|

Getting your Trinity Audio player ready...

|

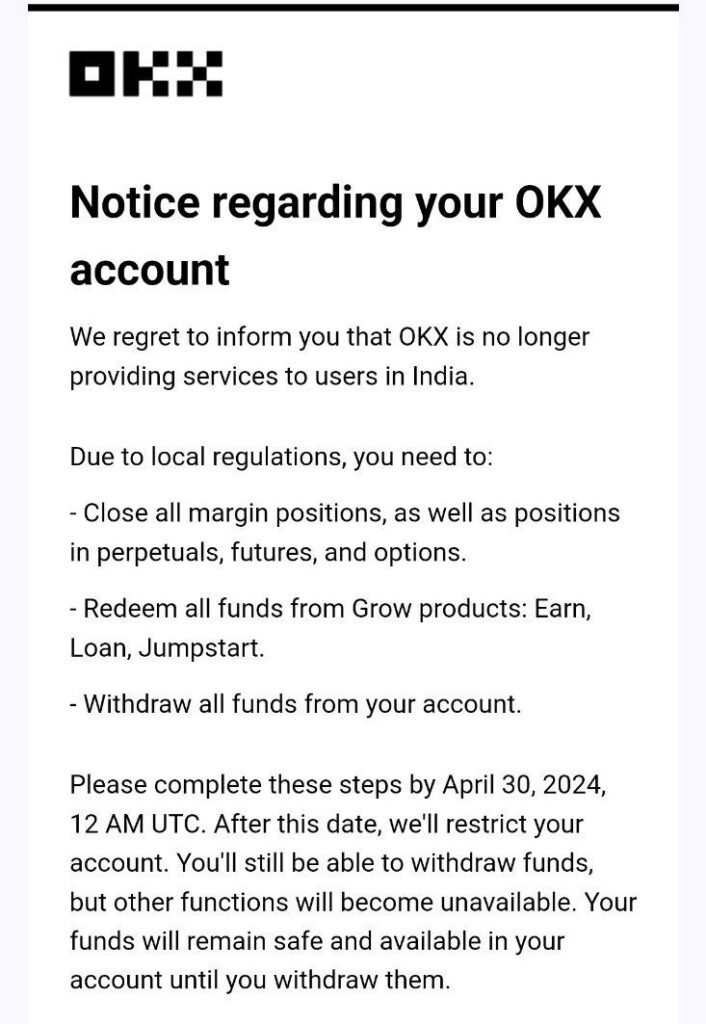

India’s cryptocurrency market faces a new hurdle as OKX, the world’s second-largest crypto exchange by trading volume, announces its withdrawal from the country. This move comes just three months after the Financial Intelligence Unit (FIU) issued compliance notices to nine foreign crypto exchanges, including OKX.

In a message to Indian users on March 21st, OKX cited “local regulatory hurdles” as the reason for its departure. This follows efforts by the exchange to comply with Indian regulations, including implementing a stricter Know Your Customer (KYC) process after authorities blocked its app and website in January. However, the recent notice suggests OKX has decided to exit the Indian market altogether.

India’s cryptocurrency landscape remains an enigma for foreign exchanges.

Despite being a thriving market with a high level of crypto adoption, the lack of clear regulations creates significant challenges. Discussions regarding a regulatory framework have dragged on for nearly four years, with the government seemingly hesitant to provide legal oversight for the burgeoning crypto industry.

The absence of regulations is compounded by a recently implemented 30% tax on crypto income, with no mechanism to offset losses. This, coupled with a 1% tax deducted at source (TDS) on every crypto transaction, has created a harsh tax environment. These factors, along with the regulatory uncertainty, have pushed several established players out of the Indian market.

The Government’s Dilemma

The Indian Finance Minister’s recent statement highlights the government’s dilemma. They argue that crypto cannot be treated the same way as traditional fiat currency, which is why a clear regulatory structure is yet to be established. However, industry experts counter that market participants aren’t seeking crypto to be treated like fiat but rather desire clear regulations similar to those governing the stock market.

OKX’s exit from India serves as a stark reminder of the challenges faced by crypto exchanges in a market brimming with potential but lacking clear regulatory direction. With the government’s stance remaining ambiguous, it remains to be seen when and how India will develop a framework that fosters responsible crypto adoption and attracts established players back into the fold.

Crypto and blockchain enthusiast.