|

Getting your Trinity Audio player ready...

|

Cardano (ADA) has seen a surge in demand, and this bullish momentum may push its price higher in the short term. After a period of consolidation from December 3 to January 15, where ADA’s price traded within a symmetrical triangle, the altcoin is showing signs of a potential breakout.

A symmetrical triangle is a chart pattern where the asset’s price experiences lower highs and higher lows, creating a triangular shape. Typically, this pattern indicates market indecision but often precedes a breakout in the direction of the previous trend. Over the past week, ADA’s price broke above the upper boundary of this triangle, signaling a shift in sentiment towards the bullish side. This breakout suggests that buying pressure is starting to outweigh selling activity, which could lead to further upward movement.

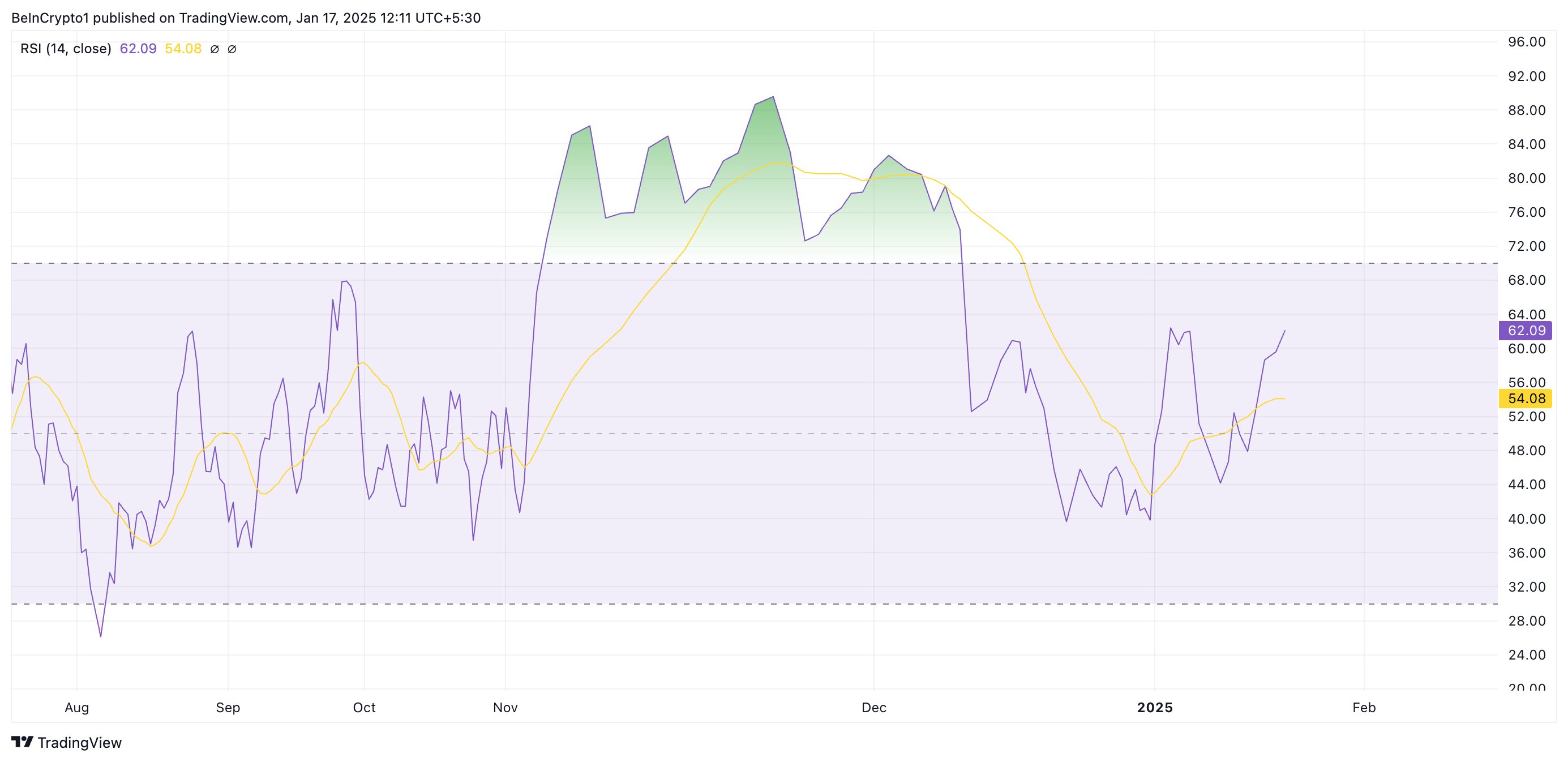

The Relative Strength Index (RSI) supports this positive outlook. Currently at 62.09, the RSI indicates that ADA is in a moderately strong uptrend. The RSI is a key indicator that measures market conditions, with values above 70 indicating overbought conditions and values under 30 signaling oversold conditions. ADA’s current RSI suggests solid bullish momentum without being overbought, pointing to more room for growth.

