|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has caught the spotlight after a week of impressive double-digit price gains. However, the momentum appears to have cooled, ushering in a consolidation phase. Despite this, large-scale investors, or “whales,” seem undeterred, using this period to expand their ADA holdings. Could this renewed interest from whales reignite volatility for the eighth-largest cryptocurrency?

Whales Stockpile ADA Amid Consolidation

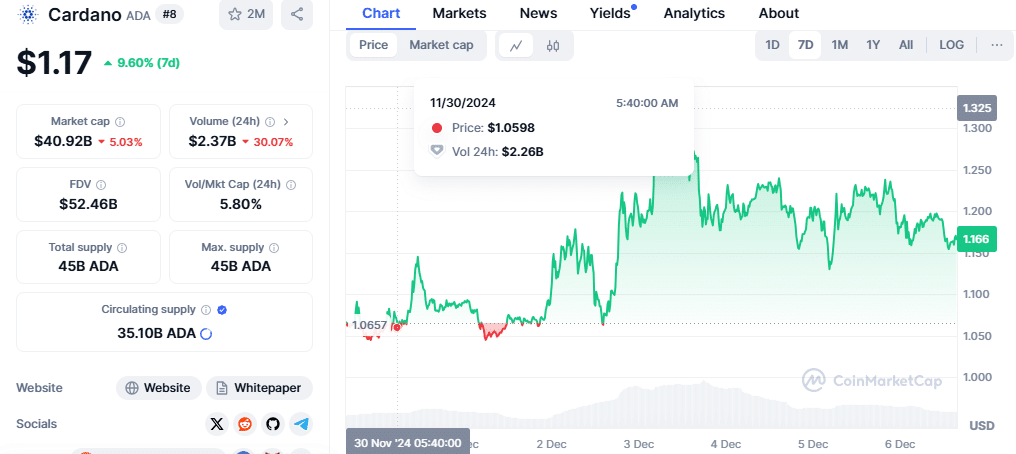

ADA saw its price surge by over 13% in the past seven days, lifting around 3 million ADA addresses into profitability—a striking 72% of all ADA wallets. However, the token’s rally slowed, with its price dipping slightly in the last 24 hours. As of press time, ADA is trading at $1.19, boasting a market capitalization of $41.9 billion.

#Cardano whales bought over 100 million $ADA in the last 24 hours! pic.twitter.com/IrZjA54tGy

— Ali (@ali_charts) December 5, 2024

Amidst reduced volatility, whales seized the opportunity to stock up. According to crypto analyst Ali Martinez, Cardano whales bought over 100 million ADA tokens within just 24 hours. This strategic accumulation signals a strong belief in ADA’s long-term potential, even as the broader market cools.

