|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- Profit-taking has spiked, dragging DOGE’s price down by 14% and increasing short-term bearish pressure.

- Long-term holders remain steady, as shown by falling Liveliness—a potentially bullish macro sign.

- DOGE must reclaim $0.245 to invalidate the bearish thesis and aim for recovery above $0.260.

Dogecoin (DOGE), the original meme cryptocurrency, is under renewed bearish pressure after a wave of profit-taking hit the market this week. While many short-term holders are cashing out, there are still signs that DOGE’s broader momentum may survive the sell-off.

Realized Profits Surge as Short-Term DOGE Holders Exit

Recent data shows Dogecoin’s realized profit/loss ratio spiked sharply—reaching a 6-month high—indicating significant profit-taking. This trend followed a strong rally in previous weeks, prompting many short-term investors to lock in gains while market conditions remained favorable.

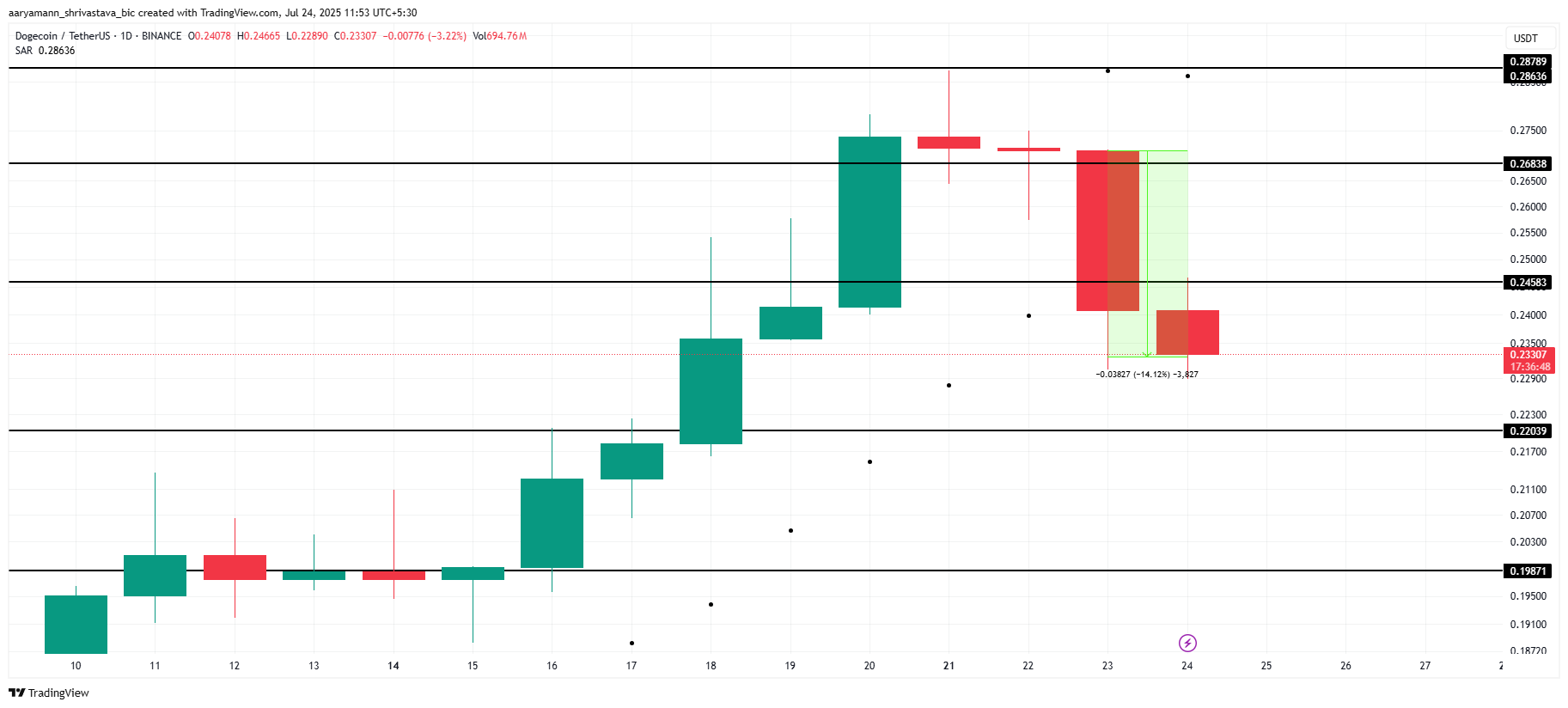

The result? Increased selling activity and a dip in confidence among speculative holders. This shift has led to a 14% decline in DOGE’s price, pulling the coin down to $0.233 and putting it below the critical resistance of $0.245.