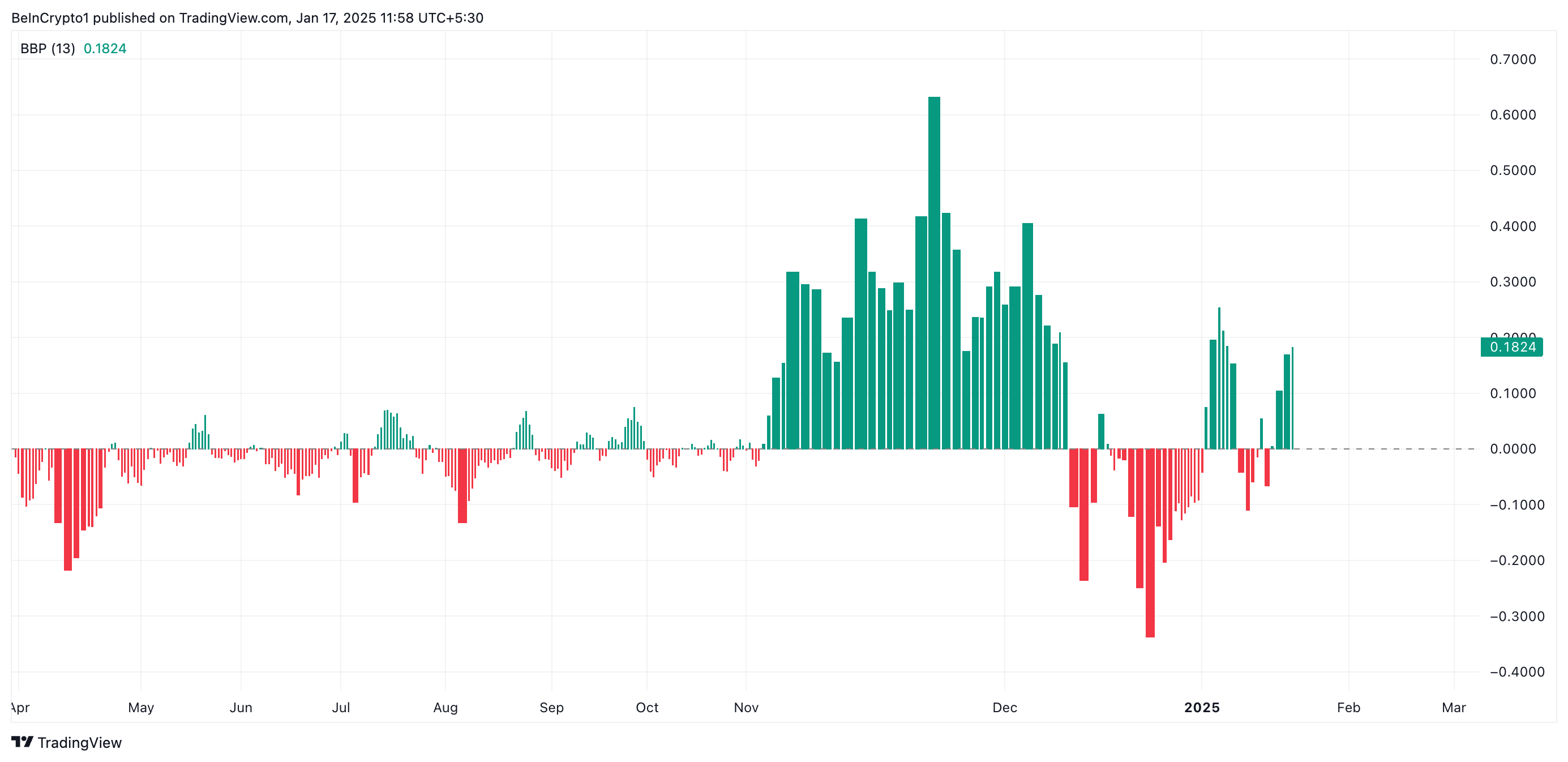

Additionally, the Elder-Ray Index, which evaluates buying and selling pressure, also reinforces this bullish sentiment. At a positive value of 0.18, the index indicates strong buying pressure, further confirming the market’s optimism toward ADA.

Looking ahead, ADA is currently trading at $1.12, just above the $1.03 resistance level formed by the symmetrical triangle’s upper boundary. A successful retest of this breakout line could flip the $1.03 price point into support, potentially pushing ADA toward its 30-day high of $1.34. However, a failed retest could lead to a pullback to the $0.94 level, bringing the coin back within the symmetrical triangle.

Also Read: Cardano (ADA) Price Surge – Will Whale Activity Push ADA to $1.50?

In conclusion, with growing demand and bullish technical indicators, ADA may continue its rally if it maintains momentum above key support levels.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m a crypto enthusiast with a background in finance. I’m fascinated by the potential of crypto to disrupt traditional financial systems. I’m always on the lookout for new and innovative projects in the space. I believe that crypto has the potential to create a more equitable and inclusive financial system.