|

Getting your Trinity Audio player ready...

|

Bybit, a major cryptocurrency exchange, has been the target of recent rumors alleging a hack and insolvency. However, CEO Ben Zhou has swiftly addressed these concerns, providing evidence to assure users of the platform’s stability.

On May 22nd, rumors surrounding Bybit’s financial health began circulating online. Fueled by a wave of memes referencing the FTX collapse, these claims gained traction, sparking worry among some investors.

Bybit Fights Back with Transparency

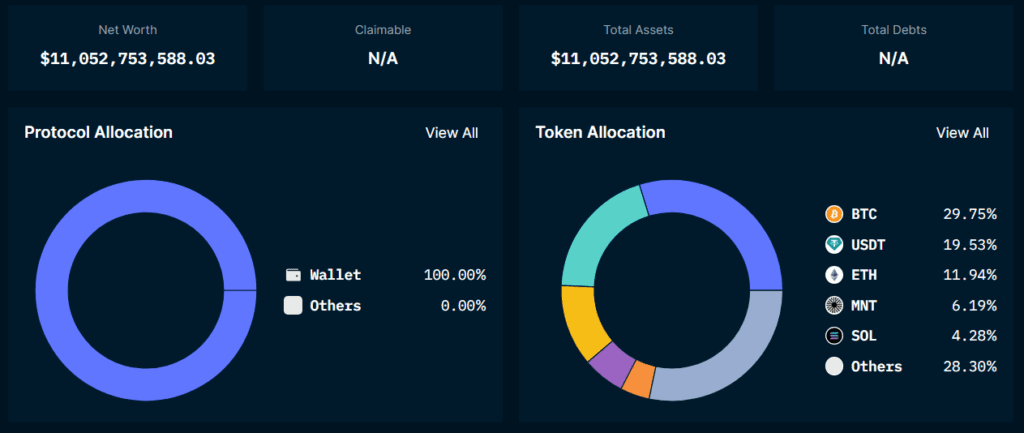

Zhou responded promptly, emphasizing that Bybit had recently updated its Proof of Reserves (PoR). He directed users to a Nansen dashboard displaying Bybit’s wallets, collectively holding over $11 billion in assets. This move aimed to dispel rumors and demonstrate transparency.

Was Arkham Intelligence to Blame?

Some crypto enthusiasts speculated that a misinterpreted chart from Arkham Intelligence might have triggered the rumors. This chart reportedly created the impression of Bybit’s wallets being drained, leading to concerns about a potential hack or insolvency. However, independent verification of Bybit’s wallets confirmed the presence of user funds. Arkham Intelligence has not yet commented on the matter.

To further bolster confidence, Zhou shared a link to Bybit’s PoR and the aforementioned Nansen dashboard. The PoR confirms that Bybit holds assets exceeding user deposits, ensuring the platform can meet withdrawal requests. Data from Nansen further solidifies this, showcasing over $11 billion in crypto assets held by Bybit. However, the analytics platform clarifies that this figure may not represent a complete picture of Bybit’s overall financial health.

This incident highlights the heightened scrutiny crypto exchanges face following the collapses of major firms like FTX and Celsius in 2022. Such events have instilled a sense of caution among investors, making them more susceptible to FUD (Fear, Uncertainty, and Doubt) campaigns.

Bybit’s Regulatory Hurdles: A Parallel Story

This incident isn’t the first time Bybit has faced challenges. In December 2023, concerns about MEXC, another exchange, arose due to the disappearance of their CEO’s Twitter account and user complaints regarding frozen funds.

Interestingly, Bybit itself operates under regulatory restrictions. France’s securities regulator, the AMF, has reiterated a warning against Bybit, highlighting their non-compliance with French regulations. Bybit is currently banned in 14 countries, including the US and Russia.

Despite these restrictions, Bybit has managed to expand its global presence, becoming one of the world’s largest crypto exchanges with a trading volume exceeding $71 billion.

Transparency Combats FUD

Bybit’s swift response and commitment to transparency have helped quell the recent rumors. However, the incident underscores the importance of clear communication in a market marked by skepticism. As the crypto industry continues to evolve, building trust through transparency and regulatory compliance will remain paramount for exchanges like Bybit.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.