|

Getting your Trinity Audio player ready...

|

A recent report from Citigroup has painted a largely optimistic picture for the future of stablecoins, suggesting the sector could burgeon to a staggering $3.7 trillion by 2030. Despite acknowledging potential headwinds, the financial giant highlighted friendly regulation worldwide as a key driver for this bullish outlook. The report, titled “Digital Dollars,” underscores the increasing integration of stablecoins with the US dollar, a factor Citigroup believes will fuel substantial long-term growth and significantly impact global financial markets.

US Dollar Dominance Expected in Stablecoin Landscape

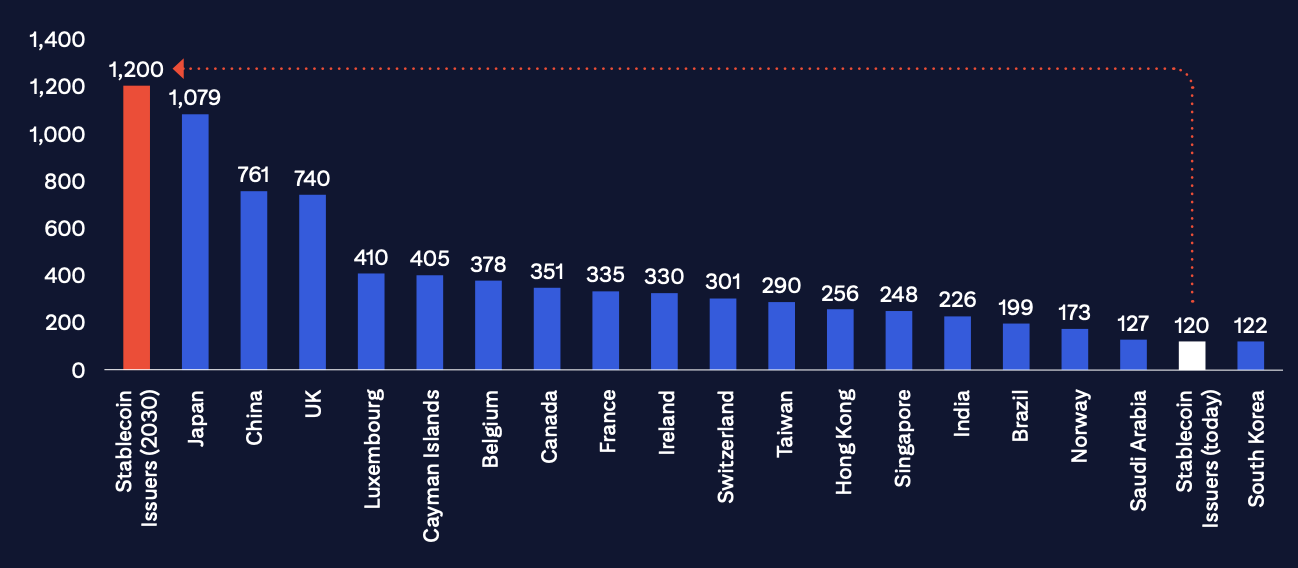

The Citi Institute’s analysis emphasizes the growing role of stablecoins as major holders of US Treasuries, a trend already influencing global financial flows. Artem Korenyuk, a managing director at Citi, noted the sustained demand for US dollar-denominated assets as a primary reason for this expansion. The report specifically focused on potential mandates requiring stablecoin issuers to hold reserves in US Treasuries.

Citigroup anticipates that such regulations will solidify the dollar’s dominance, projecting that 90% of the stablecoin market will remain tied to the greenback, leaving non-USD stablecoins and CBDCs on the periphery. This regulatory push is expected to compel issuers to align their internal policies more closely with the traditional finance (TradFi) ecosystem.

Regulatory Framework Seen as Catalyst for Cooperation

While acknowledging that stablecoins could pose a threat to traditional banking institutions, Citigroup believes that the proposed regulatory framework will foster a more cooperative environment. The mandate for US Treasury reserves is seen as a mechanism to better integrate stablecoins within TradFi. Furthermore, the report anticipates that public sector spending on blockchain technology will further support this positive dynamic.

Although Citigroup identified risks such as fraud, contagion from de-pegging events, and confidentiality concerns that could lead to a bearish scenario of $0.5 trillion, the overall sentiment remains strongly optimistic. Citigroup’s continued research and historical interest in the crypto space lend credence to their insightful projections for the stablecoin market’s significant future impact on the global financial landscape.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

Also Read: Coinbase Joins Forces with PayPal to Propel PYUSD Stablecoin Into the Mainstream

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!