|

Getting your Trinity Audio player ready...

|

Senator Elizabeth Warren is sounding alarms over Scott Bessent’s policy proposals, raising critical questions about deregulation, tax policies, and financial transparency. Drawing on past financial crises, Warren warns that easing regulations could lead to catastrophic consequences reminiscent of the 2008 economic crash or the collapse of Silicon Valley Bank in 2023.

Deregulation: A Dangerous Gamble?

Warren acknowledges that deregulation isn’t inherently harmful but stresses that reckless rollbacks have repeatedly destabilized financial markets. The 2008 crisis highlighted how unchecked risky practices can implode the system, while Silicon Valley Bank’s failure underscored the risks of insufficient oversight.

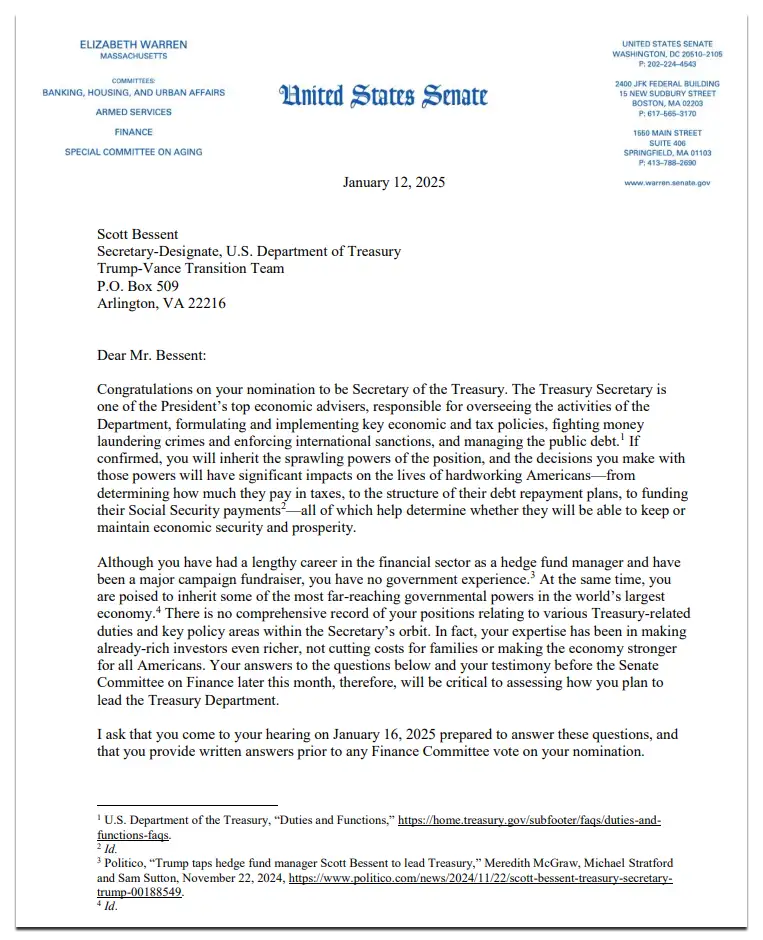

In her 31-page letter to Bessent, Warren posed over 180 questions, demanding clarity on his vision for key regulatory bodies like the Federal Deposit Insurance Corporation (FDIC) and the Consumer Financial Protection Bureau (CFPB). These agencies safeguard consumers and small businesses. Warren is concerned that shrinking their influence or privatizing their functions would benefit big banks and wealthy investors at the expense of ordinary Americans.

Tax Cuts and Tariffs: Favoring the Few?

Warren is equally skeptical about Bessent’s stance on extending the 2017 Tax Cuts and Jobs Act. She argues that these cuts disproportionately benefit corporations and the wealthy while exacerbating federal deficits.

Tariffs, another hot topic, raise additional concerns. Warren questions their impact on inflation and production costs and criticizes past practices where tariff exemptions favored politically connected companies. She demands assurance that future policies won’t repeat these mistakes.

The Need for Transparency

Warren’s concerns extend beyond policies to transparency and accountability. She questions whether Bessent will divest from financial interests that pose potential conflicts and whether he will advocate for stronger tax enforcement targeting the wealthy.

Warren’s inquiries underscore the broader risks of poorly conceived policies: economic instability and eroding trust in financial systems. As debates unfold, her warnings serve as a stark reminder of the consequences of prioritizing deregulation and corporate interests over economic resilience and equity.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.