|

Getting your Trinity Audio player ready...

|

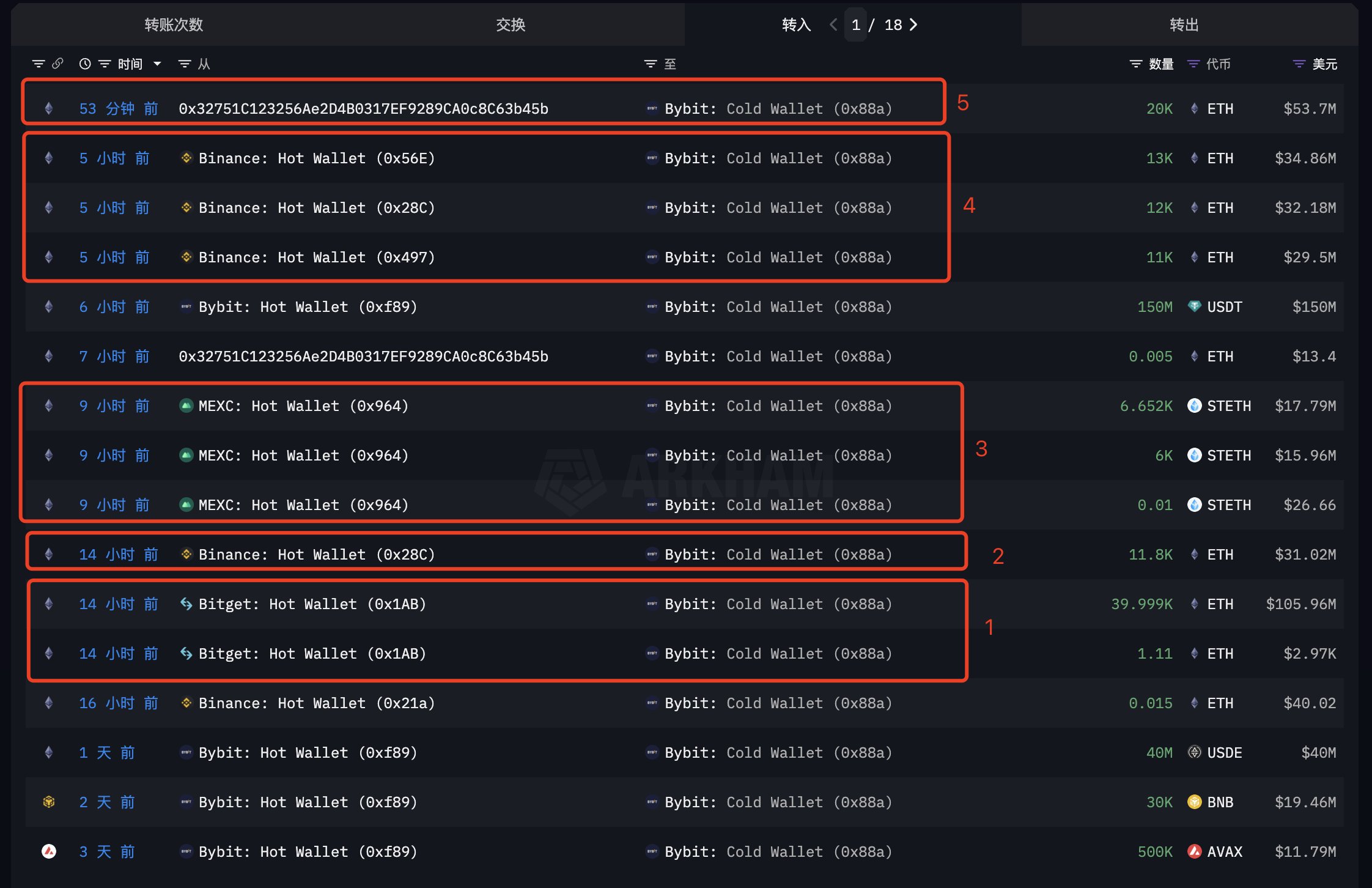

Bybit has received a massive liquidity boost with 120,000 ETH in loan support from multiple institutions and whales. According to data from EmberCN, the total loan, valued at approximately $320.97 million, underscores the growing institutional interest in the exchange.

Breakdown of Bybit’s Institutional Support

The significant loan inflow comprises contributions from five major entities:

- Bitget: 40,000 ETH ($105.96 million)

- Binance Whale (Entity 1): 11,800 ETH ($31.02 million)

- MEXC: 12,652 stETH ($33.75 million)

- Binance Whale (Entity 2): 36,000 ETH ($96.54 million)

- Unidentified Institution/Whale: 20,000 ETH ($53.70 million)

This influx of liquidity signals confidence in Bybit’s financial stability and trading infrastructure, setting the stage for potential shifts in Ethereum market dynamics.

Impact on Ethereum Market and Trading Volume

The substantial ETH injection into Bybit is expected to increase liquidity, potentially affecting ETH/USDT and ETH/BTC trading pairs. Notably:

- ETH/USDT Trading Volume: Spiked by 2%, reaching $1.2 billion within 24 hours.

- ETH/BTC Trading Volume: Increased by 1.5%, hitting $800 million on Bybit.

- ETH Price Movement: A 1.8% surge was recorded, pushing ETH to $2,722.24.

- Market Sentiment: The Crypto Fear & Greed Index registered at 72, reflecting growing investor confidence.

Technical Indicators and Market Response

On-chain data and technical indicators further reinforce the positive market sentiment:

- Relative Strength Index (RSI): Reached 68, signaling ETH is nearing overbought territory.

- MACD Indicator: Showed a bullish crossover, suggesting upward momentum.

- Active ETH Addresses: Increased by 5% to 650,000, reflecting heightened network activity.

- Transaction Volume: Rose by 3% to 1.5 million transactions in a single day.

Also Read: Hackers Steal $1.5 Billion from Bybit in Largest-Ever Crypto Heist

Institutional Confidence in Bybit’s Future

The involvement of major crypto platforms such as Bitget and MEXC highlights Bybit’s growing prominence in the exchange ecosystem. Institutional backing often translates into increased user trust and market participation, which could enhance Bybit’s competitive position among global exchanges.

Bybit’s 120,000 ETH loan infusion marks a significant moment for Ethereum’s market landscape. With increased liquidity and strong institutional backing, ETH trading volumes could experience sustained growth, influencing price trends in the coming weeks. Investors and traders will be closely monitoring how this development shapes Ethereum’s trajectory in the evolving crypto market.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!