|

Getting your Trinity Audio player ready...

|

BRETT (BRETT), a memecoin launched earlier this year on the Base network, has taken the crypto world by storm. Despite its recent dip, BRETT boasts a market cap exceeding $1.66 billion and currently ranks as the 75th largest cryptocurrency.

Explosive Growth and a Recent Correction

BRETT has skyrocketed over 300% since March, according to CoinMarketCap. However, after reaching an all-time high (ATH) of $0.235 on December 1st, profit-taking caused a 19% pullback in the past week, with the price currently hovering around $0.167.

Technical Analysis Paints a Mixed Picture

Technical indicators suggest a short-term correction. The one-day chart shows a descending triangle pattern, often preceding a dip. The MACD and RSI indicators hint at bearish control, with the MACD line below the signal line and RSI dropping below 50.

Hope on the Horizon: A Potential Rebound

However, there’s optimism. BRETT has historically mirrored Bitcoin (BTC) and the broader market. With an anticipated crypto market rally in the first quarter of 2025 due to political shifts and institutional adoption, BRETT could surge, potentially reclaiming its ATH.

Long-Term Holders Fueling Optimism

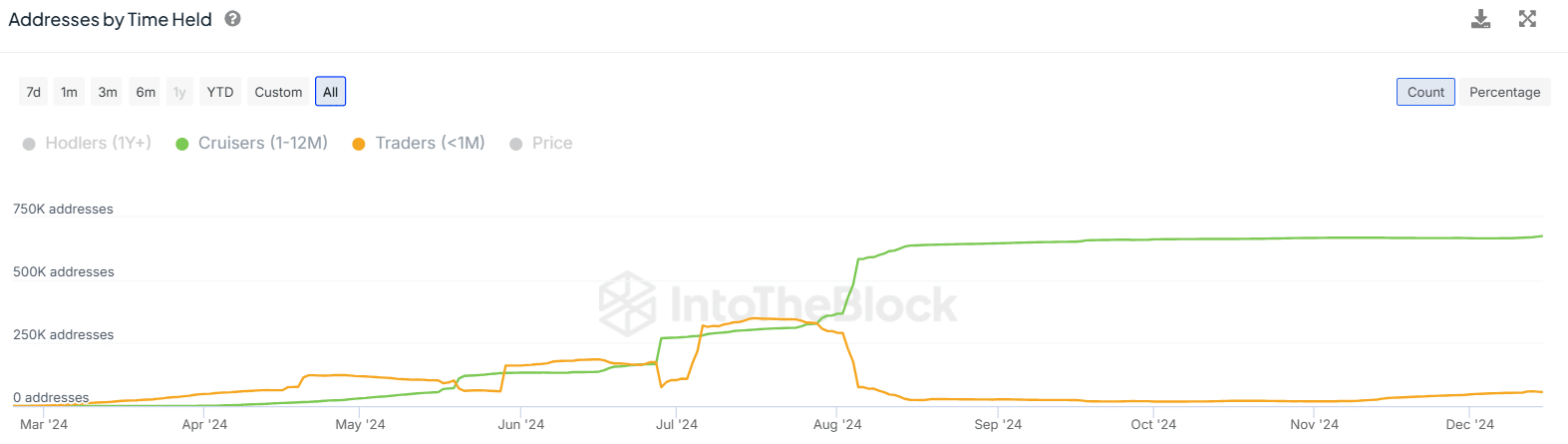

There’s a significant shift in holding behavior. IntoTheBlock’s “Addresses by Time Held” metric reveals a growing number of long-term BRETT holders (over 673,000), suggesting bullish sentiment. While short-term speculation has also increased (over 55,000 holders compared to 18,000 in November), long-term accumulation could propel BRETT’s value beyond 2025, potentially exceeding $1.

Reaching $1 within five years would require a market cap of nearly $10 billion, putting BRETT in competition with memecoin giants like PEPE (PEPE). This ambitious target is achievable, especially considering BRETT’s dominance on the Base network. As the largest Base memecoin, it accounts for almost a third of the network’s total memecoin market cap. If Base continues to challenge Solana (SOL) in the memecoin sector, BRETT’s journey to $1 could become a reality in the coming years.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.