|

Getting your Trinity Audio player ready...

|

BONK, the memecoin riding the Solana blockchain, has been a story of two halves in 2024. After a year marked by impressive gains, BONK has taken a tumble in recent weeks, hitting a two-month low. This price decline has thrown investors into a state of uncertainty, with conflicting signals creating a wait-and-see approach.

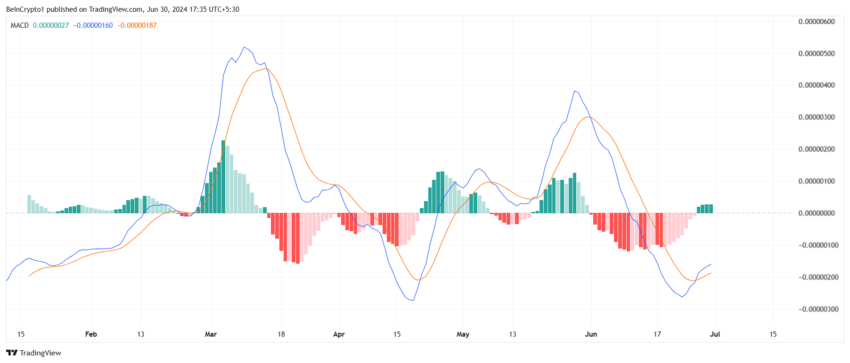

On the technical front, a glimmer of hope emerged with a recent bullish crossover in the Moving Average Convergence Divergence (MACD) indicator. The MACD is a popular tool used by traders to identify potential shifts in momentum, and this crossover is often seen as a precursor to price increases. However, this optimism is dampened by the declining funding rate for BONK. The funding rate reflects investor sentiment, and a negative shift indicates a lack of confidence in BONK’s ability to maintain an upward trajectory.

This clash between technical indicators and investor sentiment paints a confusing picture. While the MACD suggests potential for a price surge, the overall market mood leans towards caution. This conflicting data could lead BONK to enter a period of consolidation, where its price remains relatively stagnant within a specific range.

A Rough June for BONK

June proved to be a brutal month for BONK investors. The price plummeted a staggering 51%, briefly dipping below $0.000020 before staging a minor recovery. This volatility has caused many to adopt a back-and-forth stance, unsure of whether BONK is headed for a bullish breakout or a further bearish slide.

Consolidation or Breakout? The Road Ahead for BONK

Analysts predict that BONK will likely consolidate in the near future, with its price hovering between a range of $0.00002748 and $0.00002212. A breakout from this range would signal a more definitive direction. If BONK manages to break above the upper limit, it could witness a rise towards $0.00003000. Conversely, a fall below the lower limit could trigger a further drop to $0.00001375.

Investor Takeaway: Proceed with Caution

The current situation surrounding BONK highlights the importance of considering both technical indicators and investor sentiment when making investment decisions. While the MACD offers a hint of potential growth, the lack of confidence reflected in the funding rate creates uncertainty. Investors are advised to carefully weigh these conflicting factors before taking any action with BONK.

Disclaimer: The information in this article is for general purposes only and does not constitute financial advice. The author’s views are personal and may not reflect the views of Chain Affairs. Before making any investment decisions, you should always conduct your own research. Chain Affairs is not responsible for any financial losses.

I’m your translator between the financial Old World and the new frontier of crypto. After a career demystifying economics and markets, I enjoy elucidating crypto – from investment risks to earth-shaking potential. Let’s explore!