|

Getting your Trinity Audio player ready...

|

Decentralized finance (DeFi) is witnessing a surge in a new area: restaking. This innovative concept leverages Ethereum’s proof-of-stake blockchain to secure other networks, and it’s driving excitement among investors.

Ether.fi Leads the Charge

At the forefront of this trend sits Ether.fi, a liquid restaking protocol. Its governance token, ETHFI, skyrocketed to a record high on Wednesday, fueled by the red-hot restaking hype. The token, which grants voting rights within the protocol, surged a staggering 50% in just 24 hours, reaching $7.2. This impressive performance dwarfed major cryptocurrencies like Ether (ETH), Bitcoin (BTC), and the broader market index (CD20), all of which experienced slight declines during the same period.

Restaking Explained

Restaking allows users to stake their Ethereum (ETH) and earn rewards while still maintaining liquidity. This is achieved by utilizing the already-staked ETH on the Ethereum blockchain to secure other networks through a platform called EigenLayer. Essentially, it allows users to double-dip on their ETH holdings, earning staking rewards while keeping their assets readily available for trading or DeFi activities.

Also Read: Spot Ether ETF Approval in May? Crypto Market Maker GSR Lowers Odds Significantly

Ether.fi’s Dominance and the Future of Liquid Restaking Tokens

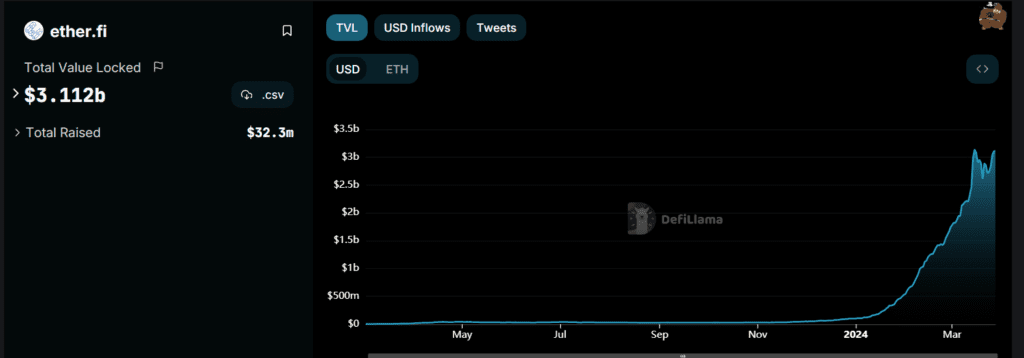

Ether.fi has emerged as the dominant player in the liquid restaking space. Since the beginning of 2024, its total value locked (TVL), which represents the total cryptocurrency value deposited in the protocol, has exploded from a mere $100 million to over $3 billion, according to data from DeFiLlama. This surge reflects the growing demand for restaking services.

Furthermore, the success of ETHFI could pave the way for even greater adoption of other liquid restaking tokens (LRTs). Ignas, a well-respected DeFi analyst, predicts that the strong performance of ETHFI will likely lead to increased valuations for future LRT airdrops. Airdrops are token distributions used by protocols to incentivize early participation and boost demand for their services.

“The higher the ETHFI price goes,” Ignas stated, “the more attractive valuations for all other LRT governance tokens will become. This means airdrops from protocols like Swell, Renzo, Puffer, Kelp, and of course EigenLayer, will become even more enticing for investors.”

A Lucrative Future for DeFi?

The red-hot popularity of restaking and the impressive performance of ETHFI suggest a potentially bright future for this innovative DeFi sector. As more protocols emerge and compete in the liquid restaking space, it will be interesting to see how this trend evolves and what impact it has on the overall DeFi ecosystem.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.