|

Getting your Trinity Audio player ready...

|

Dogwifhat [WIF] continued to struggle, maintaining a bearish trend on the daily chart. Despite sustained losses, technical indicators suggest the memecoin may be nearing a potential recovery phase. Could this mark the end of its downtrend, or is further decline inevitable?

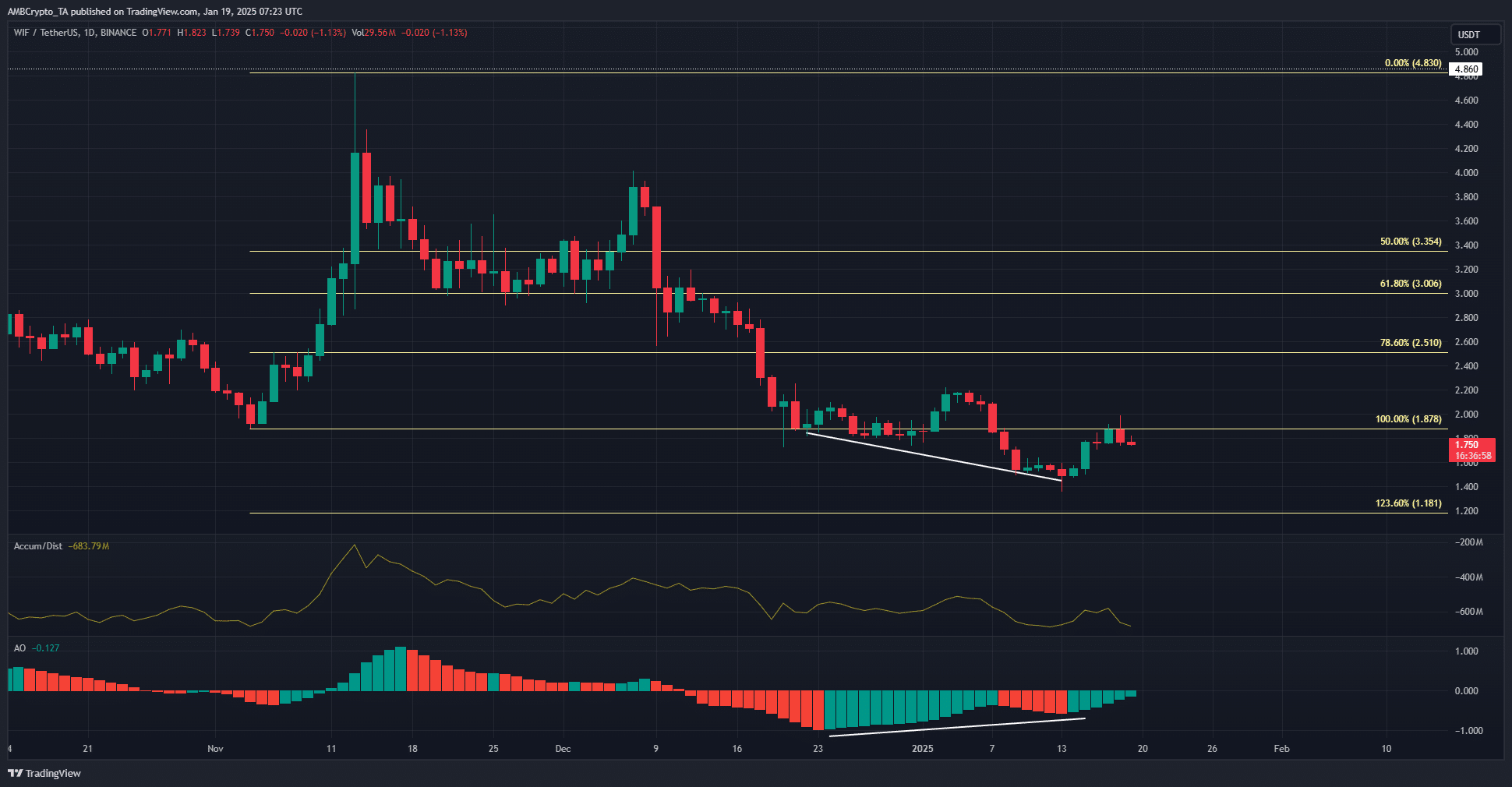

WIF’s most recent lower high was recorded at $2.22 earlier this month. Since then, the token has faced persistent selling pressure, forming lower lows and retesting the $1.878 resistance level. The Accumulation/Distribution (A/D) indicator underscored the dominance of bearish sentiment, reflecting consistent capital outflows. Additionally, the Awesome Oscillator (AO) remained below the neutral line, confirming negative momentum. However, a bullish divergence on the AO hints at the possibility of an upcoming reversal.