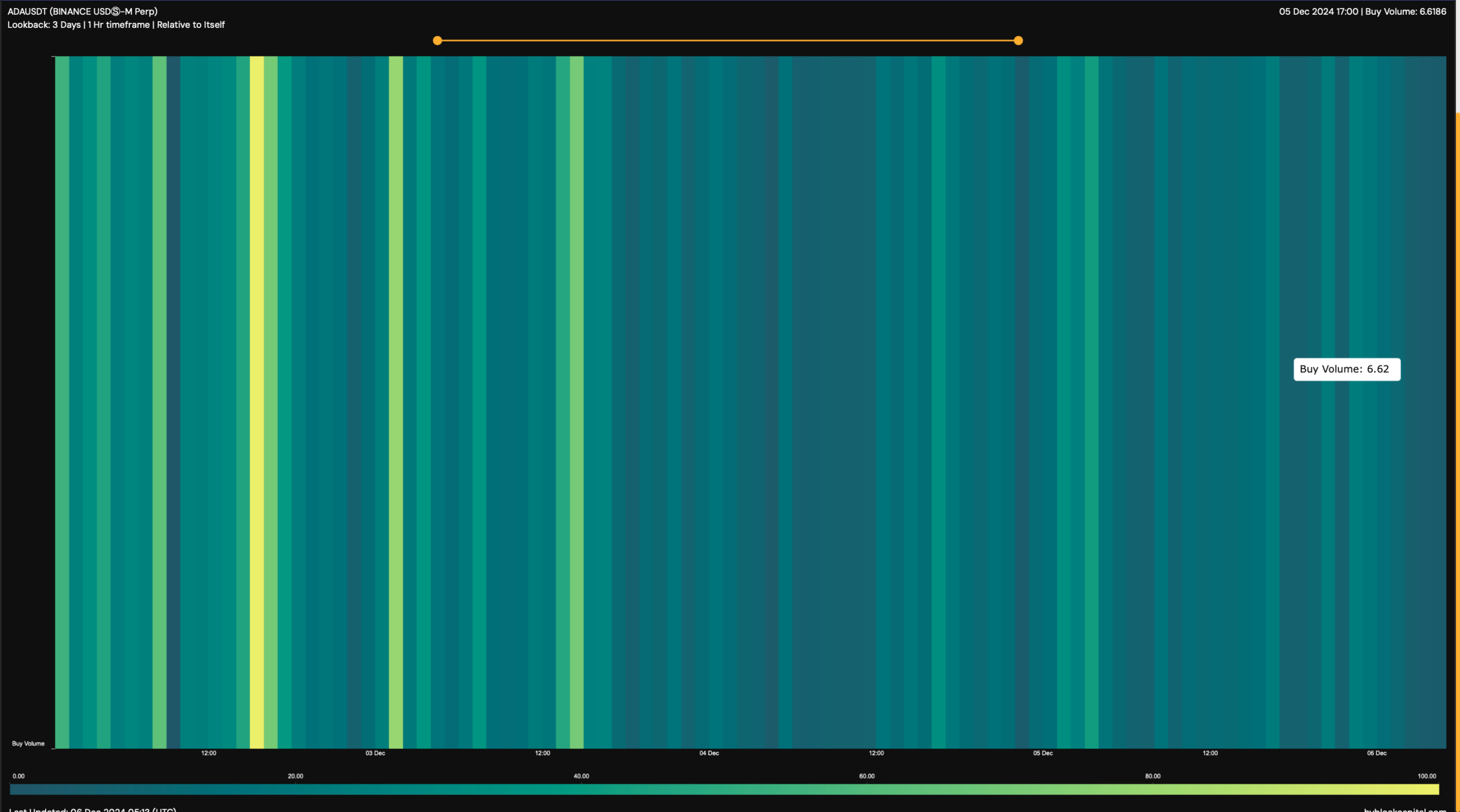

Adding to the buying frenzy, Cardano’s buy volume metric hit impressive highs of 100 and 73 on December 3, reflecting elevated investor interest. However, enthusiasm appeared to wane slightly, as the metric dropped to 6.6 by December 5.

Hydra Scaling Solution Surpasses Visa’s Daily Volume

Cardano also celebrated a significant milestone with its Hydra scaling solution. In a mere four hours, Hydra processed over 2 billion transactions, surpassing Visa’s daily transaction volume. This achievement underscores Cardano’s growing prowess as a scalable blockchain, further boosting investor confidence.

Will ADA’s Consolidation Lead to Volatility?

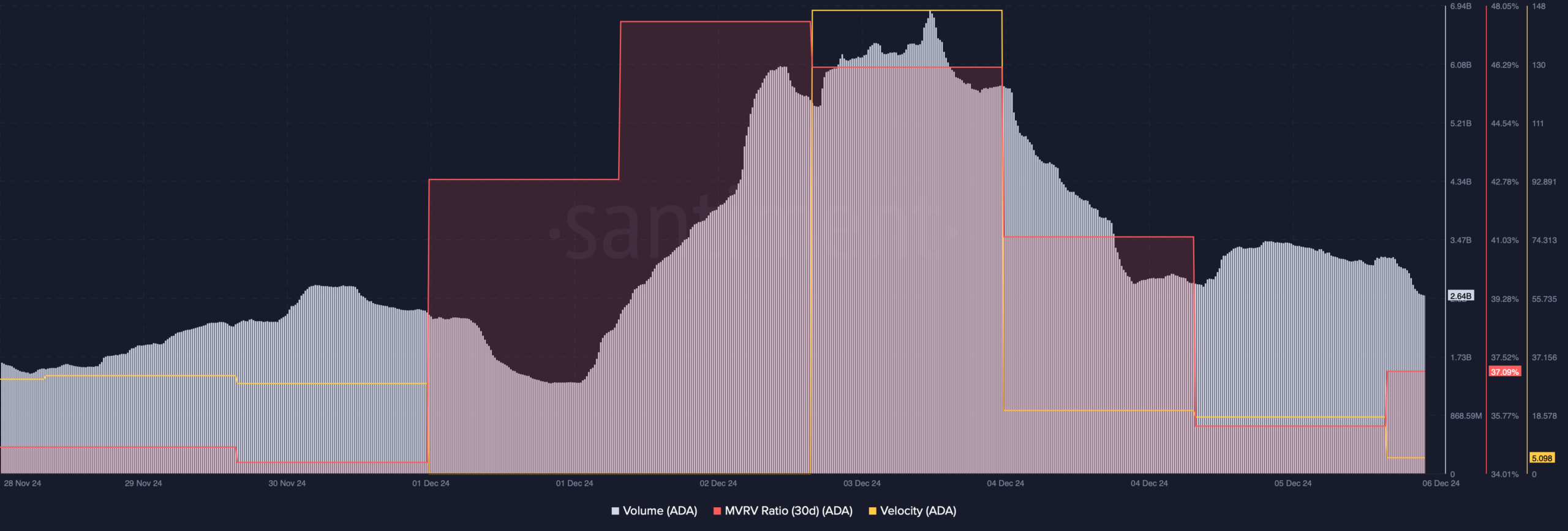

While whales and technological milestones bolster optimism, ADA’s on-chain metrics hint at a potential cooling period. The Market Value to Realized Value (MVRV) ratio dropped sharply to 37%, suggesting reduced profitability for holders. Additionally, ADA’s velocity—a measure of transaction frequency—declined, indicating diminished usage.

