystem and expanding use cases have fueled confidence in its long-term potential. Unique features, such as staking rewards, offer yield-generation opportunities, making ETH ETFs increasingly attractive to investors. Analysts predict that Ethereum ETFs could outperform Bitcoin ETFs in 2025 if the current trends persist, supported by favorable regulatory developments and Ethereum’s innovative technological advancements.

November and December 2024 marked pivotal periods, with ETH ETFs recording eight consecutive weeks of inflows. A record-breaking $2.2 billion inflow in late November highlighted heightened investor confidence, signaling a shift in institutional preferences toward Ethereum.

Challenges to Ethereum’s Ascent

Despite its progress, Ethereum faces hurdles in challenging Bitcoin’s dominance. Bitcoin’s market share of 47.1% dwarfs Ethereum’s 18.7%, reflecting the former’s entrenched position as the market leader. Ethereum must build similar trust among investors to close this gap.

Moreover, Ethereum’s historical volatility has deterred risk-averse investors. Consistency in ETF inflows and price stability will be crucial to overcoming these challenges. Analysts believe that Ethereum’s staking rewards and evolving regulatory clarity could accelerate market share growth, provided the network continues to demonstrate resilience.

Bullish Momentum and Trading Volume Surge

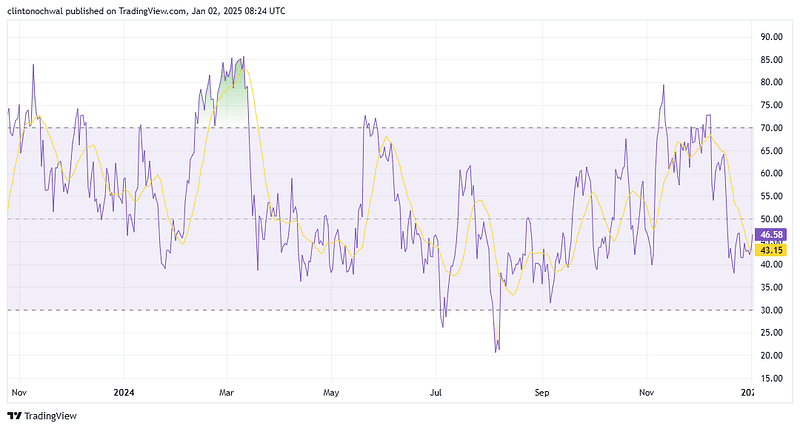

Ethereum’s Relative Strength Index (RSI) of 68 at year-end indicates strong bullish momentum. While nearing the overbought threshold, analysts expect temporary pullbacks before a continued upward trend. December also saw ETH ETFs achieve a trading volume surpassing $13 billion, underscoring growing investor confidence and robust liquidity.

Looking ahead, if Ethereum maintains its bullish price trajectory and intensifies network activity, its ETFs could emerge as top-performing assets in 2025, cementing their place as institutional favorites.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Ethereum Faces Pressure as Justin Sun’s $96.7M ETH Deposit Pushes Price Towards Key Support

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.