|

Getting your Trinity Audio player ready...

|

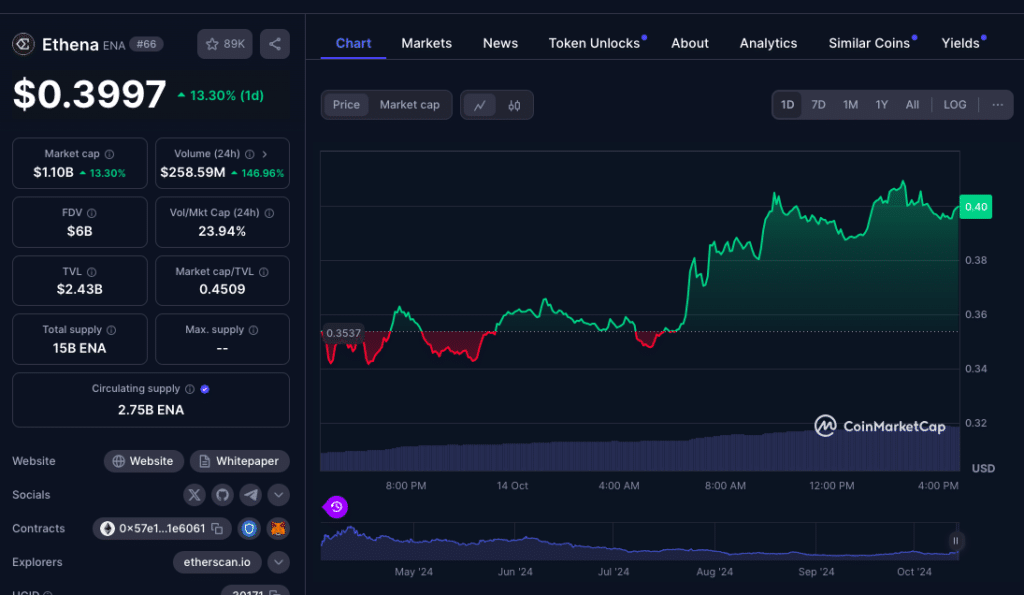

Ethena (ENA) has experienced a significant price surge, fueled by the positive momentum surrounding its proposal to add Solana (SOL) as a backing asset for USDe. The token’s market cap has surpassed $1 billion, and its price has increased by 13% in the past 24 hours.

Technical Analysis Supports Bullish Outlook

A technical analysis of ENA’s 8-hour price chart reveals an inverted head-and-shoulder pattern breakout, a bullish signal that suggests further upside potential. The token has successfully retested the 61.80% Fibonacci level, indicating strong support for the uptrend.

Additionally, the MACD and signal lines are trending upwards, with a surge in positive histograms. This further strengthens the bullish outlook for ENA.

Proposal to Add SOL as Backing Asset

Ethena’s proposal to include SOL as a backing asset for USDe has generated excitement within the community. This move would align with Ethena’s existing hedging mechanism using Bitcoin and Ethereum perpetual futures.

The inclusion of SOL, along with BNSOL, bbSOL, and Bybit Liquid Stake SOL, would diversify USDe’s collateral base and potentially enhance its stability. The decision on whether to approve the proposal will rest with Ethena’s Risk Committee.

Also Read: Ethena Picks 4 Key Assets For RWA Reserve – $46.6M Allocated, ENA Stays Steady At $0.27!

Price Prediction

Based on the current technical analysis and the positive momentum surrounding ENA, there is a strong possibility that the token will continue its upward trend. The Fibonacci levels suggest that ENA could reach $0.4431 and potentially $0.5086 in the near future.

However, it’s important to note that the cryptocurrency market is volatile, and price predictions can change. Investors should conduct their own research and consider the risks involved before making any investment decisions.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.