|

Getting your Trinity Audio player ready...

|

- Ether ETFs drew $3.87B in August 2025, contrasting with $751M outflows from Bitcoin ETFs.

- Institutional adoption is accelerating, with Ether ETFs representing over 5% of total ETH market capitalization.

- ETF inflows influence short-term price momentum, liquidity, and volatility, making them crucial for traders.

Stay ahead with real-time updates and insights—Join our Telegram channel!

August 2025 marked a pivotal moment for the cryptocurrency market. While Bitcoin, long considered the benchmark digital asset, struggled to retain institutional interest, Ether (ETH) emerged as the new favorite among investors. Spot Ether ETFs attracted a remarkable $3.87 billion in inflows, contrasting sharply with $751 million in outflows from Bitcoin ETFs during the same period.

This divergence underscores more than a temporary market trend—it highlights Ether’s evolving role beyond digital gold. As the backbone of decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts, Ethereum offers tangible utility that Bitcoin lacks. The rise of Ether ETFs is not only reshaping investment flows but also signaling a shift in institutional strategies and market dynamics.

What Are Ether ETFs and Why Do Inflows Matter?

To understand the significance of Ether’s inflows, it is essential to clarify what Ether ETFs are and how they differ from Bitcoin ETFs.

- Ether ETF Definition: A fund traded on stock exchanges that allows investors to gain exposure to ETH without directly purchasing or storing it.

- Spot vs. Futures ETFs: Spot ETFs hold Ether directly, reflecting the actual asset’s price, while futures ETFs track ETH futures contracts.

- Inflows: The net amount of capital entering ETFs. Positive inflows indicate rising demand and confidence, while outflows suggest selling pressure.

As of late August 2025, Ether ETFs managed approximately $28 billion in assets, representing roughly 5% of ETH’s total market capitalization. Key players include:

| ETF | Assets Under Management (AUM) |

|---|---|

| BlackRock ETHA | $16 billion |

| Grayscale ETHE | $4.6 billion |

| Fidelity FETH | $3.5 billion |

| Total | $28.1 billion |

In comparison, Bitcoin ETFs remain larger in absolute terms, with BlackRock’s IBIT leading at $82 billion, yet Ether’s inflows demonstrate significant momentum and growing institutional appetite.

August 2025: A Snapshot of Divergence

The inflow patterns in August illustrate the growing institutional confidence in Ether. Spot Bitcoin ETFs experienced net outflows on six consecutive trading days, signaling waning demand, while Ether ETFs posted record inflows.

- July 16, 2025: Ether ETFs recorded $726.6 million in single-day inflows.

- Late August 2025: Spot Ether ETFs logged their second-largest daily inflows ever at $729 million, following a $1.02 billion record just days earlier.

- Cumulative Inflows: Over three days, inflows reached $2.3 billion, pushing total Ether ETF holdings to a peak of $12.1 billion.

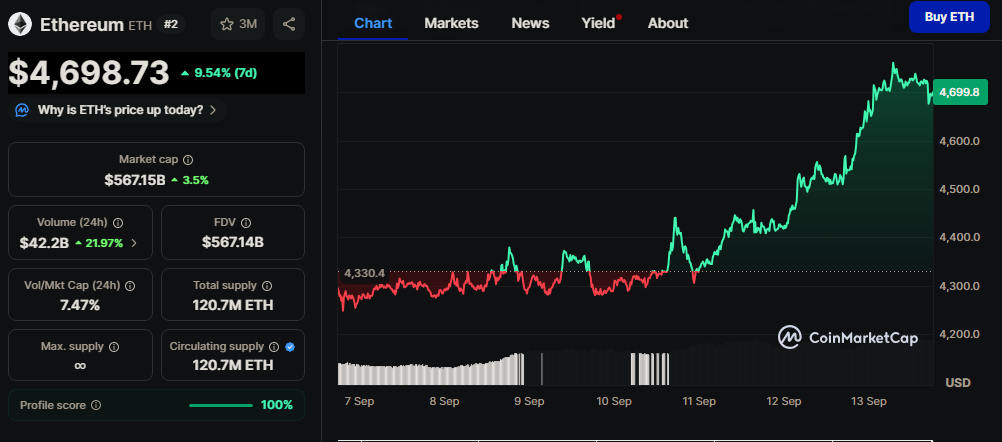

These surges coincided with ETH approaching all-time highs near $5,000, demonstrating a strong correlation between ETF inflows and short-term price momentum.

Why Traders Should Monitor Ether ETF Flows

ETF inflows are more than numbers—they are market signals that reveal how institutional investors position themselves. Traders and market analysts should pay close attention for several reasons:

- Institutional Sentiment: Rising inflows indicate that hedge funds, pension funds, and asset managers are betting on ETH’s future.

- Liquidity Dynamics: Increased ETF demand removes ETH from exchanges, reducing available supply and exerting upward pressure on prices.