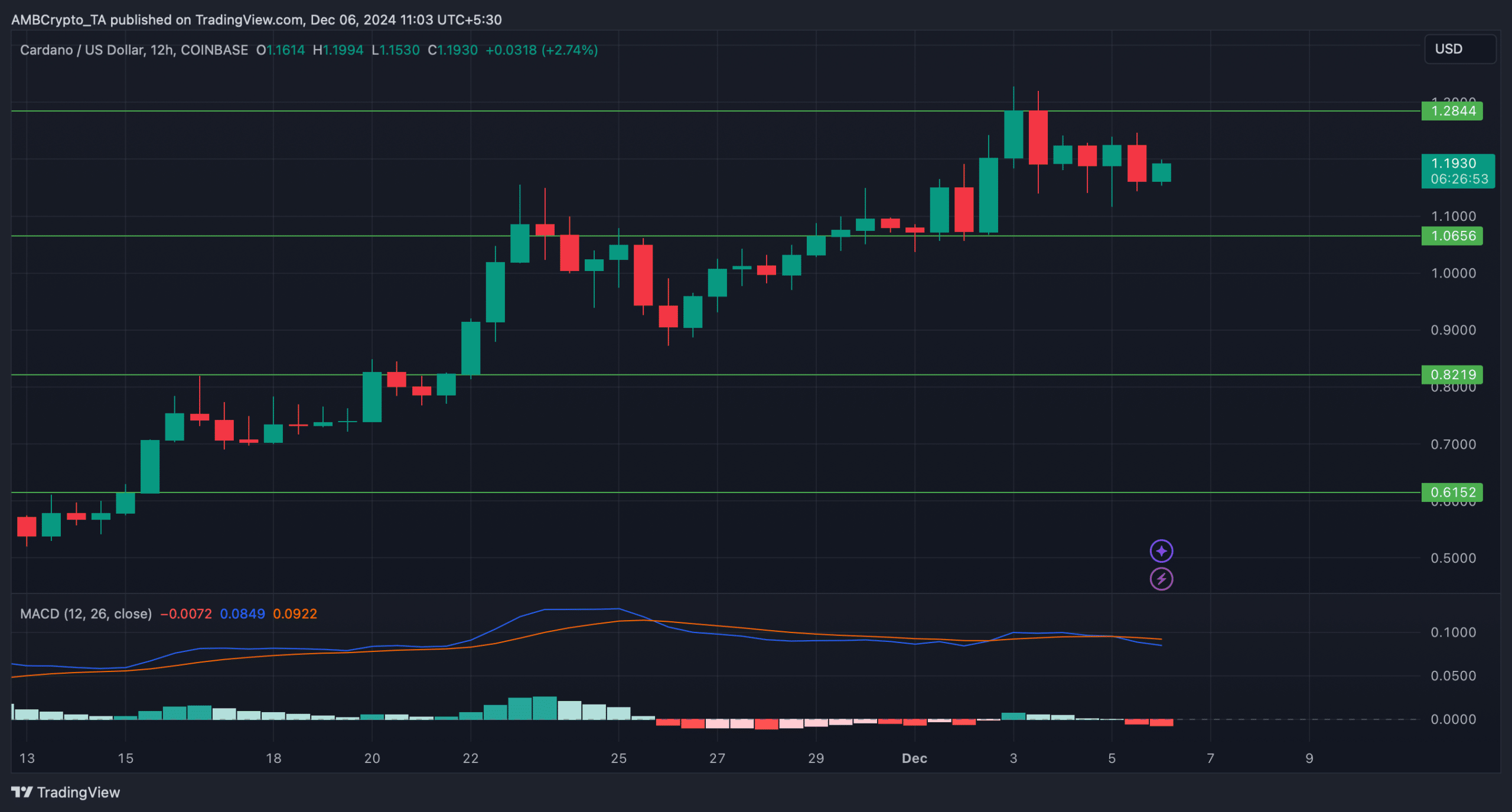

On the trading front, ADA’s volume also fell, signaling less activity among investors. Technical indicators further painted a cautious picture. The Moving Average Convergence Divergence (MACD) displayed a bearish crossover, pointing to potential downward pressure.

ADA currently hovers within the $1–$1.20 range. Should bearish sentiment prevail, the token may test its $1 support level before attempting a new rally.

Cardano’s current phase of consolidation may offer a golden opportunity for long-term investors. With whale accumulation and advancements like Hydra showcasing the network’s strengths, ADA could rebound after a short-term dip. However, traders should monitor key support levels and on-chain metrics to navigate the potential volatility ahead.

As Cardano positions itself for further growth, will its whales and technological breakthroughs be enough to fuel another price surge? Only time will tell.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.