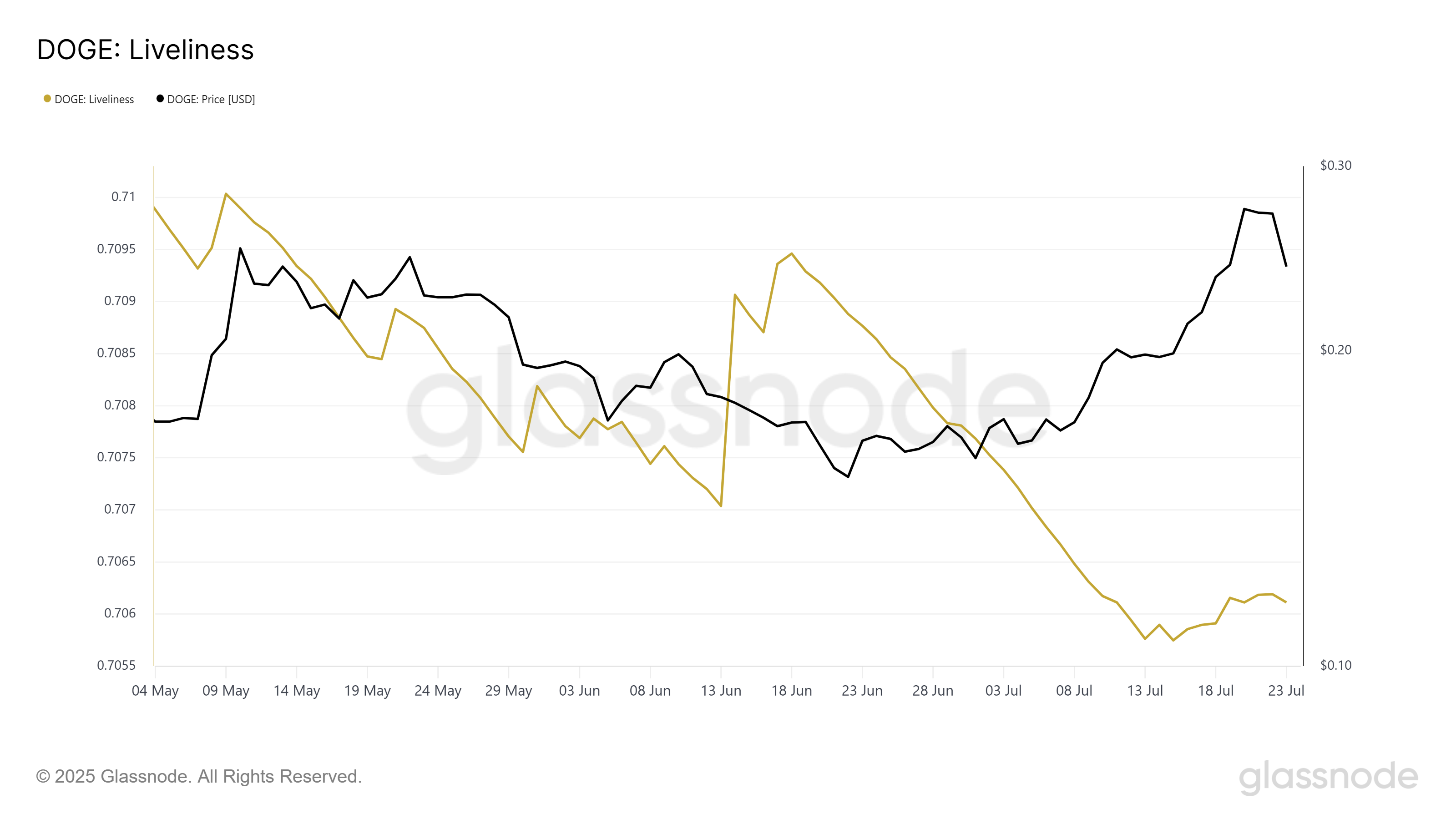

Long-Term Holders Signal Confidence With Reduced Activity

Despite the sell-off, not all investor segments are abandoning ship. Data from Glassnode highlights a continued drop in Dogecoin’s Liveliness metric—a sign that long-term holders (LTHs) are refraining from selling their holdings. This metric typically decreases when long-term wallets remain inactive, suggesting continued belief in DOGE’s long-term potential.

Historically, LTH behavior has helped stabilize DOGE during turbulent market phases, offering a backstop against extreme volatility.

DOGE at a Crossroads: Bearish Risks vs Bullish Rebound

Technically, Dogecoin is at a crucial point. A break below the $0.220 support level could trigger further losses, potentially pushing the price toward $0.198. This bearish scenario is being fueled by waning short-term sentiment and ongoing sell pressure.

However, a bullish reversal remains on the table. If DOGE can reclaim the $0.245 resistance level and hold it as support, the token could bounce back toward $0.268. For this to happen, long-term holders must continue their support, and buyer momentum must return swiftly.

The coming days will be pivotal for Dogecoin. While short-term selling has introduced downward pressure, strong hands from long-term holders offer some support. Whether DOGE bounces or breaks further depends on whether it can reclaim critical resistance.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

Also Read: Dogecoin Surges 77% in July, Targets $0.357

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!