|

Getting your Trinity Audio player ready...

|

The cryptocurrency market reeled this week, mirroring a broader sense of unease. The fear and greed index dipped, indicating investor nervousness, while the VIX index – a measure of stock market volatility – jumped.

This translated into price drops across the board, with Bitcoin retreating from its $70,000 perch to a current price of $67,000. Similarly, Solana shed value, going from $200 to $170. The total market capitalization for all cryptocurrencies also dipped to $2.5 trillion.

IOTA: A Rebound on the Horizon?

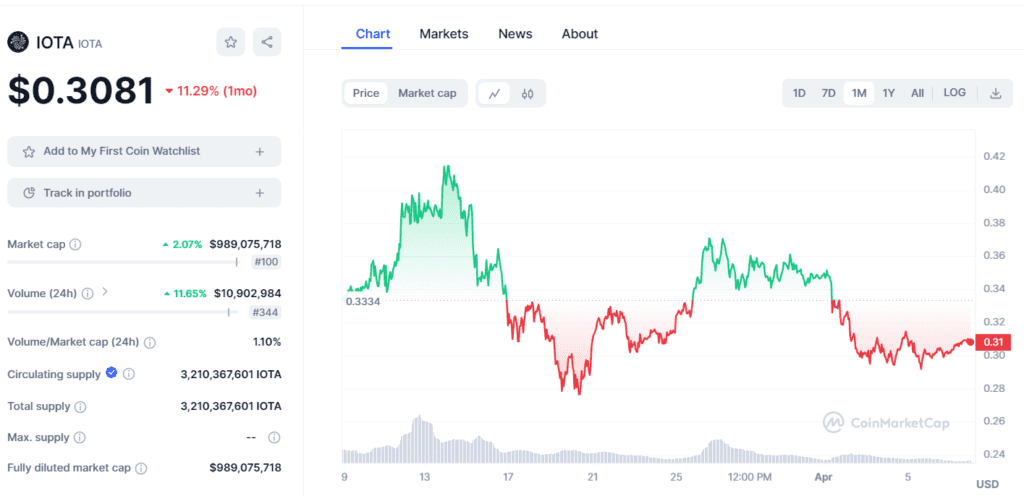

IOTA, a well-established cryptocurrency known for its tangle technology, wasn’t spared from the downturn. After reaching a high of $0.42 in mid-March, it has plunged to its current price of $0.30. This price movement closely mirrors Bitcoin’s recent volatility.

Technically, IOTA has breached key support levels at $0.37 and $0.35, raising concerns. However, a glimmer of hope remains. The coin continues to hover above its 100-day and 200-day EMAs (Exponential Moving Averages), potentially indicating a possible bounce back.

The upcoming Bitcoin halving, an event historically associated with price increases for Bitcoin, could reignite enthusiasm in the market and propel IOTA upwards. This upswing would be confirmed if IOTA recaptures resistance levels at $0.327 and $0.372.

Polkadot (DOT): Under Pressure

Polkadot (DOT) has also felt the heat in recent weeks. The momentum that pushed it to a YTD high of $11.90 has faded, leading to a drop to $8.48. This decline breached crucial support zones at $10 and $9.61.

Similar to IOTA, Polkadot finds solace in staying above its 100-day and 200-day EMAs. However, it also nudged below another critical support level at $8.55. Technical indicators like the RSI (Relative Strength Index) and Stochastic also point downwards, suggesting a potential continuation of the decline. If this scenario unfolds, DOT could fall to its January low of $6.

The Road Ahead

The next few days will be crucial for IOTA and Polkadot. Can they capitalize on the potential tailwinds from the Bitcoin halving or succumb to the broader market jitters? Investors should closely monitor price movements and key technical indicators to navigate this uncertain period.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!