|

Getting your Trinity Audio player ready...

|

Key Takeaways

- ENA leads the market with a 25% surge, driven by $3.37M in daily spot inflows.

- Futures open interest hits $425M as long traders dominate with a positive funding rate.

- Technical outlook suggests potential breakout to $0.41 if bullish momentum persists.

Ethena’s native token ENA has emerged as the top gainer in the crypto market today, surging 25% in the past 24 hours. Trading at its highest level in over a month, ENA is riding a wave of renewed investor optimism, bolstered by strong spot market demand and increased derivatives activity.

ENA Spot Inflows Hit Two-Month High

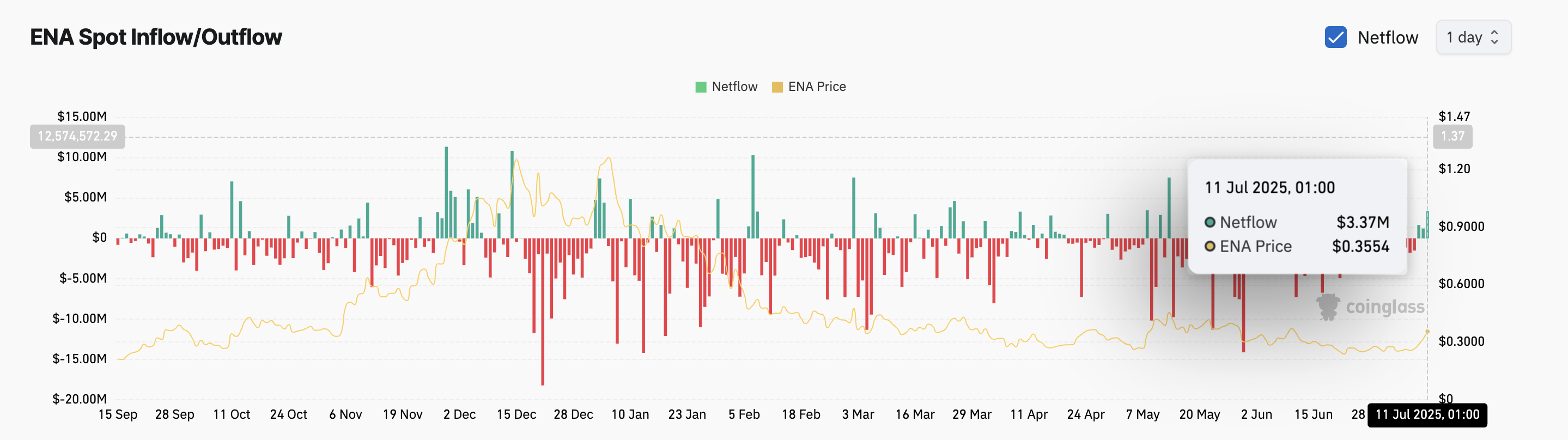

One of the clearest signs of growing investor interest is the $3.37 million net spot inflow into ENA, the highest daily figure since May 12, according to Coinglass. Spot inflows represent immediate purchases of the token, typically reflecting short-term bullish sentiment.

This surge in spot demand indicates that traders are actively accumulating ENA at current prices, reinforcing confidence in a sustained rally. The token is now comfortably trading above its 20-day exponential moving average (EMA), a technical indicator often viewed as a measure of short-term momentum.

Derivatives Market Confirms Bullish Sentiment

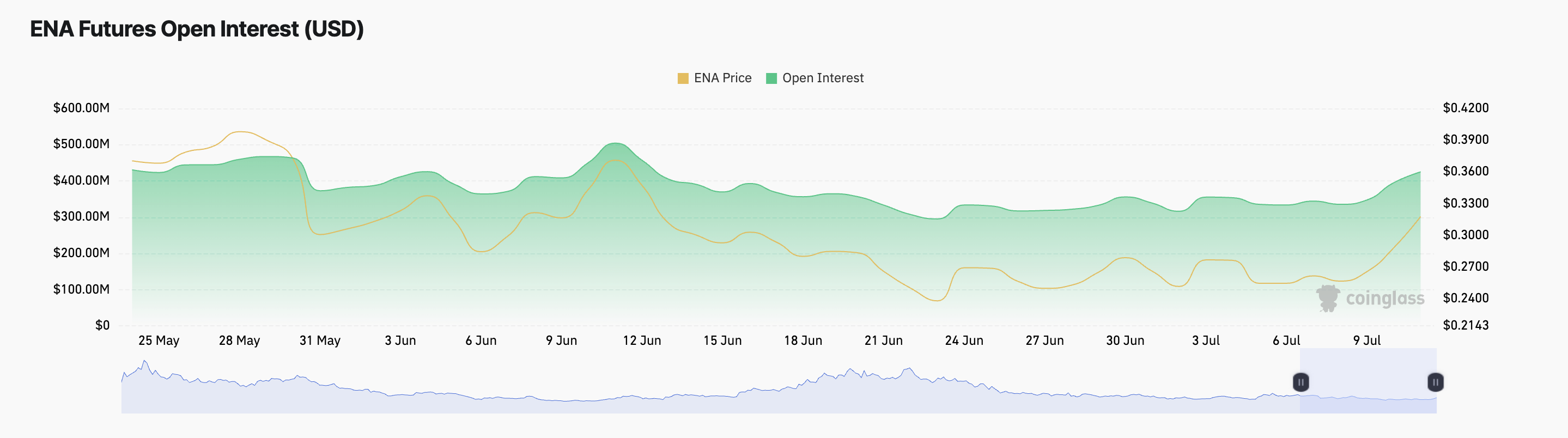

In addition to spot demand, ENA’s futures open interest has increased 8% over the last 24 hours, reaching $425 million — its highest since June 16. This uptick signals that new capital is entering the market via derivatives, as traders bet on further upside.

The positive funding rate of 0.0062% further confirms that long-position holders are willing to pay a premium to maintain leverage, highlighting a market-wide expectation of continued price appreciation.

ENA Eyes Breakout to Multi-Week Highs

Technical indicators suggest that if momentum holds, ENA could test the resistance zone at $0.37, with a potential extension toward $0.41. The current support at $0.32, reinforced by the 20-day EMA, provides a strong base for bulls to build on.

Also Read: Ethena (ENA) Drops After Token Unlock, Eyes Rebound on Coinbase Listing

However, traders should remain cautious. A wave of profit-taking could trigger a short-term correction, especially if ENA fails to maintain momentum above key support levels.

ENA’s 25% price surge is underpinned by solid fundamentals — rising spot demand, strong derivatives activity, and technical indicators pointing toward bullish momentum. While a breakout above $0.37 could pave the way for higher highs, any shift in sentiment or increase in selling pressure may challenge this trajectory.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.