|

Getting your Trinity Audio player ready...

|

Stay ahead with real-time updates and insights—Join our Telegram channel!

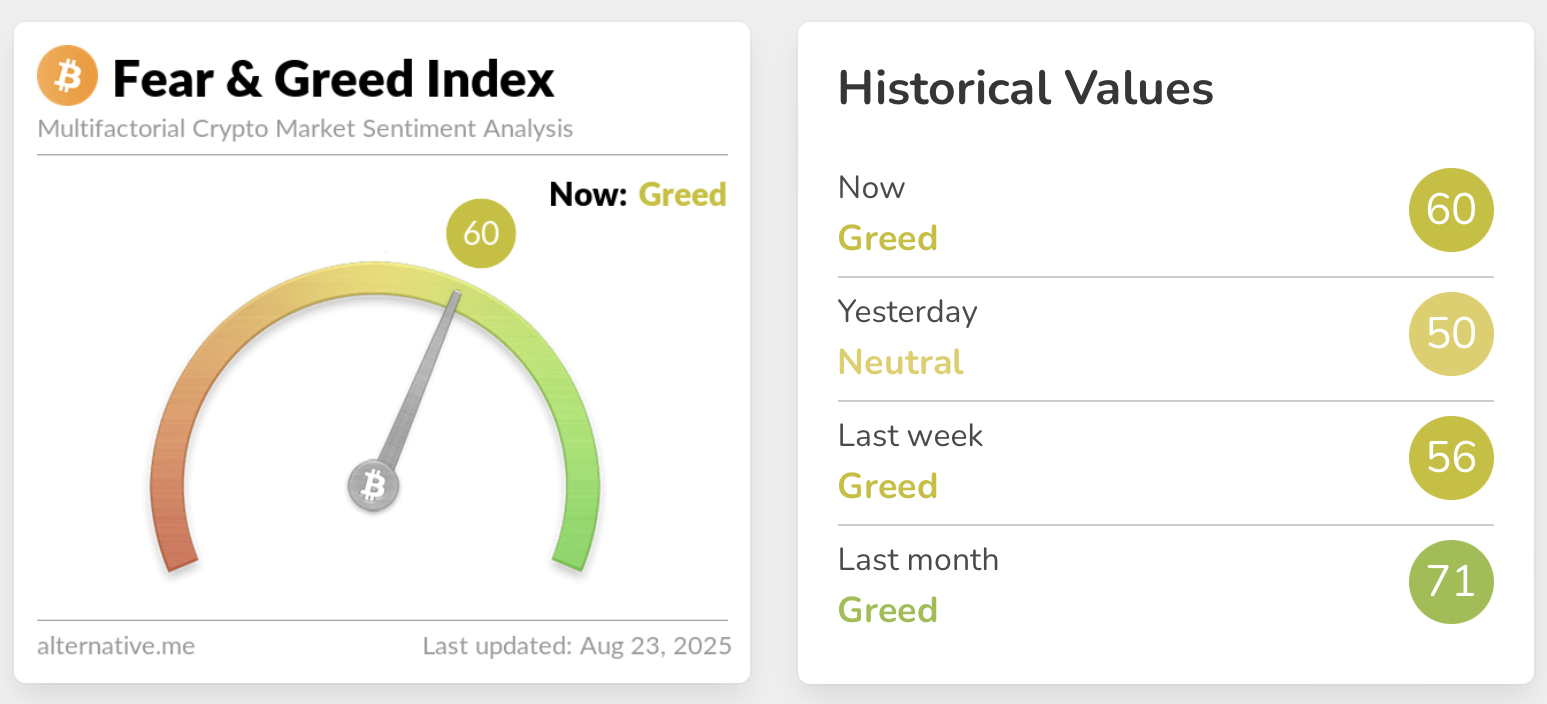

- Fear & Greed Index hits 60 after Powell’s dovish comments.

- BTC jumps to $117K; ETH nears all-time highs.

- 75% of traders expect a Fed rate cut in September.

The Crypto Fear & Greed Index rebounded sharply into “Greed” on Saturday, climbing to 60 from a “Neutral” 50 the day before, after U.S. Federal Reserve Chair Jerome Powell hinted at a potential interest rate cut in September. The rally came as Powell’s remarks at the Jackson Hole economic symposium suggested inflation and labor market conditions may justify a policy shift.

Bitcoin and Ether Lead Market Surge

The optimism quickly translated into price action. Bitcoin (BTC) jumped 5% to $117,300, liquidating nearly $380 million in short positions. Meanwhile, Ether (ETH) surged 11.5% to $4,851, coming within striking distance of its 2021 all-time high of $4,878.

Axie Infinity co-founder Jeffrey “Jiho” Zirlin noted ETH’s strong reaction, calling it the “most rate-sensitive aspect of crypto.” He explained that falling rates widen the yield gap between DeFi deposits and traditional bank accounts, making crypto assets more attractive.

Markets Eye September Fed Meeting

According to the CME FedWatch Tool, 75% of traders expect a rate cut at the Fed’s September 17 meeting. Analysts, including The Kobeissi Letter, argued that Powell’s tone effectively set the stage for a cut, a move that would boost liquidity and risk appetite across markets.

However, not all policymakers are convinced. St. Louis Fed President Alberto Musalem told Reuters he would wait until just days before the meeting to decide whether to support a cut. His cautious stance underscores the lingering uncertainty around the Fed’s next move.

Also Read: Trump Family’s DeFi Project Mints $205M in Stablecoin USD1, Treasury Hits Record High

Market Anticipation Proves Right

Many crypto analysts had predicted that Powell’s tone at Jackson Hole would trigger a breakout. Investor Jason Williams said earlier in the week that if Powell “comes in soft,” markets would “turbo rip.” Crypto trader Ran Neuner similarly argued the event would “shape crypto’s direction moving forward.”

With sentiment now firmly in Greed and ETH showing outsized sensitivity to monetary policy shifts, the stage is set for a volatile lead-up to September’s Fed meeting.

The crypto market’s shift back into Greed reflects renewed optimism fueled by Powell’s dovish remarks. If the Fed follows through with a September rate cut, Bitcoin and Ether may be primed for fresh all-time highs—underscoring just how closely crypto remains tied to central bank policy.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!