|

Getting your Trinity Audio player ready...

|

Key Takeaways:

- CBOE has filed a 19b-4 form to list the Canary PENGU ETF, making it only the second meme coin ETF to reach the SEC review stage after Dogecoin.

- The ETF uniquely includes both PENGU tokens and Pudgy Penguin NFTs, marking the first time NFTs are part of a proposed exchange-traded fund.

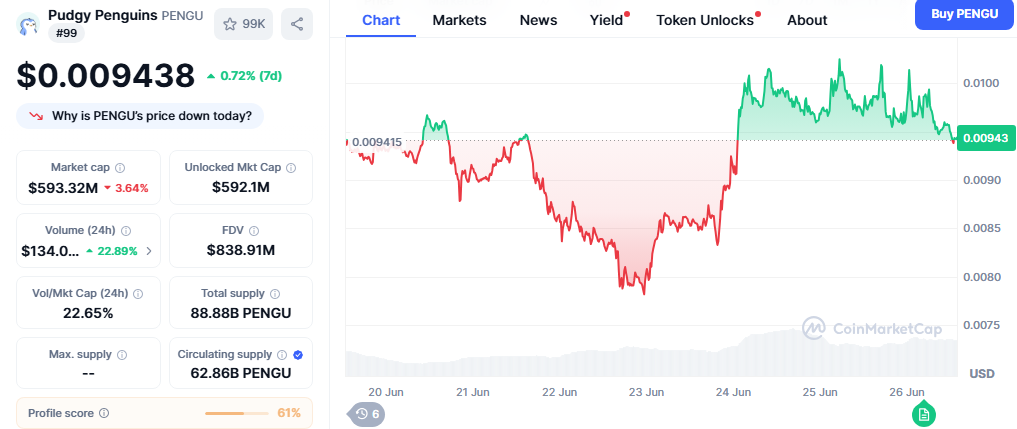

- Canary Capital’s fund also involves minimal SOL and ETH holdings, needed for transactions, while PENGU’s price rose nearly 2% following the filing.

The Chicago Board Options Exchange (CBOE) has officially filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) to list and trade shares of the Canary PENGU ETF. This filing marks a pivotal step toward institutional adoption of the Solana-based meme coin, PENGU, and its associated Pudgy Penguin NFTs.

PENGU Becomes Second Meme Coin ETF to Reach SEC Review

With this 19b-4 submission, PENGU now becomes the second meme coin—after Dogecoin (DOGE)—to reach the SEC’s formal ETF review process. Canary Capital originally filed the S-1 form for the ETF two months ago. The proposed fund will give investors direct exposure to PENGU, Pudgy Penguin NFTs, and minimal allocations in SOL and ETH.

According to the filing, the ETF will allocate between 80% and 95% of its total assets to PENGU and between 5% and 15% to the NFTs. Canary Capital clarified that SOL and ETH will only be held as necessary for transaction fees and NFT-related activities on their respective blockchains.

Pudgy Penguin NFTs Break New Ground in ETF Structure

The inclusion of Pudgy Penguin NFTs in a proposed exchange-traded fund is a landmark move. This is the first time an NFT collection has made its way into an SEC-reviewed ETF application. Igloo, the team behind Pudgy Penguins, hailed the filing as a “historic milestone” in a recent post on X (formerly Twitter).

The @CBOE files the CANARY PENGU ETF 19b-4.

— Igloo (@IglooInc) June 25, 2025

With this filing, the $PENGU and Pudgy Penguins NFTs ETF becomes only the second memecoin-style ETF, after DOGE, and first filing with NFTs to enter the @SECGov’s formal review process, joining coins such as BTC, SOL, XRP, and DOGE. pic.twitter.com/xtmHi6C8u8

This hybrid exposure structure could pave the way for broader NFT adoption in traditional finance, especially as institutional investors seek diversified crypto asset exposure beyond tokens like BTC and ETH.

Also Read: Pudgy Penguins (PENGU) Jumps 9.6% Amid Bullish Derivatives Activity

Canary’s Bold Bet on PENGU and Web3 Culture

Canary Capital remains the sole asset manager to propose an ETF around PENGU, contrasting with the broader competition for DOGE ETFs, where firms like Grayscale, Bitwise, and 21Shares are already in the running. Canary’s positioning of PENGU alongside NFTs and core infrastructure assets like SOL and ETH reflects a strategic bet on Web3 culture’s longevity and appeal.

PENGU’s price responded positively to the news, rising nearly 2% in the past 24 hours to $0.009832, according to CoinMarketCap.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!