Liquidation Heatmaps Signal Key Price Zones

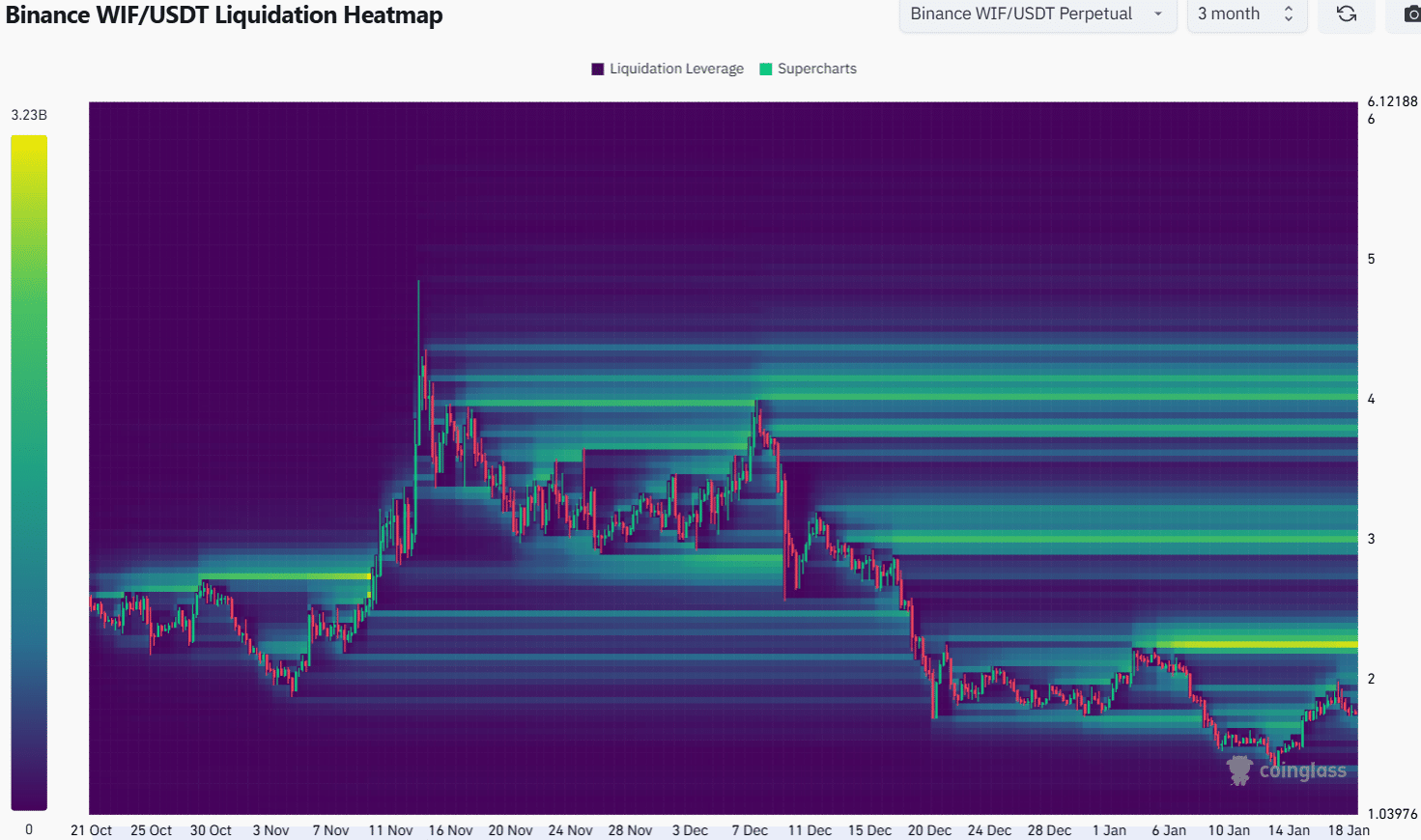

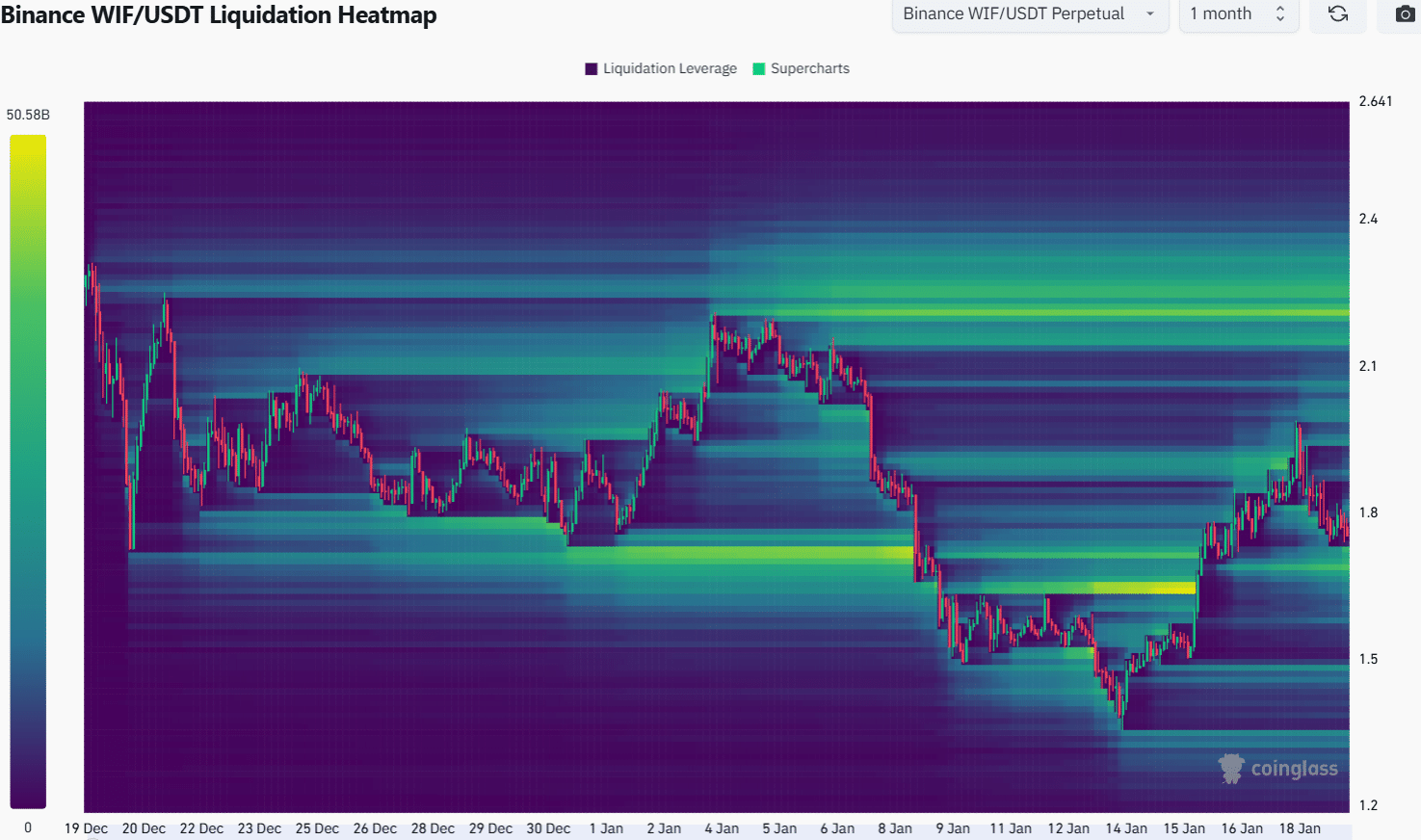

Dogwifhat’s liquidation heatmaps point to significant liquidity at $2.25, with the zone acting as a magnetic target. This level coincides with local highs from earlier this month, making it a critical price point for traders. Should WIF breach this resistance, the $3 level emerges as the next medium-term objective.

Conversely, a dip to $1.7 is also plausible before any upward movement. The $1.7-level represents a strong support zone and could serve as a springboard for recovery. However, the lack of substantial buying pressure raises questions about WIF’s ability to break out above $2.25 in the near term.

Outlook for Recovery

While the bullish divergence on the AO hints at recovery potential, caution remains essential. Unless capital inflows increase, WIF may struggle to sustain gains. A breakout beyond $2.25 seems unlikely under current market conditions, though this could change in the coming weeks.

Also Read: Dogwifhat Price Analysis: Bullish Momentum Builds as Key Resistance Levels Test $2

In summary, Dogwifhat’s immediate trajectory hinges on buyer momentum. Traders should watch for a test of $1.7 and monitor whether buying pressure strengthens near $2.25. A decisive move in either direction will set the stage for WIF’s next trend.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Crypto and blockchain enthusiast.