|

Getting your Trinity Audio player ready...

|

Worldcoin (WLD), the privacy-focused cryptocurrency, has continued its long-term downtrend, falling below key support levels on its daily chart. Despite a recent 10% surge, the broader market sentiment remains bearish, and WLD faces significant resistance to any potential recovery.

The Crypto Fear & Greed Index currently indicates a bearish sentiment, reflecting the overall market’s negative outlook. WLD is trading at around $1.63 at the time of writing, down from its 11-month high.

The downward pressure on WLD is evident in its position below all major moving averages (EMAs). The 20-day EMA at $1.67, the 50-day EMA at $2.08, and the 200-day EMA at $3.42 serve as significant resistance points for any potential recovery.

The current price action suggests that WLD is struggling to break above the 20-day EMA, which is crucial for a sustained recovery. The downward-sloping EMAs indicate that sellers are still in control, and any bounce from current levels could face strong resistance.

To gain control, WLD must close above the 20-day EMA and maintain this level. While the recent increase in volume and Open Interest suggests potential for a bounce, the broader market sentiment still favors the bears.

Also Read: Is Worldcoin The Future Of Identity? 6.3M Say Yes, But Regulators Aren’t So Sure

The Relative Strength Index (RSI) is hovering below the 50-mark, indicating a slight bearish edge. Buyers should look for a potential close above equilibrium to gauge the chances of an immediate recovery.

Key levels to watch include the immediate resistance at the 20-day EMA ($1.67). If WLD can break and hold above this level, the next target would be the 50-day EMA at $2.08, followed by a potential test of the 200 EMA level. On the downside, the support at $1.41 is crucial. A break below this level could lead to a steeper correction, with the next support around $0.95.

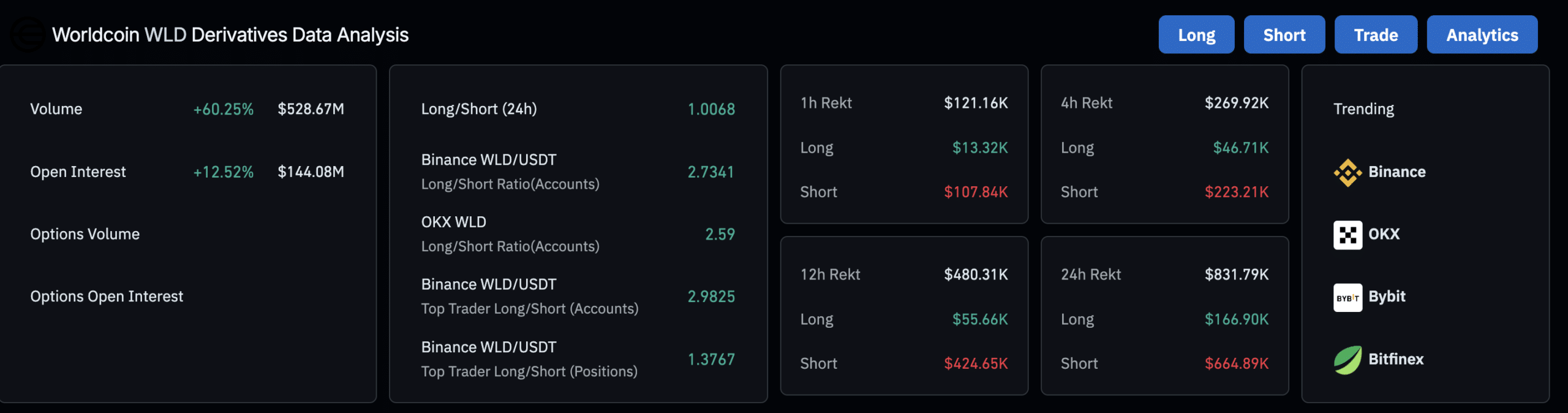

It’s worth noting that the volume increased significantly by 60.25% to $528.67 million, and Open Interest also rose by 12.52% to $144.08 million. This suggests growing interest in WLD, but whether this is driven by buyers stepping in or more sellers looking to short the asset remains uncertain.

The long/short ratio for the last 24 hours is almost balanced at 1.0068, indicating a neutral sentiment among traders. However, the WLD/USDT long/short ratio on Binance is highly bullish at 2.7341, showing that many traders hope for a potential recovery.

Buyers should also monitor external factors, such as macroeconomic trends and Bitcoin’s sentiment, as these will likely influence WLD’s price action in the near term.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.