- Historical Parallels: In 2021, crypto ETFs amassed $7.6 billion in net inflows, helping fuel Bitcoin’s rally to fresh all-time highs.

Platforms such as SoSoValue, CoinShares, and Farside Investors provide real-time insights into institutional flows, allowing traders to anticipate price movements.

Short-Term Price Dynamics Influenced by Ether ETFs

The direct impact of Ether ETF inflows is most visible in short-term price behavior. As billions flow into ETFs, ETH supply on exchanges declines, creating upward pressure but also potential volatility.

- Price Momentum: Surges often accompany significant inflows. For instance, ETH rose more than 40% in July 2025 during peak ETF inflows.

- Volatility: After failing to hold $5,000, ETH dropped 4% in 24 hours, showing that inflows alone do not guarantee sustained price gains.

- Options Market Effects: Increased inflows boost implied volatility, creating opportunities for options traders to capture premium.

- Arbitrage Potential: Gaps between ETF share prices and spot ETH markets can be exploited by sophisticated traders.

Recommended Trading Strategies:

- Momentum trading during inflow surges.

- Hedging exposure with futures or options when inflows peak.

- Monitoring ETH reserves on exchanges as an early warning system for potential price squeezes.

Ether ETFs and the Long-Term Institutional Shift

Beyond short-term trading dynamics, Ether ETFs signal deeper integration into institutional finance.

Growing Corporate Adoption

Corporate treasuries increasingly see ETH as a strategic asset:

| Company | ETH Holdings |

|---|---|

| SharpLink Gaming | 800,000+ ETH |

| ETHZilla | 102,000+ ETH |

| BitMine Immersion Tech | 1.8 million ETH |

This trend underscores Ether’s potential as a long-term store of value and operational asset in corporate finance.

Shifting Institutional Sentiment

VanEck CEO Jan van Eck has referred to ETH as “the Wall Street token,” highlighting its utility in stablecoin transfers and broader financial infrastructure. Ether ETFs now account for more than 5% of ETH’s market capitalization, reinforcing its role in mainstream adoption.

Potential Long-Term Benefits:

- Improved liquidity and reduced volatility as ETF participation deepens.

- Broader institutional demand from pension funds, family offices, and insurance companies.

- Integration into traditional financial systems, especially if staking approval for ETFs occurs by late 2025.

Ether’s real-world utility—supporting DeFi protocols, NFTs, and enterprise applications—positions it as more than a speculative instrument, but a core digital financial asset.

Key Risks and Challenges for Crypto Traders

Despite the positive momentum, several risks warrant caution:

- Regulatory Uncertainty: The US Securities and Exchange Commission (SEC) could change rules regarding ETF approvals or compliance requirements. Legislative measures like the GENIUS Act and CLARITY Act offer guidance, but uncertainty remains.

- Competition with Bitcoin ETFs: Bitcoin still dominates institutional flows with over $100 billion in ETF assets. Sustaining Ether’s momentum requires continued inflows.

- Over-Reliance on ETFs: Heavy inflows can create bullish narratives, but sudden outflows can cause sharp declines. Traders should consider technical analysis, macro conditions, and exchange reserves alongside ETF data.

- Early-Phase Volatility: Ether ETFs are new and can exhibit extreme price swings. Risk management strategies, including stop-losses and position sizing, are essential.

Ether vs. Bitcoin: A Comparative Look

Understanding Ether’s rise requires placing it in context with Bitcoin:

| Feature | Bitcoin (BTC) | Ether (ETH) |

|---|---|---|

| Primary Use | Store of value | Smart contracts, DeFi, NFTs |

| Market Cap | ~$2.3 trillion | ~$560 billion |

| ETF Inflows (Aug 2025) | -$751 million | +$3.87 billion |

| Institutional Adoption | Moderate | Rapid, growing corporate treasury adoption |

| Short-Term Volatility | High | High, but influenced by ETF inflows |

| Long-Term Utility | Limited | Extensive, multi-layered financial applications |

The contrast illustrates Ether’s unique position: while Bitcoin remains a benchmark asset, Ether offers both investment potential and operational utility.

Ether ETFs Herald a New Phase for Crypto

The surge in Ether ETF inflows during August 2025 is more than a fleeting market event. It reflects shifting institutional sentiment, highlights Ether’s real-world utility, and points to a broader integration of crypto assets into mainstream finance.

Also Read: Ethereum Based Meme Coin Pepeto Presale Past $6.6 Million as Exchange Demo Launches

For traders, these inflows are critical signals for short-term price dynamics and liquidity trends. For institutional investors, Ether ETFs represent a pathway to safely access a high-utility digital asset. As regulatory clarity improves and corporate adoption expands, ETH’s role in financial markets is set to grow, potentially challenging Bitcoin’s long-standing dominance.

Ultimately, the rise of Ether ETFs is a watershed moment, demonstrating that Ethereum is not just digital gold—it is a versatile, institutional-ready financial instrument reshaping the crypto landscape.

Stay ahead with real-time updates and insights—Join our Telegram channel!

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!