|

Getting your Trinity Audio player ready...

|

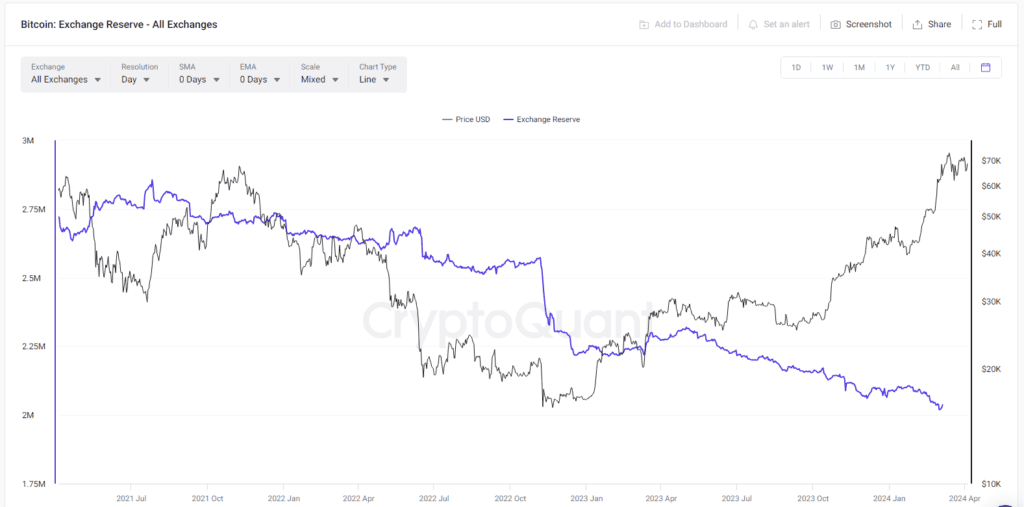

Bitcoin (BTC) is experiencing a tug-of-war between long-term investors and broader economic forces. While exchange reserves dwindle to record lows, indicating a “hodling” mentality, strong U.S. economic data casts a shadow on the digital asset’s immediate price surge.

Bitcoin Leaving the Building

Data from CryptoQuant reveals a mass exodus of Bitcoin from exchanges, with over 90,700 coins withdrawn in the last month alone. This trend suggests a long-term holding strategy by investors, who are moving their coins to cold storage for safekeeping. This behavior has been observed for several years, potentially fueled by rising Bitcoin prices and the emergence of investment vehicles like spot Bitcoin ETFs.

However, not all Bitcoin on exchanges is being withdrawn. Glassnode data paints a picture of short-term holders accumulating coins from long-term holders. This dynamic could be driven by rising Bitcoin prices and the allure of short-term profits.

Macroeconomic Headwinds

Despite a recent 2.6% price increase, Bitcoin remains roughly 10% shy of its all-time high. Analysts at Stocklytics attribute this to strong U.S. economic indicators, suggesting the Federal Reserve might hold off on interest rate cuts – a potential catalyst for Bitcoin’s rise.

The strengthening U.S. dollar further complicates the picture. As highlighted by Coinbase analysts, a robust dollar makes dollar-denominated assets like Bitcoin more expensive, potentially deterring new buyers. Additionally, a strong dollar can dampen investor risk appetite, leading to withdrawals from volatile assets like Bitcoin.

Also Read: Ethena (ENA) Token Soars 60%+ at Launch, Binance Integration Fuels Bullish Run

Jobs Report: A Fork in the Road

Friday’s U.S. jobs report holds significant weight. A positive report could usher in a period of consolidation for Bitcoin, with investors taking a wait-and-see approach.

The coming weeks will be crucial for Bitcoin. While long-term investors seem committed, short-term price movements hinge on the interplay of macroeconomic factors and the U.S. dollar’s strength.

I’m the cryptocurrency guy who loves breaking down blockchain complexity into bite-sized nuggets anyone can digest. After spending 5+ years analyzing this space, I’ve got a knack for disentangling crypto conundrums and financial markets.