|

Getting your Trinity Audio player ready...

|

In a significant development for Ethereum staking, Coinbase has emerged as the largest validator node operator, controlling 11.4% of the total ETH staking market. According to a transparency report issued by the exchange, Coinbase operates 120,000 validator nodes and has staked 3.84 million ETH across locations in Japan, Ireland, Singapore, Germany, and Hong Kong.

Coinbase’s Transparency Boosts Market Confidence

Ethereum educator Sassal highlighted Coinbase’s dominant role in the network, emphasizing that while Lido collectively has a larger stake, no single node operator within its system holds as much control as Coinbase. The report came in response to calls from industry players for greater transparency in Ethereum staking operations. Previously, Dune Analytics estimated Coinbase’s market share at 8% with 2.7 million ETH staked, underscoring the importance of verified data.

We now know how much ETH Coinbase has staked (11.42% of the total stake)

— sassal.eth/acc 🦇🔊 (@sassal0x) March 19, 2025

This, of course, makes Coinbase the single largest node operator on the network (Lido is bigger as a collective, but each node operator has a much smaller % share)

Kudos to Coinbase for the transparency! https://t.co/F3WEDdj0da

ETH Staking Surges Despite Market Volatility

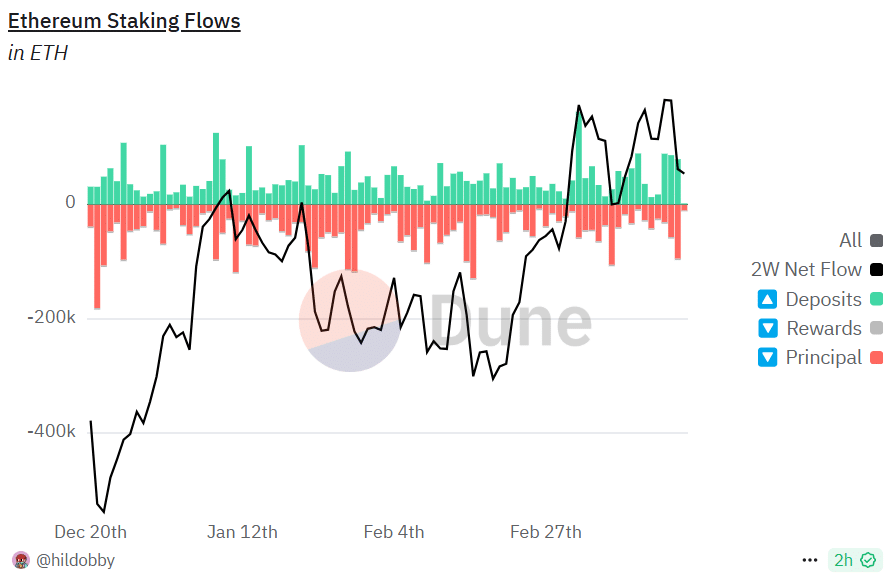

Despite Ethereum’s price struggles, staking activity has remained robust. Lido continues to lead with 9.3 million ETH staked, while the total ETH staked stands at 34.1 million, representing 27.7% of the total supply. After a downturn in January 2025, staking inflows rebounded in February, with 54,000 ETH entering the system over the past two weeks.

The rising staking participation signals growing confidence in Ethereum’s long-term potential, even as the altcoin faces a significant price drawdown. At the time of writing, ETH hovers around $2,000—down 54% from its recent highs.

Staking Rewards and Future Outlook

Ethereum stakers currently enjoy a 3% annualized reward, making it an attractive option for long-term investors seeking passive income. However, while staking participation has surged, ETH’s price performance has lagged behind other major cryptocurrencies.

As institutional players like Coinbase expand their staking operations and regulatory clarity improves, Ethereum’s staking ecosystem could see further growth. With staking playing a crucial role in Ethereum’s security and network efficiency, its long-term impact on ETH’s valuation remains a key point of interest for investors.

Also Read: Ethereum Whales Withdraw $28M from Binance as Price Fluctuates – What’s Next?

The coming months will be pivotal in determining whether increased staking participation translates to stronger price action for Ethereum.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!