|

Getting your Trinity Audio player ready...

|

Ethena’s USDe synthetic dollar has taken the crypto world by storm, with its Bitcoin collateral exceeding a staggering $500 million within a week of launch. This rapid growth has fueled both excitement and concerns within the industry.

Bitcoin Backed Stability?

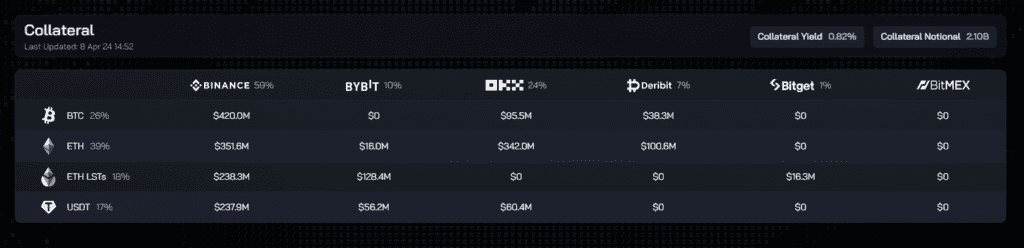

Ethena’s website data reveals a hefty $553.8 million in Bitcoin reserves spread across major exchanges like Binance, OKX, and Deribit. This represents a significant 26% of USDe’s total asset reserve, alongside holdings in Ethereum, liquid-staked Ethereum, and Tether’s USDT.

Seraphim Czecker, Ethena’s head of growth, believes this substantial Bitcoin reserve positions the platform for the upcoming Bitcoin halving, expected around April 20th. The halving will cut Bitcoin’s block reward in half, potentially impacting its price.

Adoption Boom, But Contagion Worries

The introduction of Bitcoin as collateral aimed to create a more secure product for USDe users. However, some market experts warn of potential contagion risk for the broader crypto industry if the Bitcoin market experiences a downturn.

Despite these concerns, USDe adoption has skyrocketed alongside its growing Bitcoin reserves. Data shows a market capitalization surging to $2.14 billion, with a daily trading volume of $364 million.

Major DeFi Players Embrace USDe

Major DeFi projects like MakerDAO and Frax Finance are driving this rapid adoption. Ethena Labs recently announced a $250 million liquidity pool established by Frax Finance to facilitate automated market operations for minting new FRAX tokens. This creates a deep pool of on-chain dollar liquidity and allows Frax to diversify its backing yield sources.

Further bolstering USDe, lending protocol Morpho Labs revealed a $100 million DAI allocation from MakerDAO to its USDe/DAI and sUSDe/DAI markets on Morpho Blue. This follows Maker’s successful proposal to significantly increase the DAI debt ceiling for USDe-related markets.

A Promising Future, But Questions Remain

Ethena’s USDe has made a remarkable entrance, backed by a substantial Bitcoin reserve and embraced by leading DeFi protocols. However, the potential for contagion risk and the evolving regulatory landscape surrounding stablecoins pose questions about its long-term sustainability. Only time will tell if USDe can maintain its impressive growth trajectory and navigate the complexities of the crypto market

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.