|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- $0.749 is a critical support level with high liquidation risk beneath it.

- MVRV ratio at 22.43% indicates potential for increased profit-taking.

- RSI pullback from 82.6 suggests weakening bullish momentum.

Cardano (ADA) has dropped from its recent peak of $0.93 to around $0.86, slipping into a danger zone where technical indicators and on-chain metrics suggest heightened downside risk. With critical liquidation clusters forming just beneath key support levels, ADA’s short-term outlook hinges on whether it can hold its footing.

Liquidation Clusters Signal Potential Breakdown Below $0.749

One of the most pressing concerns for ADA holders is the growing concentration of long liquidation clusters around $0.749. According to Coinglass data, over $34 million worth of leveraged long positions are stacked at this level. These are traders who expected ADA to rally further but are now at risk of having their positions forcibly closed if prices drop further.

Such forced closures can lead to a cascade of automated selling, intensifying any downward momentum. If ADA breaks below this $0.749 zone, the next downside targets lie at $0.728 and potentially $0.687.

MVRV Ratio Suggests Profit-Taking May Accelerate

Another red flag is ADA’s rising 30-day MVRV (Market Value to Realized Value) ratio, which has climbed to 22.43%. This suggests that a large portion of recent buyers are now in profit—historically a scenario that leads to increased selling pressure.

Since July 8, when the MVRV flipped positive, the incentive for traders to lock in gains has only grown. When combined with fragile technical support, this sentiment increases the likelihood of profit-taking snowballing into further declines.

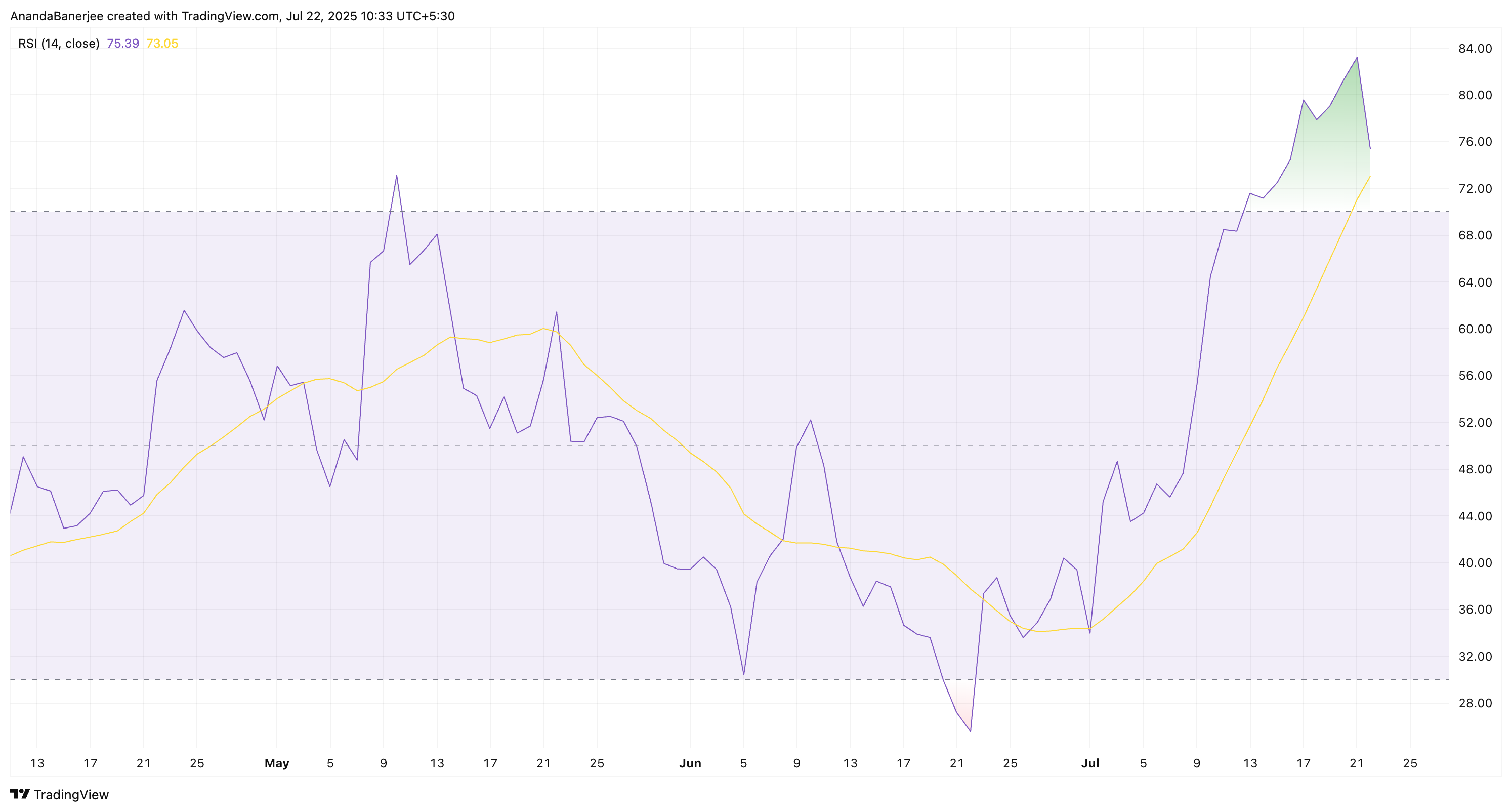

RSI Confirms Overbought Conditions Have Reversed

The Relative Strength Index (RSI) for ADA recently hit a peak of 82.6, well into overbought territory, before pulling back. This momentum cooling indicates that bullish energy may be waning, especially as RSI readings above 70 often precede corrections.

With the RSI turning lower and market enthusiasm cooling, ADA may struggle to maintain its current levels without fresh buying support.

At present, ADA is hovering near $0.86—above the 1 Fib extension level—but only barely. If this support fails, the price may descend toward the $0.84, $0.81, and then $0.78 support zones. A break below $0.78 would likely expose ADA to the heavy liquidation zone below $0.749.

If that zone fails, ADA could plunge to $0.72 or even $0.68, marking a significant trend reversal.

Also Read: Charles Hoskinson Confirms August Audit Report for Cardano, Hints at Defamation Lawsuit

On the flip side, a sustained rally above $0.93 would invalidate this bearish thesis and could push Cardano back toward the $0.98 resistance.

Cardano’s short-term fate depends on whether it can defend key support or succumb to mounting liquidation and profit-taking pressures.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.