|

Getting your Trinity Audio player ready...

|

Cardano (ADA) defied the recent market slump with a 35% price surge from July 8th to 13th. This impressive rally was fueled by a surge in buying from large investors, often referred to as “whales.” While the long-term trend remains uncertain, several indicators suggest a potential bullish reversal in the near future.

Technical Analysis Hints at Bullish Shift

The short-term price chart offers promising signs. The recent climb above $0.4235 signifies a potential market structure shift, although it doesn’t guarantee a sustained uptrend. The key psychological resistance level sits at $0.5. A daily close above this point would be a significant bullish signal, potentially reversing the current downtrend.

However, hurdles remain. The former support zone around $0.44-$0.475 now acts as resistance, further complicated by a bearish order block between $0.46 and $0.5. Overcoming these obstacles will be crucial for sustained bullish momentum.

Momentum Indicators Flash Green

Technical indicators also paint a cautiously optimistic picture. The daily RSI (Relative Strength Index) climbed above the neutral 50 level, suggesting a shift in momentum towards bullish territory. Additionally, the OBV (On-Balance Volume) indicator has surpassed lows from two weeks ago, hinting at buying pressure supporting the recent gains.

Whales Accumulate ADA: A Bullish Sign?

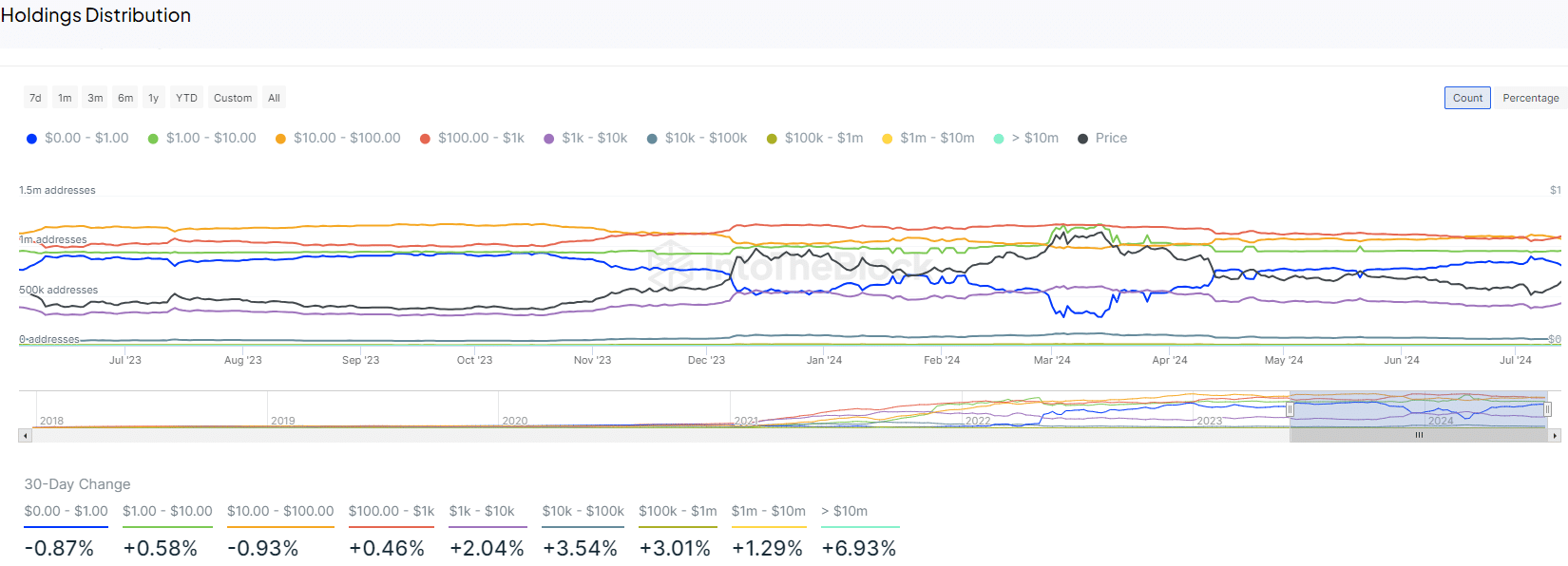

The on-chain data adds another layer of intrigue. The 30-day change in ADA holding distribution reveals a 6.93% increase for addresses holding over $10 million worth of tokens. This “whale accumulation” suggests that large investors were buying ADA even during the recent price decline, potentially anticipating a future upswing.

In the near term, a retest of the $0.42-$0.43 zone could present a buying opportunity for investors targeting a move towards $0.46-$0.5. A decisive breakout above $0.5 would be a major bullish signal, potentially paving the way for a longer-term uptrend towards $0.57 and even $0.68, levels seen earlier in 2024.

Caution Remains: Market Volatility is High

While the technicals and on-chain data offer promising signs, the cryptocurrency market is inherently volatile. Investors should always conduct their own research and exercise caution before making any investment decisions.

Also Read: Cardano (ADA) on the Verge of Governance Revolution: Can Chang Fork Ignite a New Price Surge To $1?

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.