|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Derivatives data shows more shorts than longs, signaling weak confidence in DOGE’s rebound.

- DOGE must break $0.228 to confirm bullish momentum and avoid retesting $0.18.

- Traders are exploring alternatives like Solaxy as DOGE consolidates around $0.20.

Dogecoin (DOGE) briefly surged 3.5% to $0.205 on August 6, but derivatives market signals suggest the rally lacks conviction. Despite holding support above the key $0.20 mark, sentiment among traders remains mixed, with bearish positions dominating short-term activity.

Derivatives Data Shows Bearish Bias

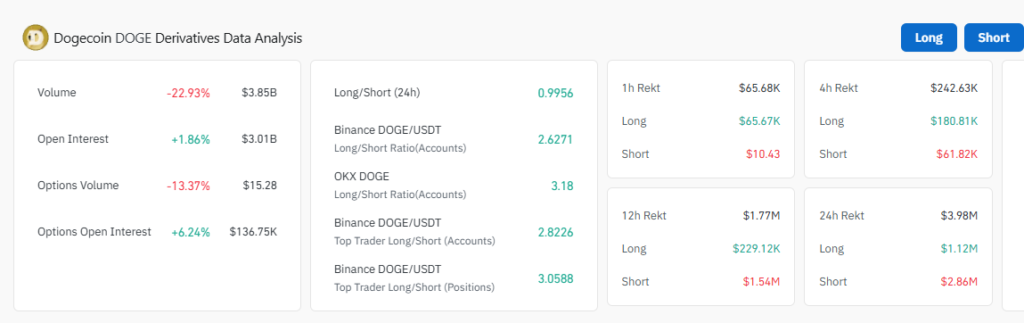

Daily trading volume in DOGE dropped by over 20% to $4.14 billion, indicating weakening interest among short-term speculators. While open interest rose 1.66% to $3.05 billion, short contracts outnumbered long positions across all major timeframes—1h, 12h, and 24h—signaling a bearish outlook.

Liquidation data from Coinglass reinforces this view. Over $4.73 million in DOGE derivatives were liquidated in 24 hours—$2.72 million from shorts and $2.01 million from longs—suggesting bulls continue to be squeezed despite the price recovery.

Technical Outlook: $0.228 Is Key Level to Watch

Technically, DOGE has reclaimed the lower Bollinger Band, establishing support at $0.20. However, upside resistance at $0.228 and the median Bollinger Band at $0.23 represent critical barriers. The MACD indicator remains bearish, though momentum appears to be flattening.

If DOGE can close above $0.228, a surge to $0.25 is possible, particularly if overleveraged shorts are forced to cover. Conversely, failure to breach $0.22 could see the price fall back toward $0.18.

Also Read: Dogecoin Price Risks Further Decline as Bearish Signals Persist Despite Breakout

DOGE Traders Eye Alternatives Like Solaxy

With DOGE showing signs of indecision, some investors are pivoting to alternatives like Solaxy (SOLX)—a new Layer-2 solution built on Solana. Its early presale has attracted attention from Dogecoin traders seeking high-upside opportunities ahead of the next altcoin cycle.

Dogecoin’s price rebound may be technically encouraging, but derivatives metrics and liquidation trends highlight persistent bearish pressure. The next few trading sessions will be critical: a break above $0.228 could signal a bullish reversal, while rejection at current levels may push DOGE back to $0.18.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.