|

Getting your Trinity Audio player ready...

|

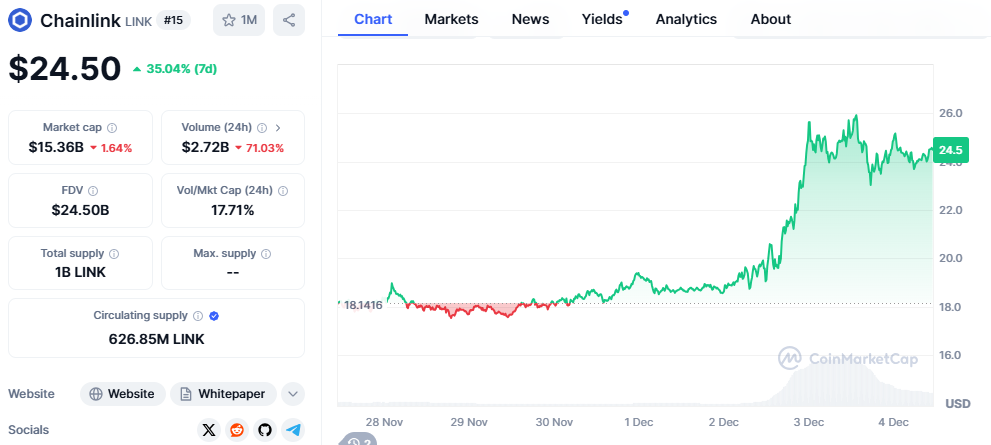

Chainlink (LINK), a prominent blockchain oracle network, has been a standout performer in the recent altcoin rally. The cryptocurrency surged by a remarkable 22.4% in the past 24 hours, reaching a price of $22.92 during the New York session. With a market capitalization exceeding $21 billion and daily trading volumes surpassing $6 billion, Chainlink has firmly captured the attention of investors and analysts alike.

We're excited to announce Europe’s first tokenized securities trading & settlement system—21X (@tradeon21x)—is adopting the #Chainlink standard.

— Chainlink (@chainlink) December 2, 2024

Price Feeds will underpin 21X’s trading engine & CCIP will connect it to assets across the onchain economy: https://t.co/ACGrBKuduL pic.twitter.com/BYKSBGUFp8

Strong Fundamentals Power Chainlink’s Rise

Chainlink’s robust fundamentals have been a key driver of its recent price surge. The platform has emerged as a crucial component of Web3 development, providing reliable and secure data solutions for smart contracts. A growing number of major corporations, including T-Mobile, Nexon, and the Central Bank of Brazil, have integrated Chainlink’s cross-chain protocol into their blockchain initiatives.

The network’s significant role in the global digital economy is further evidenced by its facilitation of over $17.3 trillion in transactions. This substantial volume underscores Chainlink’s position as a trusted and widely-used blockchain infrastructure.

Technical Analysis Points to Further Upside

Technical analysts have identified bullish signals in LINK’s price chart. The cryptocurrency’s monthly chart exhibits a series of higher highs and higher lows, indicating strong upward momentum. Additionally, the Relative Strength Index (RSI) is approaching the overbought level of 70%, suggesting that the buying pressure remains intense.

Partnership with 21X Expands Chainlink’s Reach

Chainlink’s recent partnership with Frankfurt-based fintech firm 21X marks a significant milestone in its growth trajectory. The collaboration aims to develop a tokenized exchange that adheres to the stringent regulatory standards set by BaFin, Germany’s Federal Financial Supervisory Authority. This initiative will enable the creation of sustainable and compliant trading services within the European Union.

Angie Walker, Global Head of Banking and Capital Markets at Chainlink Labs, emphasized the importance of the partnership. Walker highlighted that Chainlink’s technology plays a pivotal role in tokenizing real-world assets, bridging the gap between traditional finance and blockchain innovation.

Chainlink’s impressive performance and strategic partnerships position it as a leading force in the blockchain industry. As the demand for reliable and secure data solutions continues to grow, Chainlink’s innovative technology and robust network are poised to drive further adoption and price appreciation.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

A lifelong learner with a thirst for knowledge, I am constantly seeking to understand the intricacies of the crypto world. Through my writing, I aim to share my insights and perspectives on the latest developments in the industry. I believe that crypto has the potential to create a more inclusive and equitable financial system, and I am committed to using my writing to promote its positive impact on the world.