|

Getting your Trinity Audio player ready...

|

Dogwifhat (WIF), the once-hot meme coin, is experiencing a significant downturn in both social media engagement and investor interest. According to data from Kaito, the coin’s social mindshare on X (formerly Twitter) has plummeted since its peak in March and April.

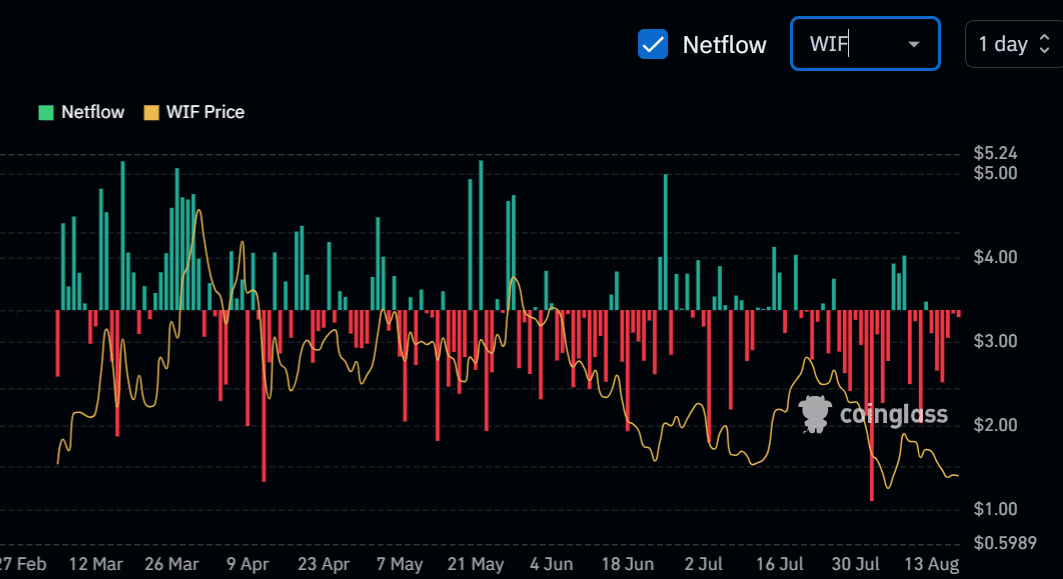

The lack of sustained social buzz has directly impacted investor sentiment. Spot net flows have been consistently negative, with August witnessing a particularly sharp outflow of approximately $24 million. This indicates a waning appetite for WIF among investors and traders.

Technical indicators are also painting a bearish picture. The RSI (Relative Strength Index) and CMF (Chaikin Money Flow) have been trending below average, suggesting weak price momentum. Despite a recent attempt to recover, WIF has failed to gain traction, with its price currently trading below $1.5.

Bitcoin’s struggle to maintain its position above $60K has further hindered WIF’s recovery prospects. The meme coin’s price is likely to remain volatile in the short term, with key levels of $2.0, $1.0, and $1.5 acting as potential support or resistance based on Fibonacci retracement analysis.

Also Read: Dogwifhat (WIF) Tanks 20% As Meme Coin Market Bleeds

Adding to the bearish outlook, a surge in short positions on the futures market indicates a growing number of traders betting against WIF’s price. This negative sentiment, coupled with declining social engagement and weak investor interest, suggests that WIF may face challenges in regaining its former momentum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.